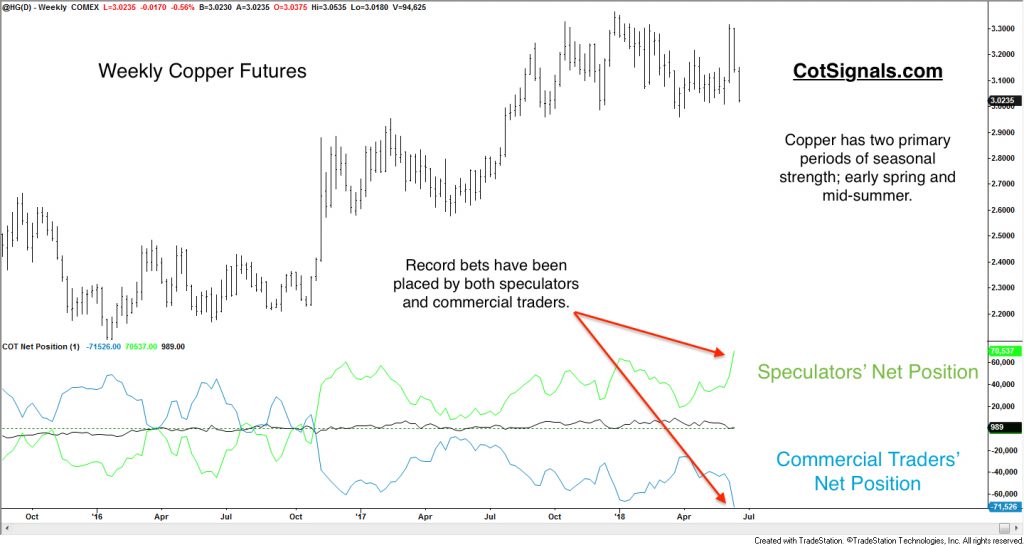

I believe the copper market will peak following one more bounce off of the support around $3 per pound. We have opposing market forces between the copper producers' forward selling and a seasonally strong month for copper based on a booming economy and construction sector. The speculators are carrying a record long position expecting industrial needs to continue while copper producers are locking high prices while the opportunity is available.

Typically, traders acting on behalf of their companies business plan, employ a disciplined scaling approach to their hedging. This helps average their prices over time, and also allows them to time to execute a large number of futures contracts in smaller chunks to hedge their physical risk.

The record speculative long position is likely to grow further as latecomers look for profitable opportunities on the long side. This could push the market to one more high before the commercial selling of forward production takes over and forces the market lower through the third quarter.

First, let's look at the weekly copper futures chart and the record wagers being placed on the market's direction.

Can the speculative surge in buying push the market to one last new high?

The diverging behavior between the market's participants is relatively standard as the commercial traders, via builder purchases, procure the necessary raw materials for the spring thaw and the year's anticipated construction. This cycle creates a period of strength from April through June. Once these bids are filled, copper miners become the dominant seller in the market. This brings us to the current seasonal trade and what we believe to be the last, "hurrah!" for the copper market's year.

