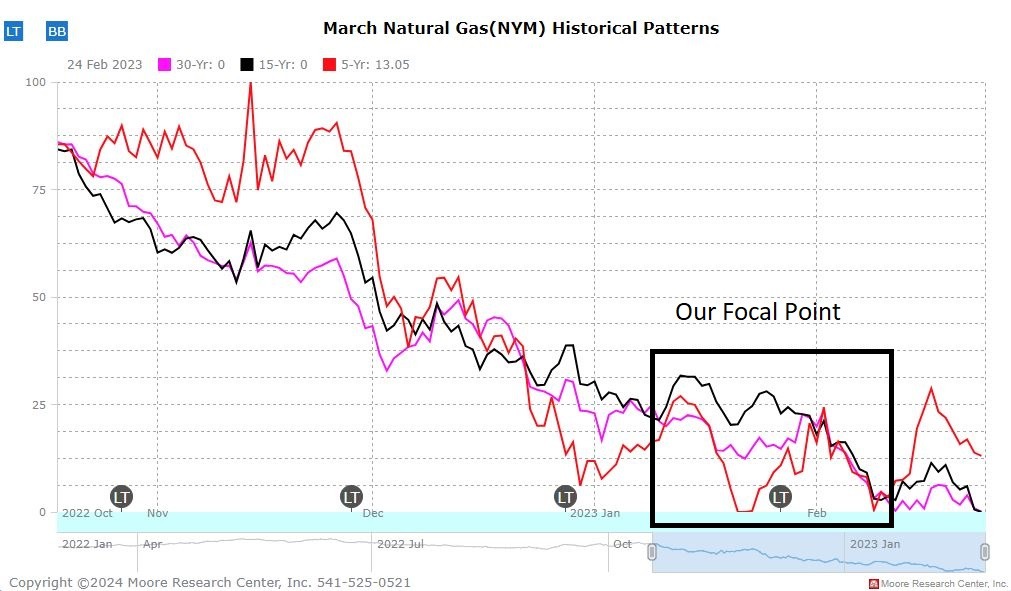

This natural gas is a bit counterintuitive, and I believe that's part of the reason for its consistent success.

The Setup:

People have a tendency to think of energy usage in times of climate distress. Historically, this is a rookie move due to two primary reasons. First, by the time the weather turns cold, natural gas supplies have already been purchased. Secondly, natural gas suppliers have already begun to sell off excess supply. These two factors create a, "buy the rumor, sell the fact" situation.

We'll use the cold snap to create a rookie rally that will allow us to place a short sale betting against the price of natural gas at optimal levels. We intend to hold the trade around three weeks and fully expect the market to retest its December low.

The Action:

We intend to hold this trade for about three weeks. The natural gas market's behavior can best be described as "spikes up" and "grinds down." We'll use the rally off the December low along with the boogeyman of colder weather to drive the market higher for us to sell short. This will be a trade that can be executed in the March natural gas futures or, the double leveraged exchange traded fund from Pro Shares - KOLD.

Given the market's recent movement, we expect to risk the trade just beyond the current high around 2.800. This represents a $2,000 risk per contract in the futures market or, a risk of about 4% in in KOLD.

Our holding time is expected to be two to three weeks and our target is 2.400 at a minimum and a test 2.000 more likely.