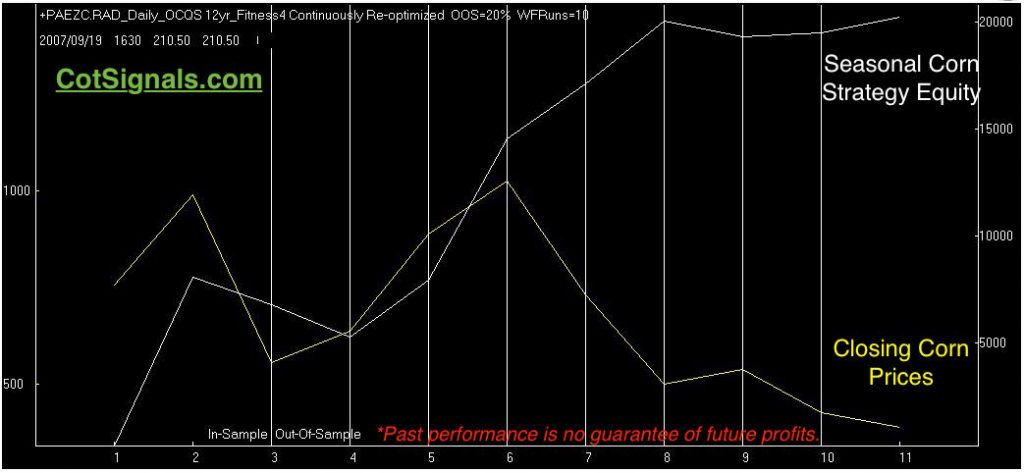

There are typically three solid seasonal setups, annually in the corn market. The first is a short sale following the pre-planting fears. The second aligns with the 4th of July. We skipped this trade due to corn's precipitous trade war decline. The market's recent bounce has proven the statistical assumption that the market had fallen too far, too quickly correct. The trade war noise had this effect on several agricultural markets and materially impacted the total number of trades we would typically execute in a seasonal portfolio from July through August. The markets have adjusted, and we believe a pending short sale in the December corn futures later this week will be a worthwhile trade.

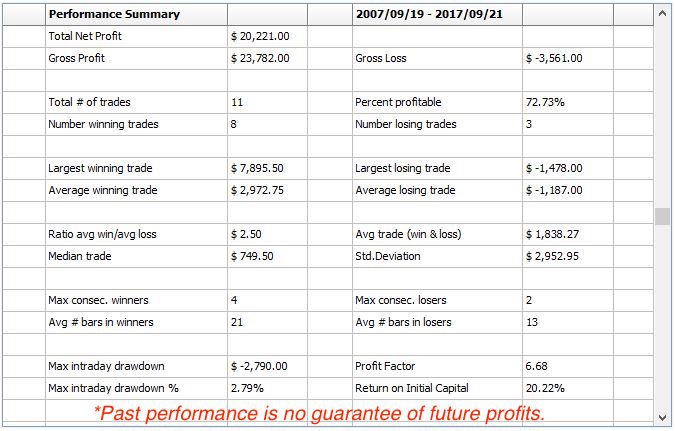

We'll be employing a static stop placed six percent above our entry price, once it's triggered. December corn is currently trading around $3.75 per bushel. Six percent above $3.75 equals $.225 per bushel, or $1,125 per contract. Corn margin is currently $880 per contract. This math suggests you should be able to allocate $2,000 while risking just over half of that to make a historical average of $1,838. I would certainly suggest allocating more than $2,000 per contract but, it does show the power behind this type of leveraged strategy. After all, we are controlling 5,000 bushels or, $18,750 worth of corn for the $880 we put up as margin.

Users should carefully determine leverage levels appropriate to their investing strategies.

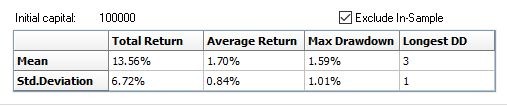

As always, we'll close with the Monte Carlo analysis. I believe this provides a much better approximation of what is likely to happen.

We use ratio adjusted contracts for seasonal Monte Carlo testing because the futures contracts' expirations are spliced together using percentages rather than an average of recent prices or, some other method. Basing the Monte Carlo simulation on a $100,000 account makes the percentages, math and, cash equivalent fairly intuitive. There's a pretty good chance (77%) that we should make $1,700 +/- (50%) or, between $850 and $2,550. This translates to a projected market price between $2.865 and $3.60 towards the end of September.