Last week, we noted that the declining volatility of option prices ahead of this Wednesday's FOMC meeting was curious, to say the least. As we dug in, we noted the broader scope of this trend towards declining option volatility. Today, I'll show you another way of using the Commitments of Traders report to track investor sentiment and in this case, why the correspondingly bullish put/call ratio via the large speculators is probably bad news for the stock market.

The Commitments of Traders report breaks the market's noteworthy participants into four categories; Commercial/Merchant, Swap Dealers, Large Speculators and Small Speculators. For today's purpose, we'll focus on the interaction between the Large Speculators and the Commercial/Merchant categories. These categories pretty well define themselves. The included chart plots the index values in the first pane, followed by the net Commercial and Large Speculator, net positions. The second pane plots just how bullish or, bearish the individual groups are based on the Dollars they've committed to their positions in the stock index futures.

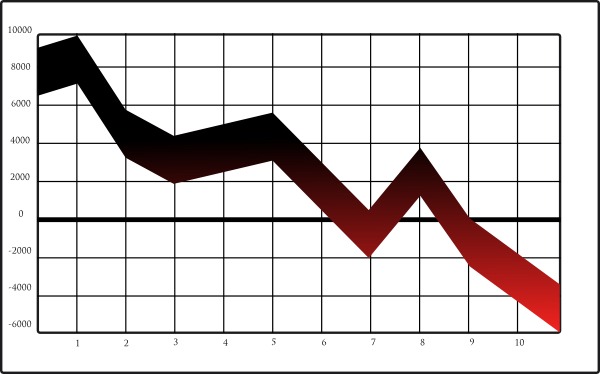

Quickly moving to the setup, the Large Speculators increasingly bullish net position also shows up in the option markets as a declining put/call ratio. The put/call ratio declines as the Large Speculators net futures position grows. There are certainly subtle nuances to measure within the individual option and futures market behavior but for the pre-FOMC, COT crash course purposes this will have to suffice. I'm a data junkie. It's always interesting to see how many calculations and derivatives can be extrapolated and sold as data feeds when they, ultimately measure nearly the same things. The most important piece on the chart is Large Speculator buying since April has pushed the total speculative position to very bullish levels ahead of a MAJOR market event. There's a growing herd mentality among the Large Speculators that FOMC inaction will lead to extended stock market gains.

Typically speaking, the commercial traders are very good at forecasting event driven market moves. Date driven, outcome based events play right into the networking of the Commercial Traders' hands. We've provided anecdotal evidence over and over, again. Based on the Large speculators' already large position, we think the potential for failure is much greater than the potential for continuing higher....especially in the short-term. We expect a good portion of the Large Speculators' position to be wiped out as near-term resistance and an increasingly bearish commercial trader population leaves the stock market looking for buyers in thin, choppy and downward, post FOMC trading action.

We offer both discretionary (method-based) and fully mechanical versions of our programs and trade across 35 domestic futures markets. Click the link below for access to a free trial of our Discretionary COT Signals.