This seasonal bond trading model intends to capitalize on the annual November - December shift to cash in the US.

The Setup:

The Treasury bond market futures are down more than 30% since making their March of 2020 high. Recently, the downward price trend has intensified but, I think there's good reason to expect some Thanksgiving interest rate relief. I'll use this seasonal bond trading strategy to capture the annual shift in holiday cash.

My focus on bond market seasonality lies in the price action, rather than the story. It seems every year the talking heads on TV come up with a new way to frame the same old price action. Let's just agree that American consumers and corporations begin to take risk off the table towards the end of the year. When they move the cash into government backed securities it creates a seasonal bid in the bond market and a corresponding decline in yields. I expect the bounce may be higher than normal because of how far we've recently fallen.

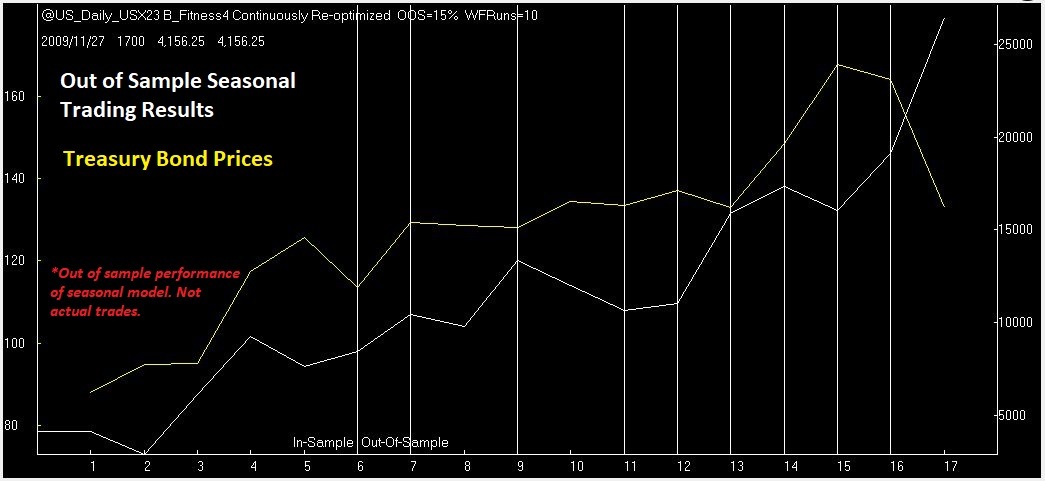

The vertical lines in the chart represent the floating in and out of sample data. Each of the 30-year US Treasury bond seasonal trades plotted from trade number 6 onward is being tested in the blind. Finally, even as bond prices began to collapse, our seasonal trading strategy was still able to capitalize on a forecasted a window of opportunity.

The Action:

I'll buy the December 30 year T-Bond futures. There are many other investment vehicles available that track this market because the US bond market is the largest in the world. Some the ETF's are, "TMF," "TLT," and "UBT."

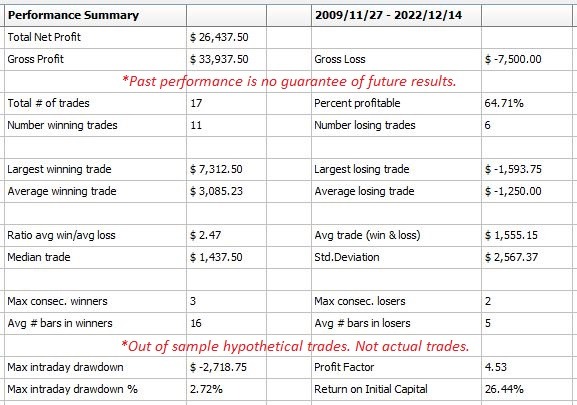

Basically, I'm risking a little over $1,000 to make hopefully, around $3,000 per contract. In percentage terms at these prices, an ETF trader can choose an investment amount that makes sense for their portfolio. This means risking about 1.5% of the initial capital placement with expectation of returning a profit of around 6% in about three weeks. Obviously, this assumes the ETF is not one of the leveraged ones available, in which case, both the risk and reward would increase proportionately.

November and December are busy months on the seasonal calendar year. If you're considering subscribing, it will be a better value than purchasing a single report. We typically have trades in energies, equities and metals heading into the new year.

I'll email you directly when it's time to enter this trade, where to place your protective orders and follow up once again when it's time to exit.