We will be buying the June Euro currency futures late this week for our third seasonal entry this month. We expect to hold the position for approximately three weeks while risking just one percent from the opening price, once the trade is triggered.

The Details:

Euro currency futures margin - $2,310.

Risk - This is an easy one. We'll be risking one percent of the entry price the night the trade is triggered. This protective stop is static and will remain in place throughout the trade's duration. That's a cash value of $1,550 based on a price of $1.2400.

Reward - The average return for this strategy is $2,640. The Euro currency futures contract has a $125,000 face value with a tick value of $12.50. Dividing the average return by the tick value shows that, on average, this strategy expects the market to move approximately 210 points inclusive of profits and losses. This provides a risk to reward ratio with the market trading at $1.24 of $1,550/$2,640 or, 1.7:1.

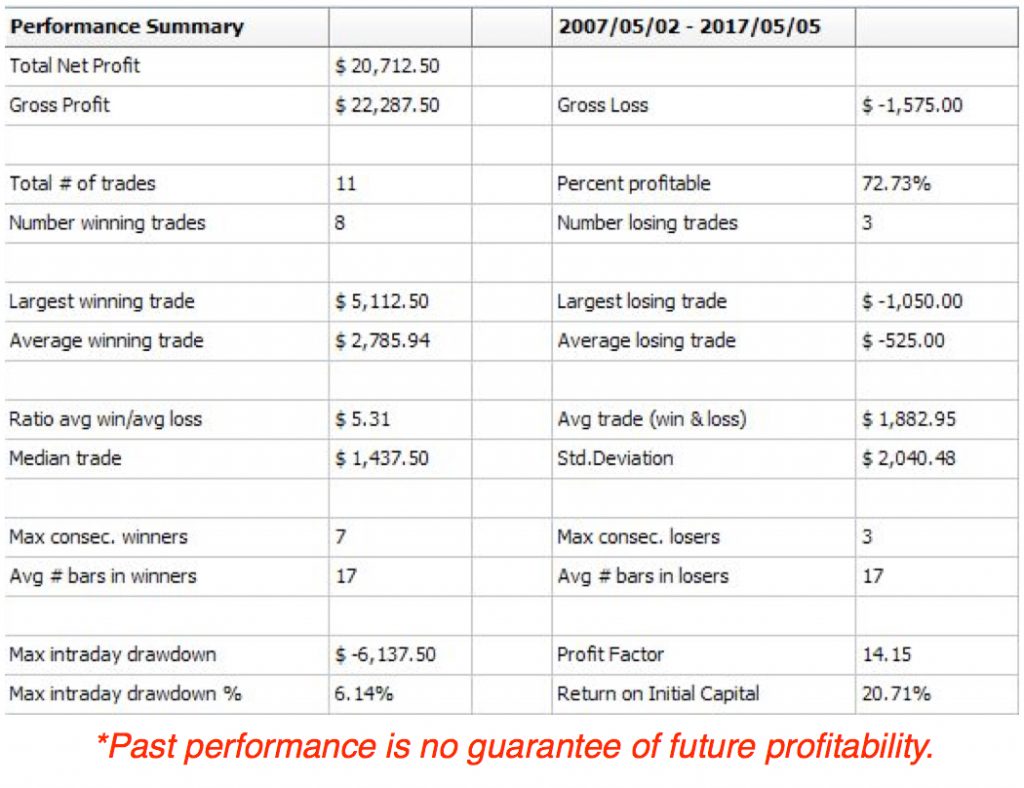

See the Tradestation report below for the full out of sample performance.

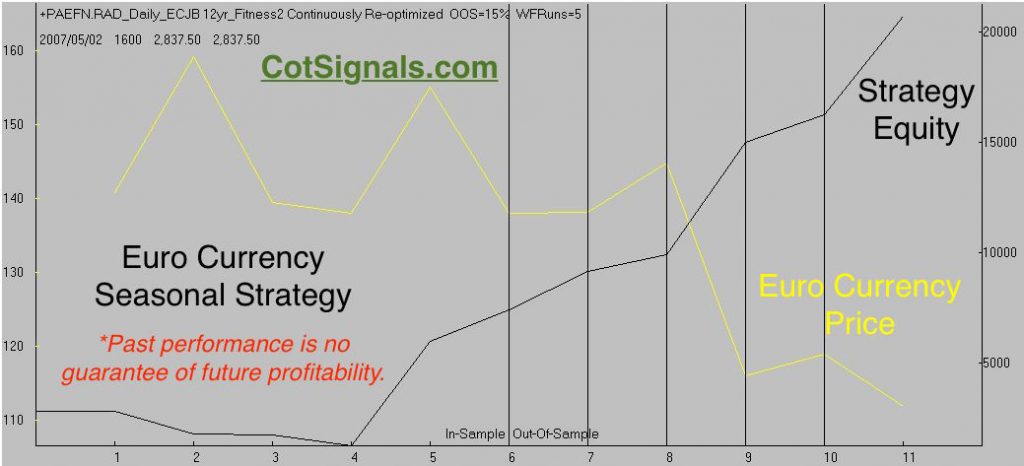

Now, the Euro currency's closing prices plotted against the strategy's closed trade equity curve. Once again, we have a case of generally declining underlying prices, and yet, the model can pick out a repeatably profitable opportunity with manageable risk. One of our further areas of exploration will use the "R" program to determine performance differences based on the underlying market's action (trend, sideways, reversal) versus the model's anticipated direction and magnitude.

Finally, we’ll close with theMonte Carlo statistics. The results below are the composite results of 1,000 walk-forward runs based on a $100k account size. This provides a more representative sample of trade expectations. Once again, the drawdown/return metrics coupled with the expected winning percentage meets the edge necessary to put my dollars at risk. Remember, I developed this to trade my account, as well.

One final note on the Euro trade. I just finished my next column for Modern Trader magazine, and I noted that, while the US Dollar Index appears relatively neutral, several bullish foreign currency setups imply a weaker Dollar ahead. Specifically, the Euro has two factors working in its favor. First, the commercial traders in the Euro have used the consolidation since February's rally to buy back their short positions as they've been net buyers three of the last four weeks. This runs contrary to their typical negative feedback behavior and suggests that the people making the largest forward sales are pretty sure they'll be able to execute at a more favorable rate.

Secondly, the declining volatility following January's sharp rally has led to a bull flag continuation pattern on the weekly chart. A close above $1.2545 this week or, $1.2506 next week should trigger this pattern higher. Measured objectives moving ahead are $1.2820 next week and $1.2732 for the last week in April.

We've updated the seasonal results through our last loss in the KC wheat.