Our next new positions are in the copper and live cattle markets.

The markets are closed Thursday, and we'll be out of the office on Friday. Don't worry, the nightly COT Signals email will go out as usual, and will update any new seasonal actions to be taken.

We'll go over the specifics of the copper trade then, live cattle, and finally, display the cumulative annual results for the seasonal portfolio from our current Canadian Dollar position through New Year's Eve and our last trade of the calendar year in the gold market.

Get Andy's Seasonal Analysis - $35 per/mo.

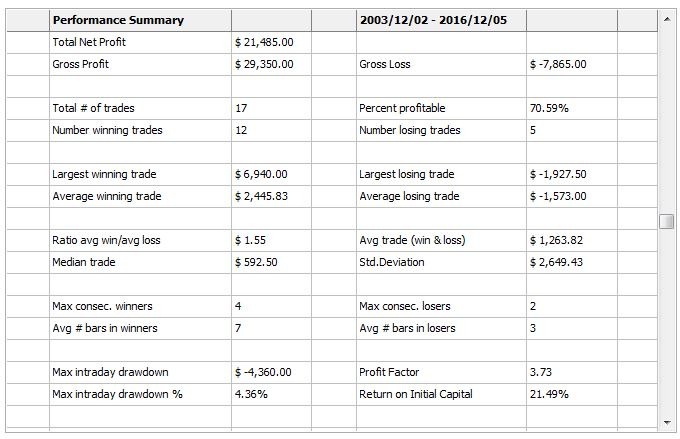

Copper 15-Year Summary:

Buy March copper futures when we issue the signal.

Place a protective sell stop 2% below the entry price, risking approximately $1,550 at today's price.

We'll hold the trade until the first day or, two of December.

Please, let me know if you like this format. All percentage calculations are based on a $100k account balance for easy interpolation.

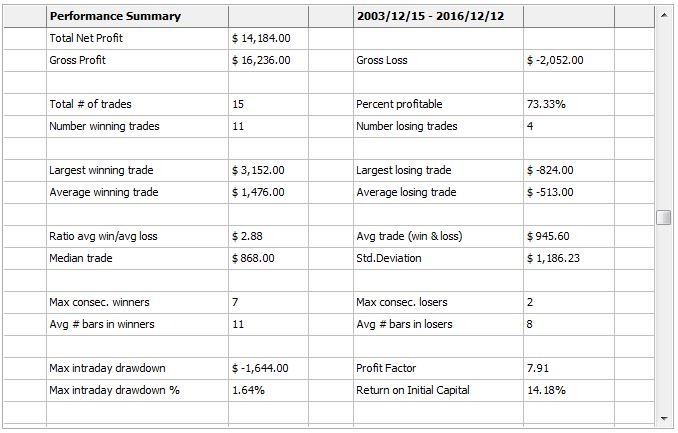

Live Cattle 15-Year Summary:

Sell February live cattle futures when we issue the signal.

Place a protective buy stop 2.5% above the entry price, risking approximately $1,230 from today's price.

We'll hold this short position about three weeks.

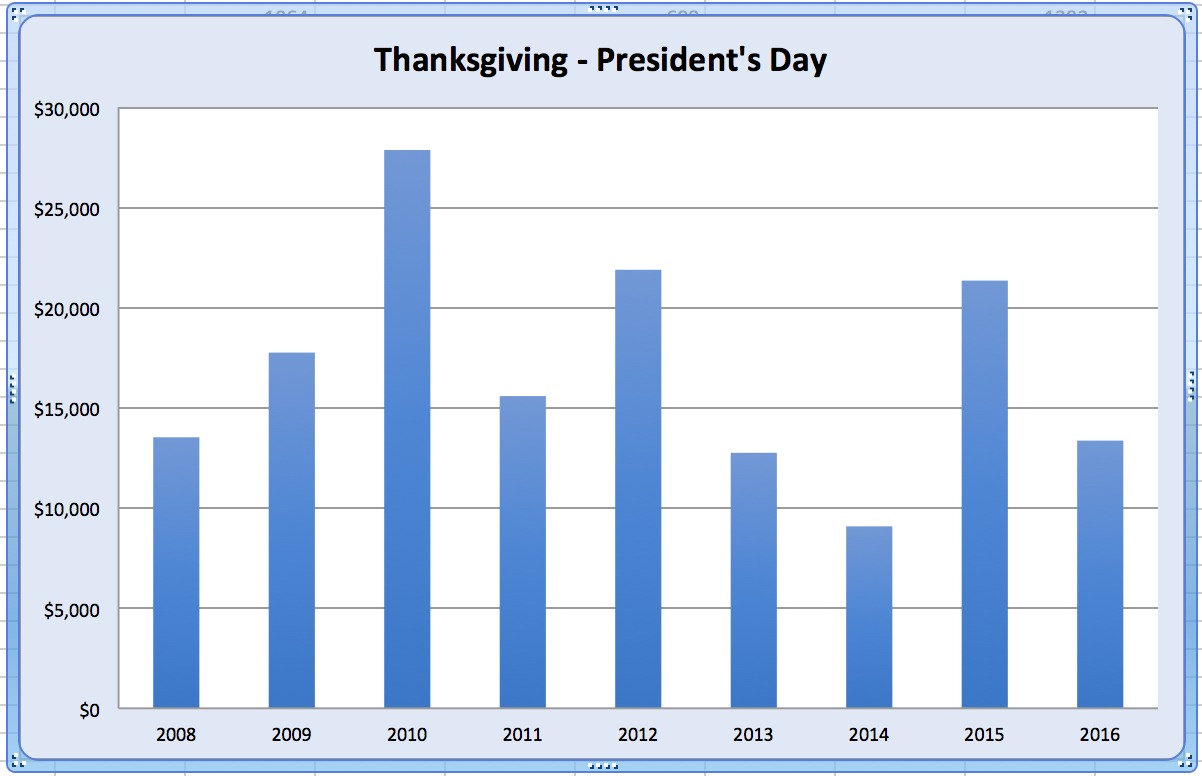

Finally, we've compiled the profit and loss by year for our current open positions plus the five more trades we'll execute through year's end into the chart, below.

Seasonal Composite by Year:

First, an important portfolio composition point. The above chart assumes two contracts are traded in the cattle market. This is the adjustment we make to our portfolio to help even out the average trade sizes between markets.

Follow Andy's seasonal analysis for $35 per month.

Now, as you can tell, we've got some work to do if we're going to catch up to our 9-year average of more than $17k for the seven setups that come to pass through this period.

We're already in the Canadian Dollar and S&P 500, and we've mentioned the cattle and copper trades coming this week. This leaves gold, platinum, and another cattle trade yet to come.

Stay tuned.