The British Pound is facing severe headwinds as Brexit negotiations begin to take center stage ahead of the EU Summit starting October 18th.

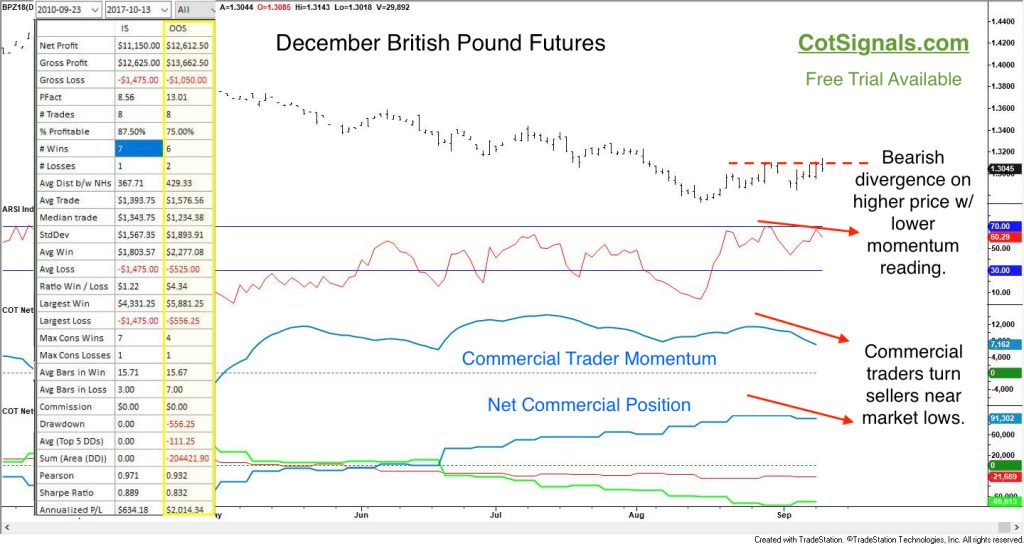

Technically speaking, the downward trending market is already showing signs of a bearish divergence. Fundamentally, the commercial traders had been huge buyers on the recent 4% decline. However, the market's meager rally is now being turned back by commercial traders unwinding their near record-setting purchases. Finally, the British Pound has a significant seasonal tendency of closing the third quarter weakly. We hope to exploit these tendencies in a seasonal trade we see setting up next week.

Typically, commercial traders are negative feedback traders. They buy more as the market declines and sell more as the market rallies. They're very good at forecasting turning points in the market. They set a new net long record position in March of 2017, and the Pound rallied more than 13% through January of this year.

The commercial traders currently find themselves on the wrong side of the trade. This doesn't happen very often and is placing the commercial traders in the position of selling into a downward trend as they unwind their position ahead of the summit.

We do quite a bit of seasonality testing to find the optimum parameters for the coming trade. Seasonal trading requires careful risk assessment as well as rigorous analysis of the program's previous history relative to market behavior. Once we find a trade that matches our risk to reward profile, we publish it as part of our seasonal analysis. The number of trades can vary tremendously from month to month but, we've been happy with our seasonal results.

We'll be watching this market closely next week for an entry signal. Once triggered, we'll risk it to 1.5% above our entry price. Sign up, and we'll keep you appraised of our current short corn position, and any new seasonal trades coming up.