There are many methods to successful trading. One key to all of them is an intimate understanding of risk at the program development and implementation levels. Rather than make this a highly technical article, we'll let each picture speak 1,000 words. Then, we'll tell you how the Commitment of Traders(COT) report, seasonality, and advanced data analysis come together to point towards higher cattle prices heading into Christmas in 750 words or, less.

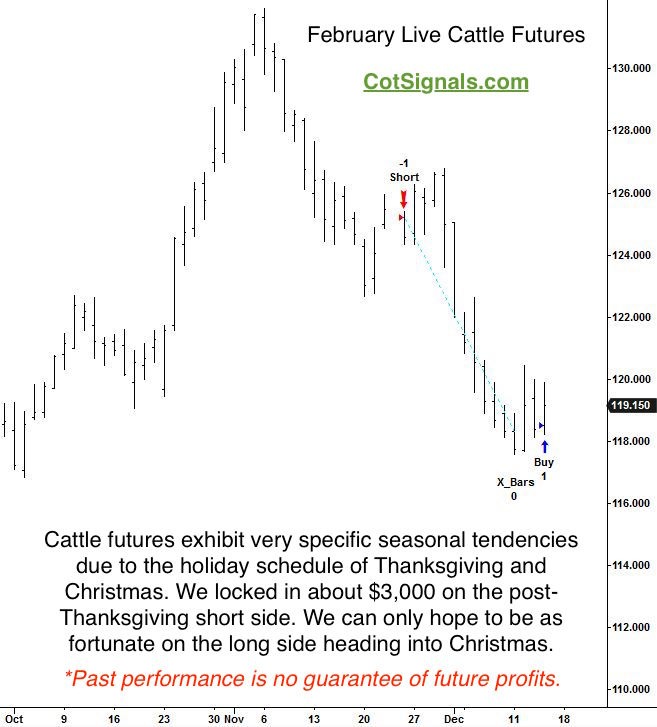

First, we'll look at our discretionary Commitment of Traders methodology. This is the setup I've been tracking daily for more than 15 years. The idea is a straightforward three-step process. First, we monitor the momentum of the commercial traders. They're the ones with their feet in the fields and drills in the ground. They tend to be right about future prices, especially when they're betting big. Second, we wait for the market to move against them on a short-term basis. You'll notice on the first chart, below, that commercial momentum is negative throughout the period. We waited for short-term rallies to sell. Third, our short-term momentum trigger indicates a reversal, and we take action in line with the commercial traders' prediction. The third step also provides us with our stop loss placement point, which will always be the recent swing high or, low depending on the setup.

This is a discretionary methodology because it doesn't provide the exit points. Those must come from the trader. That's also why most of my programming resources went into developing a purely algorithmic application of our COT report trading premise. The discretionary application above is more sensitive, the protective stops are tighter and, the trade length is shorter than the mechanical version of our COT program. Commercial trader momentum will most likely shift to positive in the coming days. This would put us in the position of waiting for a sell-off to buy into for our next trade, as we only take trades in line with the commercial traders' momentum.

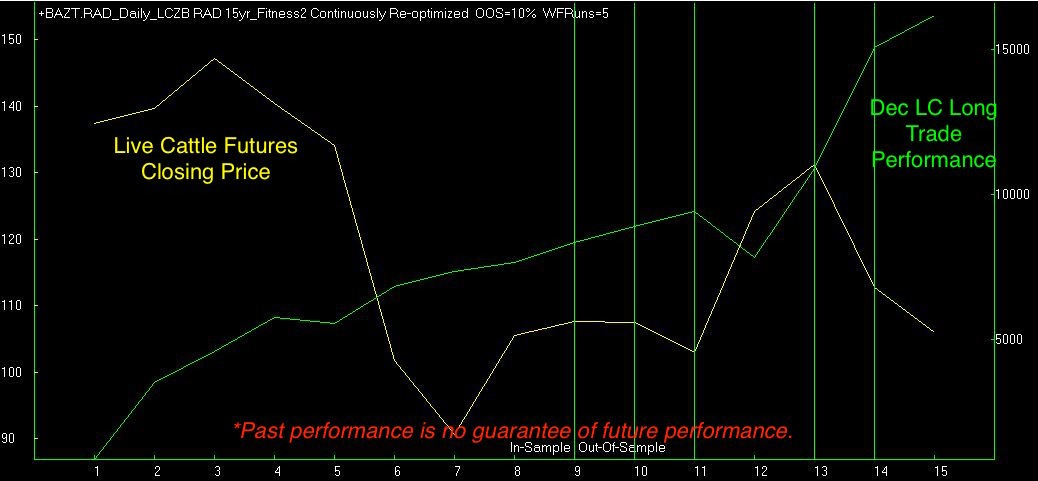

The mechanical version uses percentage-based protective stop levels. Algorithmically speaking, protective stops typically come in two flavors volatility and percentage. While volatility has the advantage of adjusting to the market, risk can vary dramatically during the trade's life. This makes pre-trade resource allocation tougher to calculate. Percentage based stops provide an absolute measure of risk, which can then to be used to adjust for proper trade sizing.

As you can see, our mechanical program is now long February live cattle. Our protective sell stop is at $111.80. This is currently about $8 below the market or $3,200 per contract. The risk is much higher in the mechanical program than in our nightly Discretionary COT Signals which use the swing high or, low that is created by the chart formation. Commensurately, the reward tends to be much larger in the mechanical program as well because it will hold winning trades for a couple of weeks, rather than the discretionary program's typical 3 - 5 day window of opportunity.

Finally, let's talk about seasonality, which is an entirely different approach. Our seasonal research is the result of advanced data analysis focusing on nothing but price. There is no fundamental or, technical information being fed into this model. Therefore, its predictions are entirely independent of our other trading programs. Secondly, we've found that there's very little correlation between overall market structure and the periods of seasonality our model predicts.

Our seasonal analysis doesn't give us much to show on a chart. Most of the work for this is done in outside applications. It does show how all three methods predicted the same decline in cattle prices. One last bit on seasonality. Note the divergence between cattle prices and the equity curves for the two seasonal trades, above.

Now, look at the long side of the trade and our expectations heading into Christmas.

We've just looked at the cattle market from discretionary, mechanical, and seasonal viewpoints. These reinforce each other through variable risk and holding periods. Now, if we just get this rally.

Free trial available for the Discretionary Commitment of Traders Nightly Worksheet.