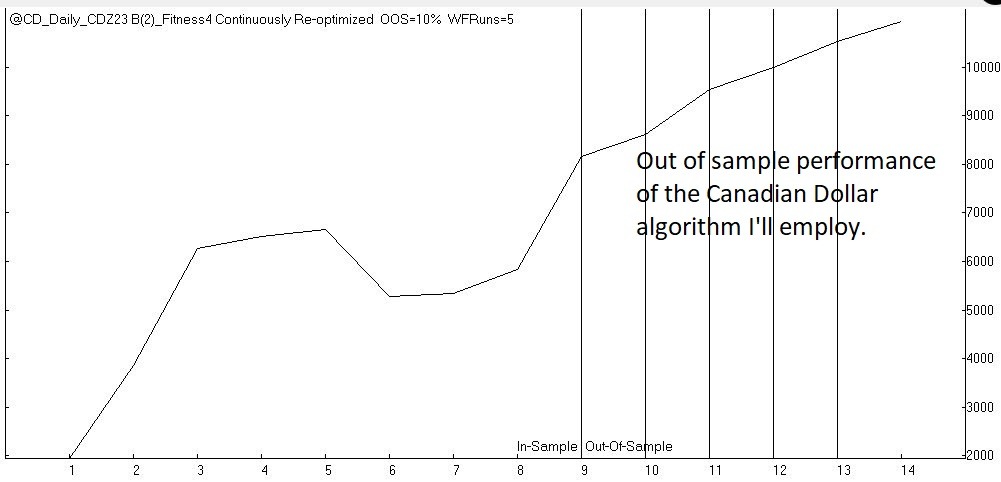

This trade looks at the tendency for the Canadian Dollar to rise from late December through early January. This trade's short duration and fantastic performance make it one I watch every year.

The Setup:

There's a strong year-end push to hold Canadian Dollars. A large part of this has to do with end of year cross-border contract settlements. We buy more Canadian goods and services than the US sells in Canada and much of this is due to reconciling the books.

The Action:

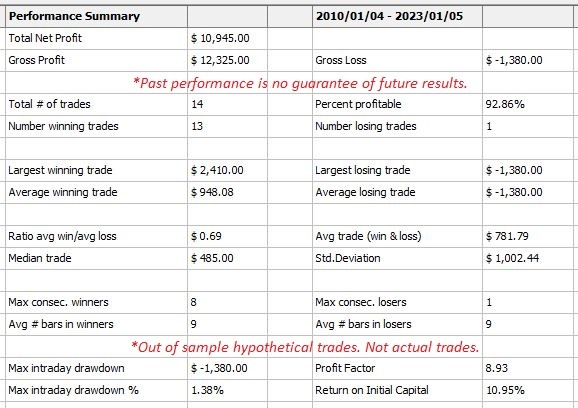

My timeframe on this trade is roughly two weeks. The average historical return in the futures market is about $950 with an average loss of only $1,380. Now, it's important to separate loss from risk. This trade has an extremely high winning percentage so, the out of sample loss is based on a single trade. I'm still risking about 2% from my entry. This means that my maximum risk in the futures market is about $1,500 with the Canadian Dollar trading at .75:1 against the greenback. This is one of the rare times I'm willing to risk more than my average win based on the probability of success.

You can make this trade through the Canadian Dollar futures market at the CME Group or, you can trade the Canadian Dollar on the forex platform of your choice. Two points of caution for the forex traders. First, remember that I'm buying strength in the Canadian Dollar vs the US Dollar. Secondly, watch your leverage and trade with appropriate risk measures.

December and January are busy months for seasonal trading. I'll be examining trades in everything from gold and silver to oil and the stock market as we head into the new year. Follow along and let me show you how to follow the rhythms of the season while capitalizing on predictable human behavior.