This model focuses on the expiration of the December corn contract and new supply purchases shifting to the March corn futures contract and ETF, "CORN."

The Setup:

Corn prices have fallen sharply heading into year-end, having fallen about 10% post harvest. We'll be watching intently as the market tends to bottom sometime between early and mid-December. The bottom coincides with the expiration of the December corn futures contract on December 14th. Many traders holding December positions will execute new contracts in the March contract. This process is known as "rollover" in the futures market.

The Action:

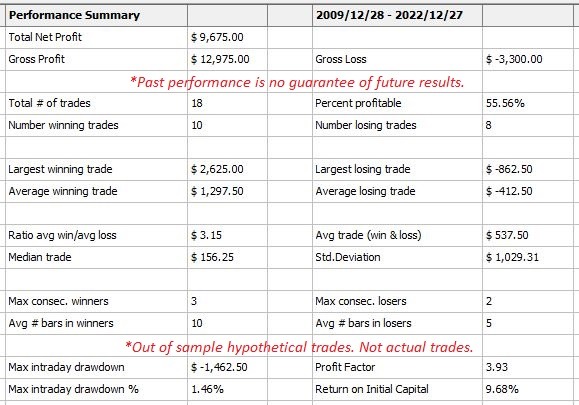

This trade fits my risk to reward criteria as we're expecting to make about 3X our risk. On average, the risk on this trade has been a a little more than $400. I expect the risk to be a bit more this year due to market volatility and perhaps about 4% for those trading the ETF, "CORN." Fortunately, the added volatility can also work to our advantage as the market begins to move higher.

However, my favorite part of this trade is its duration. We only expect to hold the trade for around two weeks. This is definitely one of our shorter term trades. Ideally, the market will give us a nice 5%+ pop during this condensed window of opportunity.

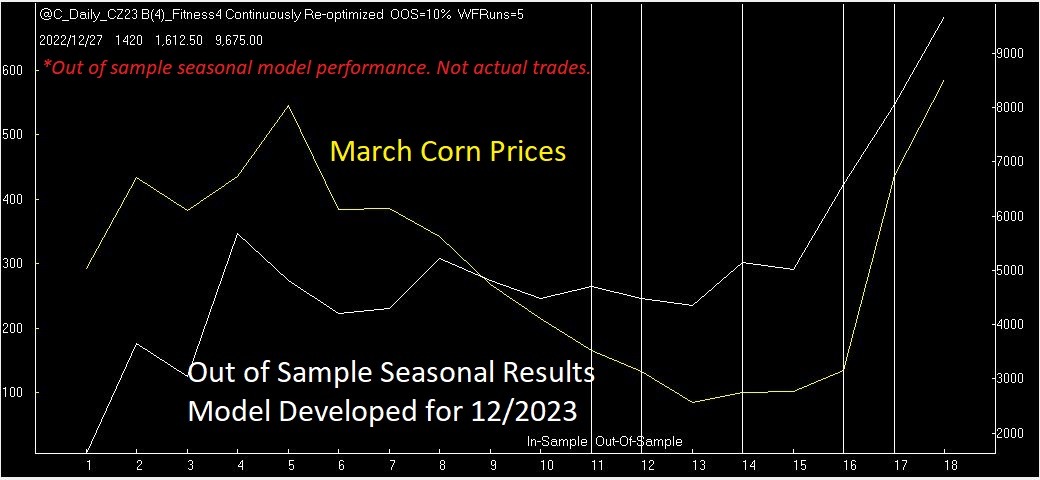

The graph below shows the model's in and out of sample performance against the price of the underlying corn market. Note that even as corn prices fell to a fraction of their value from 2011 - 2018, this strategy managed eek out gains. Like any solid strategy, we limit rigorously limit risk. Whether you are trading the March corn futures or the ETF, "CORN" I'll keep you abreast of any risk adjustments to be made.

The Subscription:

Join me as I prepare for the corn market to form a bottom in the coming weeks and rise into the New Year. I'll email you when it's time to enter and with the amount we're risking. Then, I'll only bother you when there's an update to our trade.

December and January are busy months on the seasonal calendar year. If you're considering subscribing, it will be a better value than purchasing a single report. We typically have trades in energies, equities and metals heading into the new year.

I'll email you directly when it's time to enter this trade, where to place your protective orders and follow up once again when it's time to exit.

Great article on corn year end.