There are several tradable wheat markets both domestically and, internationally. Today, we'll focus on domestically produced soft red wheat. This can be traded at the Chicago Mercantile Exchange in the July wheat contract (WN24) or, in the Teucrium etf, WEAT.

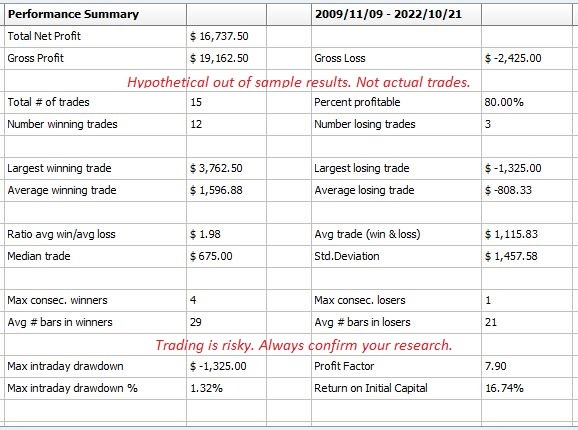

Expected Trading Performance:

Our out of sample testing suggests we may be able to generate a profit of more than $1,100 per futures contract at the current prices. Historically, wheat prices have been higher which leads to inflated profit and loss figures. I expect to be in this trade about 20 - 25 days and be right about 80% of the time. I expect to make about $1,500 while risking about $900 on this setup. Those are better odds than you'll get at FanDuel!

If you're trading the etf, you'll be looking for about a 3.5% pop on the invested amount within 20-25 days while limiting risk to about 2%.

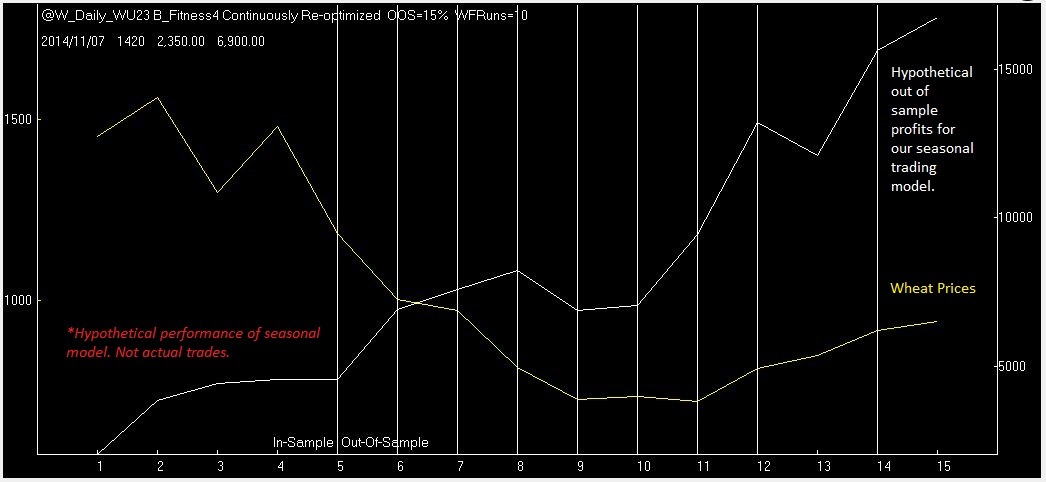

Seasonal Wheat Market Dynamics:

Here are the out of sample trades overlaid with the price of wheat. As you can see, the strategy still found pockets of strength even in a downward trending market. This is because of the seasonal market dynamics and the expiration cycles of the wheat futures contracts. Again, we consider this, "Event Based Trading." We know the event. We know when and we know where. We just use the algorithm to determine the best dates and appropriate risk controls to complete the seasonal trading strategy.

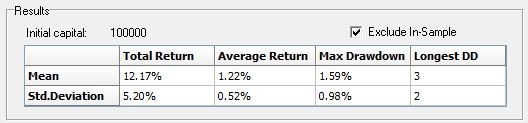

Statistical Analysis of Seasonal Wheat Algorithm:

Monte Carlo analysis provides us with a different view. Monte Carlo testing is statistics rather than timelines. The performance chart and equity curves above are temporal data; data with a time component. Monte Carlo data is has no time component. This allows me to randomize the data to determine if we are merely curve fitting the algorithm or meeting our goal of finding and exploiting a statistical bias in the markets.

In this case, we can expect to make somewhere between .7% and 1.74% about two-thirds of the time. Most importantly, because the standard deviation is less than half of the mean, there's a good chance we make a profit even if the market underperforms. As an update, we have about a $500 profit since entering the trade last night.

Wheat Market Forecast:

I bought July wheat last night and it's currently trading a little higher. I expect the market to hold its recent lows around $6.26 per bushel and head higher to test the resistance around $6.90 per bushel by the third week in October.

Subscribe (as low as $50 per mo.) to our email service and you'll only get actionable dialogue. No upsells. No Spam.