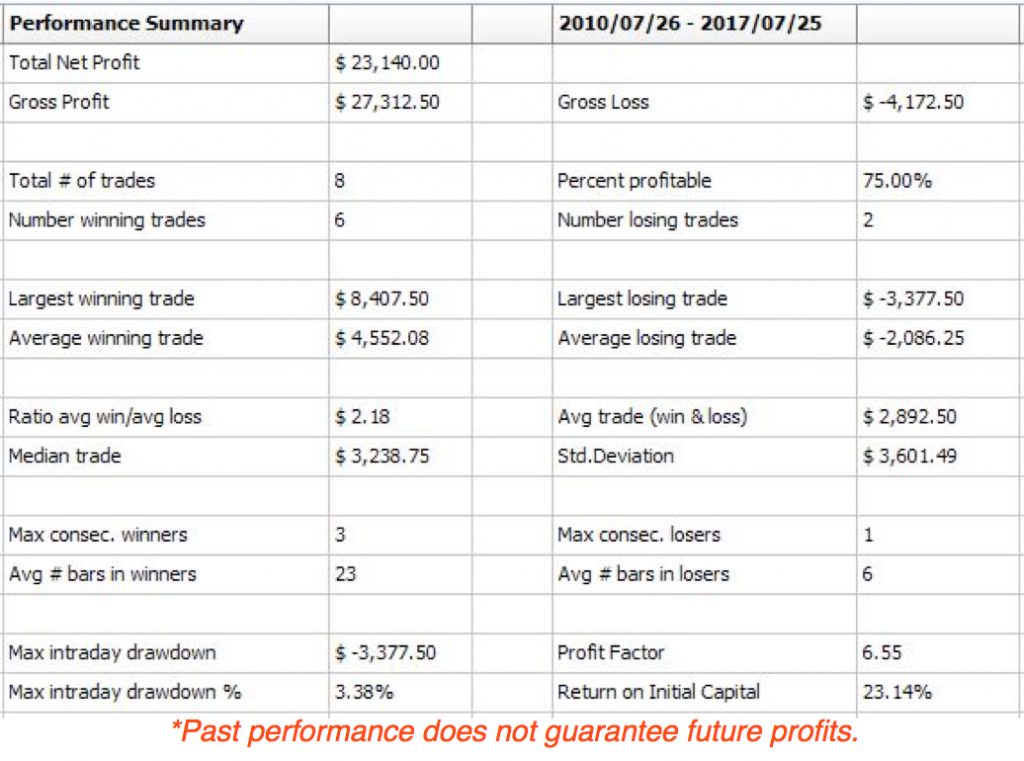

Our seasonal algorithm currently has a buy signal pending. We'll send an email once it fires, and update the protective stop, daily. We use a dynamic stop in this market due to volatility, contract, and tick size. This provides two benefits. First, our maximum risk is limited to 1.5% from the entry price. This about $1,150 per contract from the current price of $3.05 per/lb. The second benefit of the dynamic stop model is that it allows us to capture a portion of accrued profits should the market violently reverse. Again, we expect the copper market to fall, perhaps precipitously, once the speculative buying runs its course later this summer.

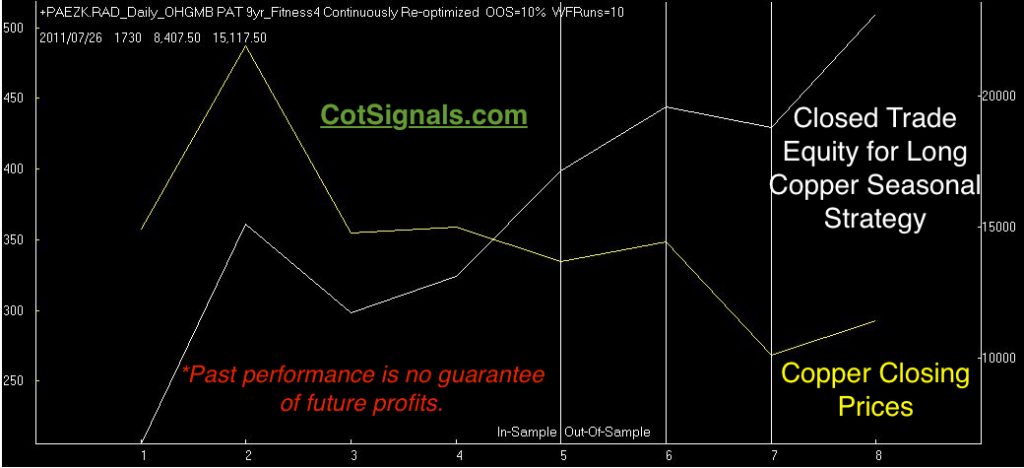

The next chart shows our seasonal algorithm's closed trade equity, plotted in white, vs. the closing price of copper, which is plotted in yellow.

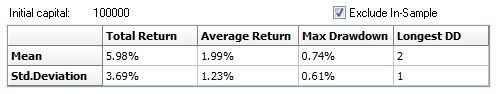

Finally, we use Monte Carlo analysis to help offset the limited nature of seasonal data. The most significant difference is that the performance results above, are the result of the model we're testing across time as we've known it. While the model had never seen the data it produced the results from, it is still only one run, and it only produced eight trades. Monte Carlo analysis splices up the data and runs the same setup 1,000 times. Monte Carlo analysis then calculates the performance averages and distributions across the entire population of runs.

See our Seasonal Results and remember, we can execute these strategies on your behalf, leaving your hands free to tend to your daily affairs.