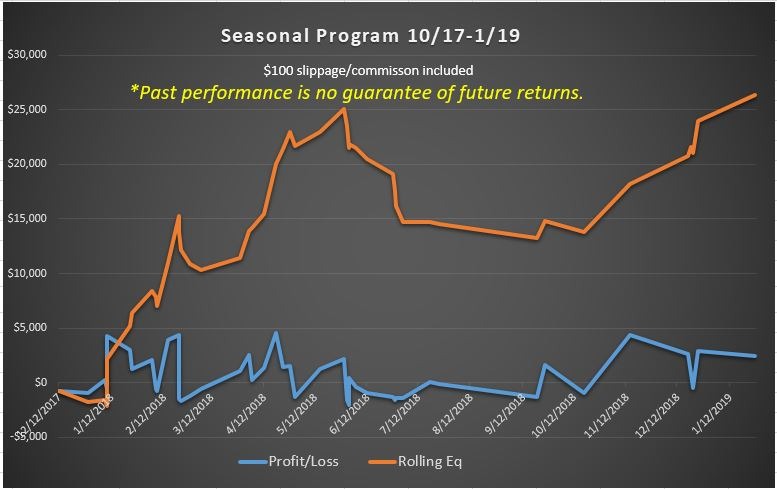

Some of you have requested an update on where we stand since we began publishing the seasonal trades. You'll find the results below, along with some trading notes and helpful hints.

Best, Andy Waldock.

($100 included for slippage and commissions)

10/02/2017 - ($800) loss shorting December cocoa.

10/26/2017 - ($1,000) loss buying November soybeans.

11/21/2017 - $240 profit shorting the Canadian Dollar.

12/05/2017 - ($587.50) loss buying December copper.

12/12/2017 - $4,300 profit buying the mini S&P 500.

12/12/2017 - $3,000 profit shorting February live cattle.

12/29/2018 - $1,250 profit buying February live cattle.

01/08/2018 - $2,030 profit buying March Australian Dollar.

01/09/2018 - ($625) loss buying March 10-year T-Notes.

01/09/2018 - ($781.25) loss buying March 30-year Treasury Bonds.

01/23/2018 - $3,900 profit buying April platinum.

01/24/2018 - $4,390 profit buying February Gold.

2/05/2018 - ($1,500) loss buying March soybeans.

02/07/2018 - ($1,675) loss buying March silver.

02/08/2018 - ($1,240) loss buying March Dow Jones futures.

02/14/2018 - ($600) loss buying April crude fixed stop.

02/21/2018 - $1,080 profit re-buying April crude fixed stop.

02/21/2018 - $2,520 profit buying April crude dynamic stop.

02/22/2018 - $230 profit buying March Australian Dollar.

02/27/2018 - $1,300 profit buying March silver.

03/06/2018 - $4,580 profit buying March Dow futures.

03/29/2018 - $1,411 profit buying May sugar.

04/03/2018 - $1,541 profit buying May RBOB unleaded.

04/05/2018 - ($1,300) loss shorting May KC wheat.

04/12/2018 - $1,280 profit buying May crude oil.

04/19/2018 - $2,168 profit shorting May coffee.

04/23/2018 - ($1,556) loss buying June euro currency.

04/27/2018 - ($2,056) loss buying the June British Pound.

04/30/2018 - $400 profit buying July soybeans.

05/15/2018 - ($420) loss buying June live cattle.

05/29/2018 - ($980) loss buying the Canadian Dollar.

05/31/2018 - ($1,350) loss shorting July coffee.

06/01/2018 - ($1,590) loss buying September cocoa.

06/01/2018 - ($1,405) loss shorting September Nasdaq 100 futures.

06/05/2018 - ($1,450) loss shorting Nasdaq 100 futures.

06/12/2018 - $20 profit buying the Canadian Dollar.

06/27/2018 - ($170) loss buying August lean hogs.

06/28/2018 - ($1,338) loss buying September copper.

06/29/2018 - $1,588 profit selling September corn.

07/03/2018 - ($963) loss buying October sugar.

07/19/2018 - $4,330 profit selling October platinum.

07/24/2018 - $2,630 profit selling August natural gas.

09/20/2018 - $788 profit shorting December corn.

09/25/2018 - ($526) loss buying March sugar.

10/18/2018 - $2,890 profit buying March sugar.

11/14/2018 - $2,425 profit shorting December Japanese Yen.

12/18/2018 - ($1,285) loss buying March cotton.

12/20/2018 - ($660) loss buying January orange juice.

12/21/2018 - ($480) loss shorting February live cattle.

12/24/2018 - $2,230 profit shorting February lean hogs.

01/27/2019 - $613 profit buying April platinum.

Total Profit = $27,228.

50 trades. 26 wins. 24 losses.

Big win = $4,580.

Big loss = ($2,056).

*Past results are no guarantee of future success. Futures trading is inherently risky. Therefore, only true risk capital should be used.

*Past performance, though real trades are no guarantee of future performance. Futures trading is risky.

Please, call with any questions and remember, we can trade these for you via a letter of direction.

Best, Andy Waldock.

Full Seasonal Disclaimer -

Seasonal tendencies are a composite of some of the most consistent commodity futures seasonals that have occurred in the past several years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year even if a seasonal tendency occurs in the futures, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the futures, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.