Recent trade discussions have been unfavorable to the domestic agricultural markets, including June live cattle, which have fallen more than 18% in six weeks. There are two reasons we believe cattle will bounce. First, the commercial traders, in this case, the packers, have been net buyers for seven straight weeks. The strength of their buying states that they believe we've reached bargain prices. Secondly, we're entering a period of seasonal strength for June live cattle that we forecast to last through the second week in May.

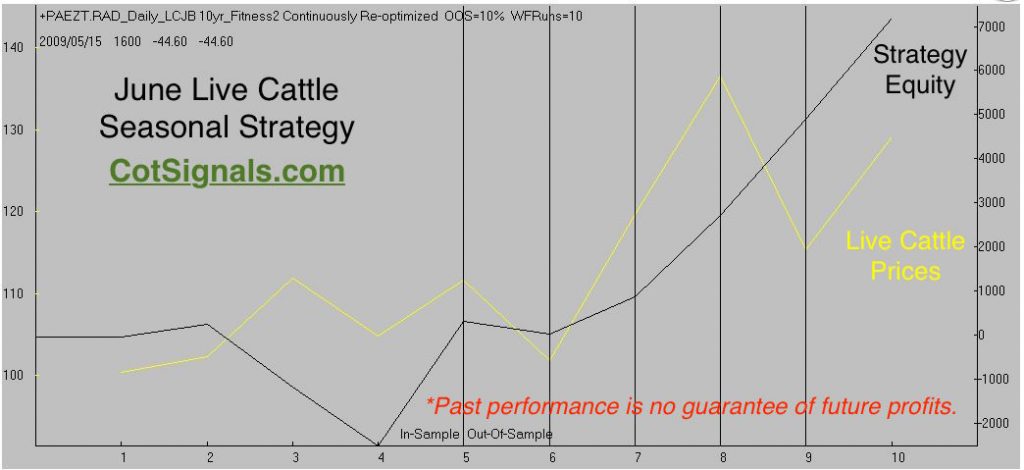

Based on the 10-year seasonal model of June live cattle prices, we'll go long on Monday's open at 9:30 EST.

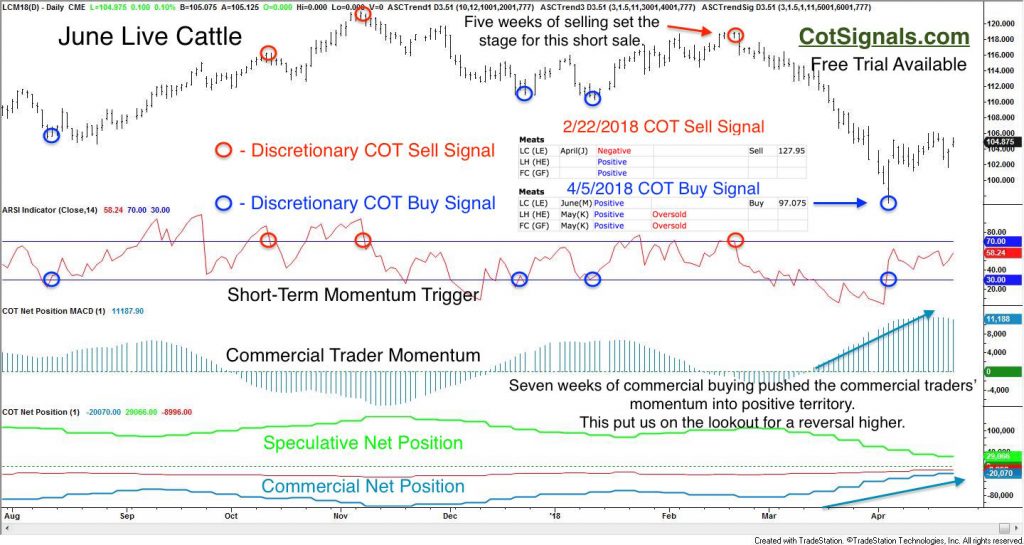

Before moving to the seasonal analysis, let's look at the commercial traders' expectations for the live cattle market via the Commitment of Traders report.

