Most of the trading we do is based on some form of mean reversion. The idea is that a market that has moved too far away from its predicted value area is apt to return. This is the equivalent of buying low and selling high in a sideways market. The primary difference in our methodology is that we use the commercial traders within their respective markets to provide us with the two necessary keys required to make this work.

First of all, we only take trades inline with their forecast of market prices. We want to make sure that we're on the same side of the market as those who produce the commodity and use the commodity. Between their information and their financial stability, we view this as, "Don't fight the Fed." Secondly, we track both their total net position as well as the rate of change in their net position. The sum of these two tells us how eager the commercial traders are to get their hedges placed at the current price levels.

See sample charts and trades at COTSignals.com

What does this have to do with this week's trading? Well, on both Monday and Tuesday, we looked at markets that had been stretched beyond their perceived value areas and had growing commercial trader positions in favor of the markets returning to their recent price levels. We recommended using stop orders to enter these markets in order to catch the returning price run since the markets had not yet begun to revert. We call this our, "Don't catch a falling knife" entry signal. As such, neither our cotton trade for TraderPlanet nor our unleaded gas trade for Equities.com were entered. We'll review the commercial traders' actions over the weekend and see where these markets stand.

A Play in May Cotton Futures – Our analysis for TraderPlanet

Bucking the Seasonal Gasoline Trend - Our Analysis for Equities.com

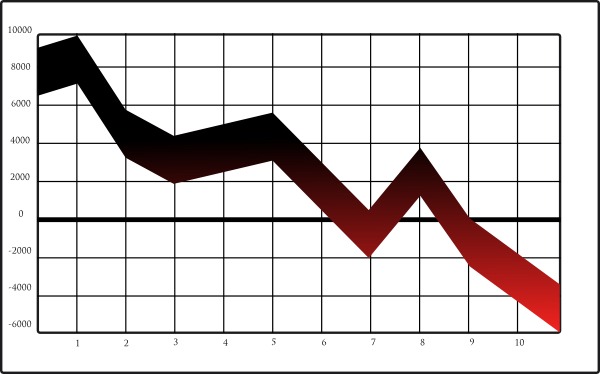

Finally, our main piece showed the effectiveness of using the commercial traders' momentum as a stock market filter. We published the results, charts and spreadsheet in "Equity Rally Waves a Caution Flag." Based on the results of this testing and the fresh signals just issued in the Nasdaq and Dow, it's worth the read to protect your equity portfolio.

Finally, look for a new research this Sunday on ForexMagnates.com, where our coffee futures research will be featured.