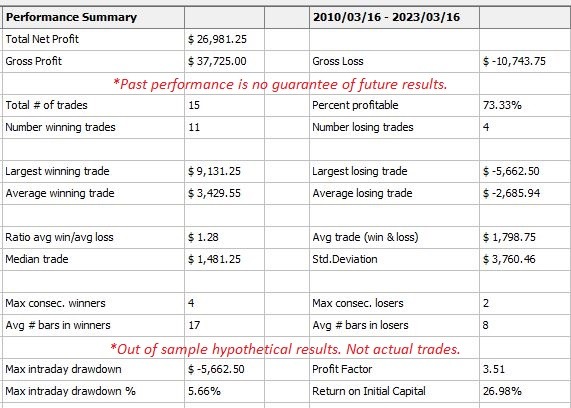

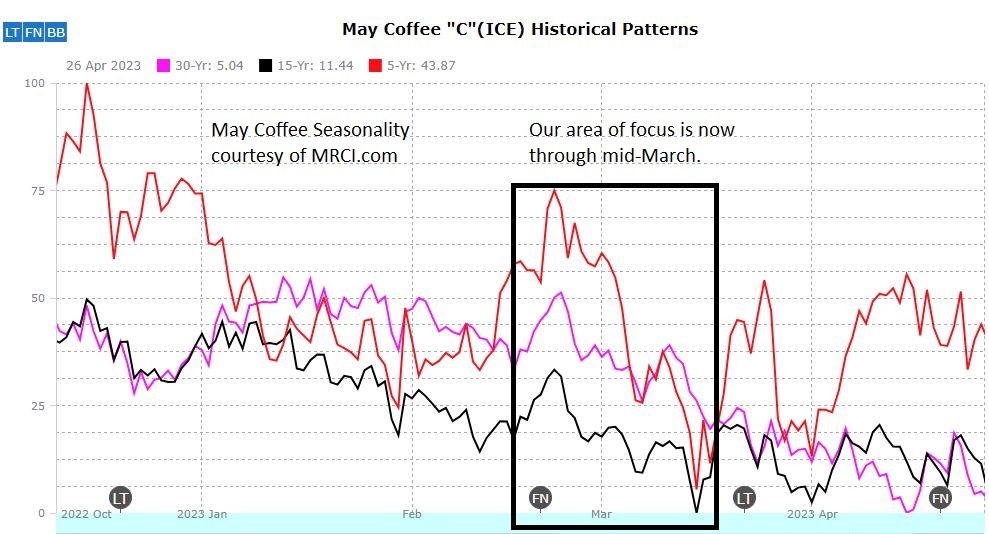

Coffee prices tend to slide heading into the Brazilian harvest. Additionally, there are other reasons to believe the coffee market will head lower over the next few weeks.

The Setup:

Coffee prices tend to decline into the Brazilian harvest. Additionally, there is both technical and fundamental resistance for the market to overcome if it wants to continue higher. At this point, the market is likely to decline over the next few weeks.

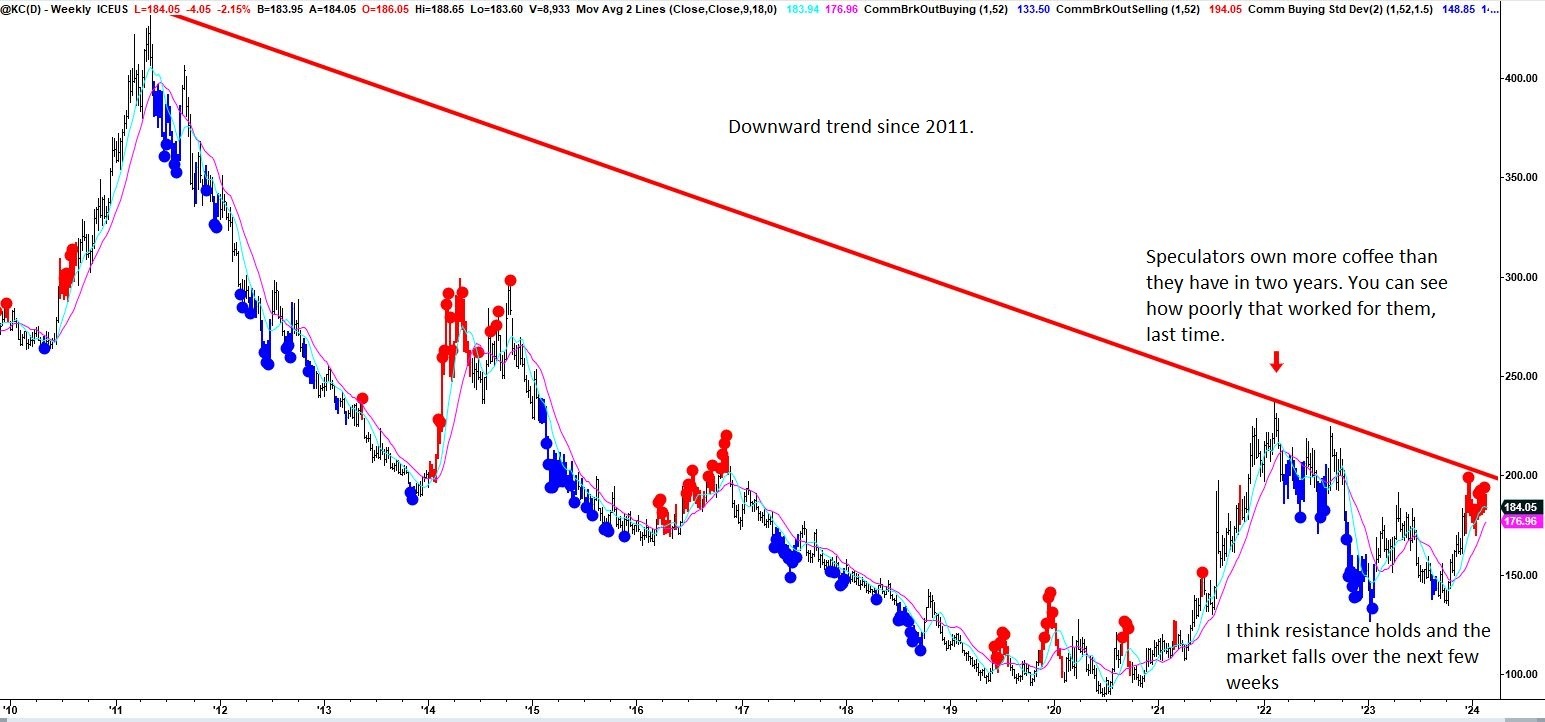

First, there is technical resistance dating back to 2011 on the weekly chart. Make sure to notice the peak in 2022.

This leads to my second point. I'm a dedicated observer of market behavior and I find that the Commitments of Traders (COT) report is the best proxy for this information. Right now, the COT report is telling us that the small speculators, the little guys who are usually wrong, are holding their largest position since the coffee market's labeled peak in 2022. At a minimum, this means that the market is running out of buyers. At most, this will be the peak before the market heads down towards another multi-year low.

The Action:

Follow along to be notified when I sell this market. How much I'll risk. How long I hold it and any other adjustments I make to this trade in real-time.