There are two situations that lead to big events in the markets and they represent psychological mirror images of each other. The first issue is overconfidence. Whether this is overconfidence in a market, a strategy or one's self, overconfidence leads to carrying the largest position at the most inopportune moment. The second issue is indecision. There are times when a market approaches critical levels yet; the trading population appears uninterested or, scared. Either way, indecision leads to fewer participants while overconfidence leads to too many. Therefore, our focus today is the examination of a very bullish net commercial trader position in the face of the lowest commercial participation rate since the economic collapse of 2008-2009.

First, a brief background we frequently reference the net commercial trader position and commercial trader momentum in our featured analysis. This is because the total position is really only meaningful at its extremes. The important thing to keep in mind while reviewing the following charts is the mathematical relationship between the total and net positions. The commercial trader net position is measured by subtracting the reported short positions from the reported long positions of the given traders. Long contracts minus short contracts equal the net position. We use this as a measure of sentiment generated as the consensus of commercial trader population. The total commercial position is measured as the total long contracts plus the absolute value of the total short contracts. This is the opposite of the net position as each long and short contract in the total position receives a value of, 1. Therefore, while the net position predicts the degree of bullish or, bearish sentiment, the total position measures the overall level of interest in a market at a given point in time. This is one of the times when total interest must be used in conjunction with the net position to avoid trading under a false set of assumptions. Therefore, while the current sentiment is positive, most of the collective big money is sitting on the sidelines, uninterested.

First, a brief background we frequently reference the net commercial trader position and commercial trader momentum in our featured analysis. This is because the total position is really only meaningful at its extremes. The important thing to keep in mind while reviewing the following charts is the mathematical relationship between the total and net positions. The commercial trader net position is measured by subtracting the reported short positions from the reported long positions of the given traders. Long contracts minus short contracts equal the net position. We use this as a measure of sentiment generated as the consensus of commercial trader population. The total commercial position is measured as the total long contracts plus the absolute value of the total short contracts. This is the opposite of the net position as each long and short contract in the total position receives a value of, 1. Therefore, while the net position predicts the degree of bullish or, bearish sentiment, the total position measures the overall level of interest in a market at a given point in time. This is one of the times when total interest must be used in conjunction with the net position to avoid trading under a false set of assumptions. Therefore, while the current sentiment is positive, most of the collective big money is sitting on the sidelines, uninterested.

Let's review a bit of history before moving onto the charts. Fear is the primary reason for the big money to be sitting on the sidelines as the Dow Jones and S&P 500 futures near their all-time highs. Commercial traders would typically be sellers of this rally as they use futures to lock in gains in their equity portfolio while dodging tax liability and basis issues. The contracts sold forward are typically allowed to expire as the equity index futures are all cash settled as noted by the quarterly peaks in the total positions on the charts below. Their indecision is again noted by their exceptionally low participation rate as the current global economic environment continues to seesaw back and forth from one economic announcement to the next. U.S. growth versus global stagnation appears to be the order of the day as our Federal Reserve Board attempts to begin withdrawing a decade's worth of stimulus. Since commercial traders are typically the most well informed group of market participants and usually lead the market's next moves, their uncertainty is noteworthy.

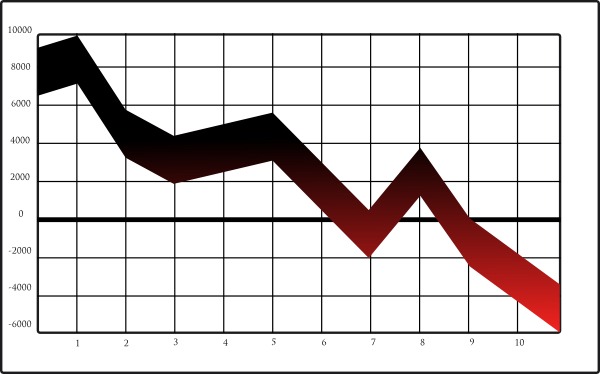

The S&P 500 futures present an interesting situation. The commercial trader participation rate is the lowest it's been since 2008 yet, the net commercial position is near a multi-year high. This means the commercial traders currently in the market are exceptionally bullish, even if it's just a few of them. Of course, the million-dollar question is, "Are they right?" My guess is that they may be right for a bit. My expectation is that we'll see the broad stock market continue to rally into a new high. However, I also believe that this high could coincide with the early May seasonal peak and that the new May high will show up with weaker underpinnings which, will show us some sort of momentum divergence or, new commercial selling pressure and provide the first confirmation of a top.

The Nasdaq 100 futures chart begins to show us what a top might look like. Commercial buyers of the September decline were rewarded with new highs less than a month later. They were quick to rush into this year's decline as well and their current net position nearly matches the total from the last run up. However, note the large decline in the total commercial position since the October highs. Their participation rate is the lowest since...ever. Furthermore, the commercial participation rate has been trending lower since March of 2014 when the Nasdaq made its high around 3680. This is just below the August and February lows in the Nasdaq between 3880-3850. As usual, the Nasdaq appears to be the leader of the group and has begun most of the recent moves. Therefore, our outlook is that the Nasdaq may not breach its recent high around 4725. It will be very interesting to see if the commercial traders will confirm this rally by coming back to the market. Until they do, sentiment should remain on the short side.

We've illustrated a similar pattern to the Nasdaq on the Dow Jones future's chart. As you can see, commercial traders set a bullish net position record on the late summer decline. Once again, deeper analysis reveals that the new net long record came on the heels of the smallest total commercial position in years. While it still created a fantastic trading opportunity that we were able to capture on a short-term basis, we believe the broader pattern is indicative of a bearishly divergent top based on commercial trader behavior patterns and activity.

We suggested that fear is the primary cause for the declining commercial participation rate. Let's conclude by determining why the commercial trader positions matter. Generally speaking, the commercial traders are among the most well informed group of market participants. Their unwillingness to participate at these prices reveals two main keys. First, the current prices aren't distorted enough to draw them into the market on either side. Secondly, the current banking and political environment is too much of a crapshoot for them to place ANY long-term bets. We'll be watching closely to see what it takes to draw the markets' largest players back. In the meantime, we'll continue to trade following our mechanical Commitments of Traders signals as the discretionary picture continues to sort itself out.