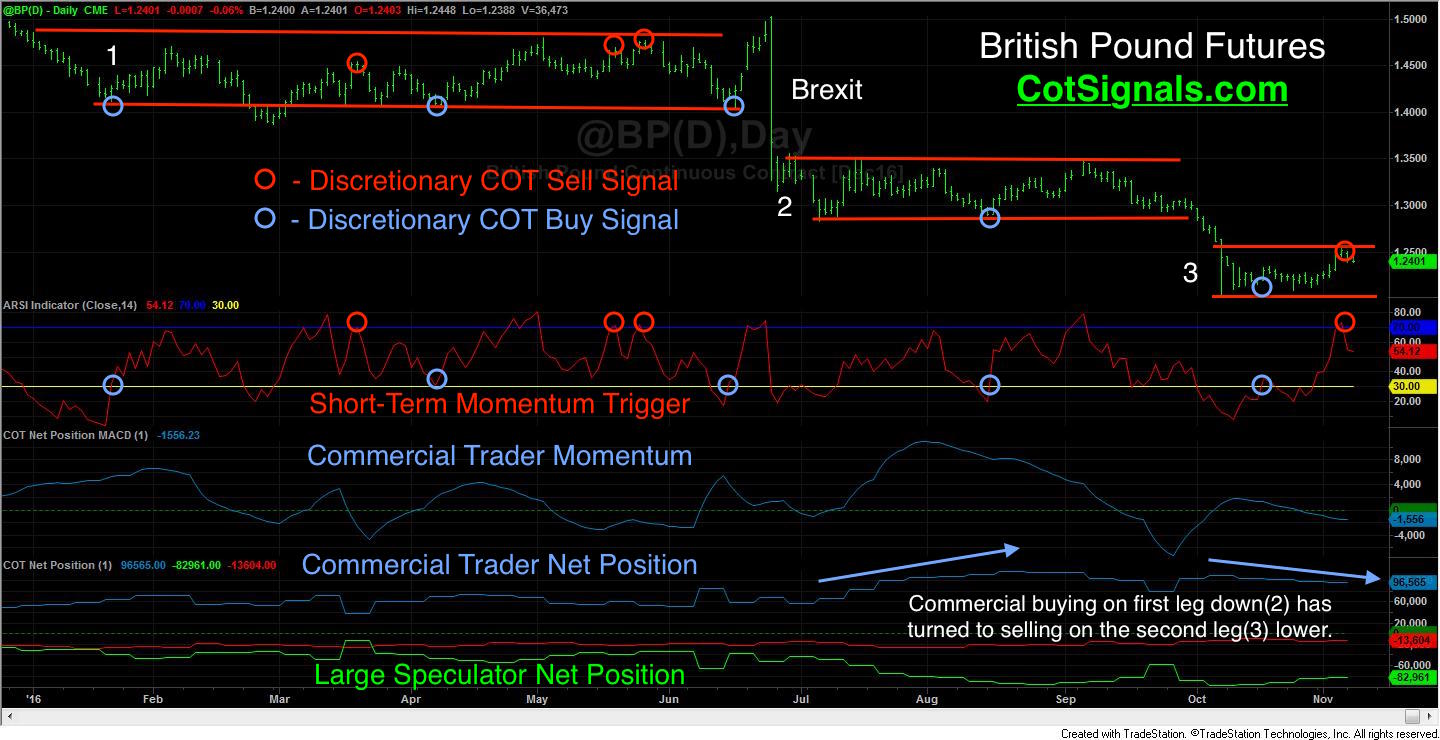

The British Pound has spent 2016 trading in three distinct ranges. This first half of the year it traded between $1.40 - $1.50. The Brexit vote pushed us $.20 lower and defined the range through the end of September. Finally, the market made a big push lower in the early October and has traded between $1.20 and $1.2650 for the last month. First, we'll look at the individual trades picked up over the course of the year using the commercial traders' actions as a guide. Then, we'll address the enormous shift in commercial trader sentiment over the month of October and what that could mean for future prices.

We frequently discuss the notion that commercial traders are value or, range traders. While this is true, it's also important to note that they trade their positions around the core hedges necessary to their business models. This requires the ability to think on a macroeconomic scale while still executing within daily bars. Therefore, the dual purpose of the enclosed chart is to illustrate the swing trading opportunities that make themselves available as the commercial traders apply support and resistance at the market's extremes.

Our range trading methodology is a simple but effective three-step process. First, we only take trades in the same direction as the commercial traders' momentum indicated in the third pane of the enclosed chart. We buy when they buy. We sell when they sell. However, because we are risk-averse retail traders, we must be more selective with our entries. So, we wait for a range bound market to become overbought or oversold as indicated by our short-term momentum trigger. Applying the short-term momentum indicator in the context of opposing commercial trader momentum sets up conflict within the market. Within each of the three ranges listed on the chart, there is at least one setup that matches the criteria. Each is noted as a discretionary Commitments of Traders buy or, sell signal. Profits are taken as the market returns to its mid-range value area.

Shifting to the macro level, we can see that commercial traders were big buyers in July and August on the decline following the Brexit vote. This led to the August and early October buy signals. However, the commercial traders have been sellers for four straight weeks, and there is growing concern that post-Brexit aftershocks may be looming on the horizon. Erik Norland, Executive Director and Senior Economist of CME Group recently calculated that the British Prime Minister's announcement for invoking Article 50 in March of next year could lead to a "hard exit." Importantly, this announcement also spurred the last leg lower in the Pound along with the shift in commercial sentiment. He further states that he doesn't expect hard negotiations between the UK and the EU to gain traction until the Pound is closer to parity with the U.S. Dollar.

The stair-step nature of the British Pound's decline has provided a textbook illustration on how the commercial traders implement their outlook within a given market. Furthermore, choosing opportune moments to use their actions as a backstop for the implementation of our trades not only helps reduce our initial risk, it tends to put us on the right side of the market's value equation. You can sign up for a free 30-day trial of our Discretionary COT Signals and see how this methodology can improve the efficiency of your swing-trading.