So far the feedback we've received, besides the losing trades, has centered on the topic of, "too much testing jargon," to quote one of our customers. Therefore, we'll make this short and sweet. Anyone who wants more information should feel free to contact me directly. I'd be happy to discuss the technical side of things with like-minded quants.

866-990-0777

awaldock@commodityandderivativeadv.com

The trade:

Sell December Canadian Dollar to initiate a new short position on Friday night's open.

The protective buy stop will be placed 1.5% above Friday night's opening price. I'll follow up with the exact price for Monday's trade.

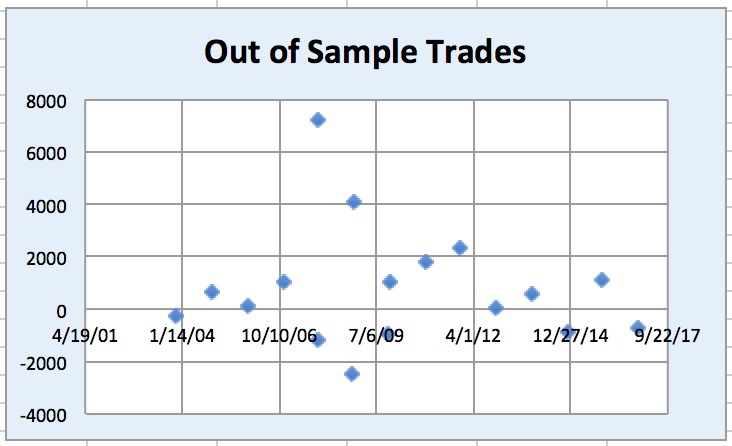

We'll be following the 15-year pattern, which has produced the following out of sample results.

Average win - $1,816.

Average loss - $1,095.

Win rate - 65%.

Expected risk with December Canadian Dollar trading at $.78 to the Dollar - $1,170.

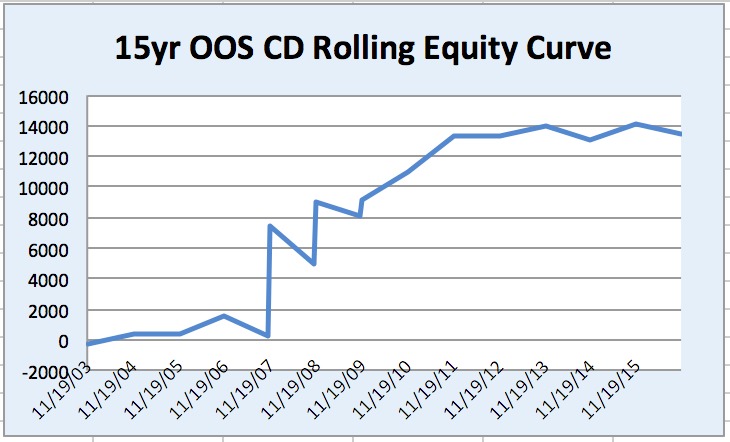

Next, we'll follow the scatter plot up with a standard rolling trade equity of the previous years' trades.

Finally, we'll offer a bit of a preview for the rest of November. Our next trade will be a buy signal in the mini S&P 500. This was a bit harder to separate the seasonality from the trend due to the stock market's decade-long roar. Not unexpectedly, the winning percentage for this trade is quite high. More importantly, the risk to reward metrics are quite robust with an average win of more than $2,000 and a standard deviation of returns that is less than one-fourth of the mean.

Sign Up for Seasonal Analysis - $35 per/mo.

Our last trade for the month will be in the March copper futures. This trade takes advantage of both the roll from the December to March contract as well as the early construction inventory build for the coming year. Copper is a big ticket market, which creates lots of risk and reward. We'll be risking 2% on the trade. This is equal to $1,575 with copper futures trading at $3.15 per pound. This strategy has won about two-thirds of its trades, with an average winning trade of more than $3,200.