We track the battle between the speculators and the commercial traders. Our research has shown that conflict between these two groups typically resolves in the commercial traders' favor. The Discretionary COT Signals are shown above and plot the battle between these two groups along with the market prices and our short-term momentum trigger. Note that we only take trades in line with the commercial traders' momentum and the market must reach overbought levels when commercial trader momentum is negative to set the short sale trigger. Conversely, commercial trader momentum must be positive, and the market must breach the oversold threshold to set the trigger for a long entry.

Finally, note that the protective stops, as shown on the inset of the chart, are always the most recent swing high or, low. We use chart based stops because this is a reversal methodology. We expect to profit as the speculators exit the market and the market prices resolve in the commercial traders' forecasted direction.

The Discretionary signals are our most sensitive product, and it triggered a buy signal in June live cattle on April, 5th; the trade-war low. This makes perfect sense as the commercial traders had been net buyers ahead of the pending window of seasonal strength.

Discretionary COT Signals Free Trial

Seasonal Details:

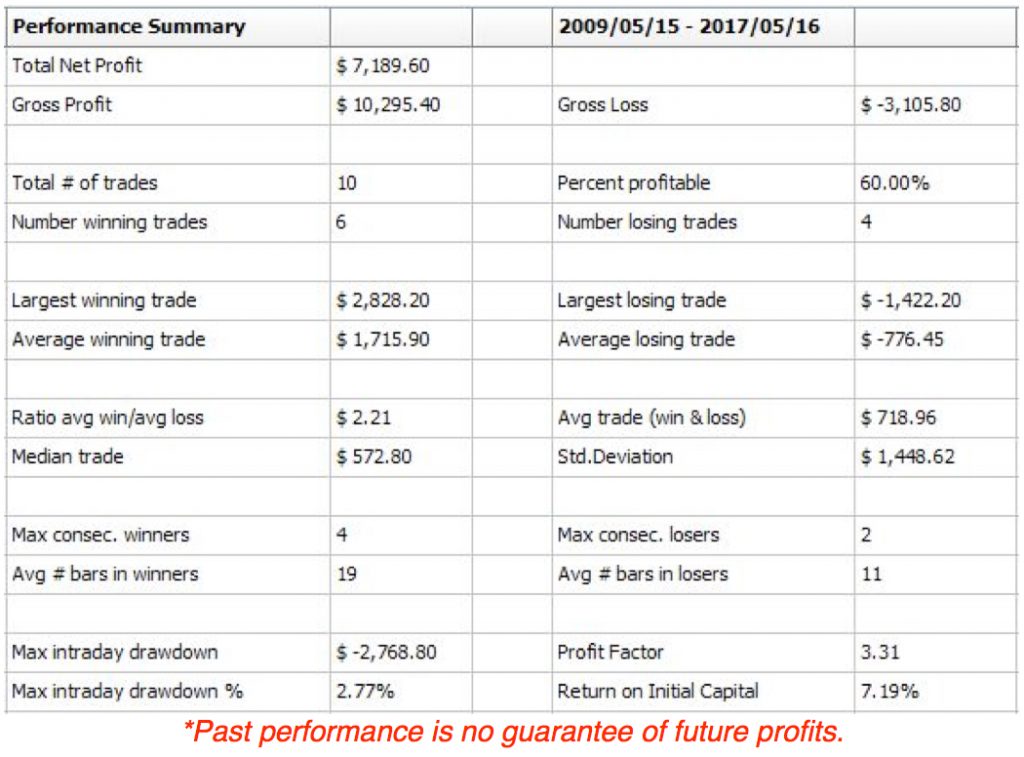

June live cattle futures margin - $1,650.

Risk - We're using a fixed sell stop to protect the position placed 1% below Monday's opening tick. Based on Friday's close, this is a price of 102.675, which equals a $420 risk from Friday's close at 103.725. The stop is pretty close to the market and helps minimize the total Dollars at risk, however, note below that this strategy only has only won 60% of its trades.

Reward - The average return for all trades is $730. The average winning trade is $1,715. This is a little more than 4 points worth of movement and would run the price up towards 108.

Now, the Live cattle futures prices plotted against the model's equity curve. Note that the two successive losing trades occurred before the first re-optimization period.

As always, we'll close with the Monte Carlo results. These results are based on 1,000 runs and a $100,000 account to make the math simple. The trading metrics aren't as gaudy for this trade as they have been for others. However, we feel that this is a solid play on its own. The exogenous selling pressure placed on the markets by the news cycle is likely to mitigate heading into a period seasonal strength.

We shall see.