We will be buying the June British Pound for our first seasonal entry in April. We'll buy the June British Pound futures sometime between Thursday and Monday, depending on the market's action. This will be one of our longer holding periods as we expect to let the market run through the rest of the month.

The Details:

British Pound futures margin - $1,980.

Risk - We'll be using a dynamic stop set to 1.5 times the average true range. The six-month average for this range has been .0168 or, $1,050 per contract. The six-month range for this calculation has been .0360 - .0068 or, $2,250 - $425, respectively. Currently, we're at .0105, which equals a current cash risk of $656.25 exclusive of commissions and fees.

Reward - The average return has been nearly .0300 points or, $1,875.

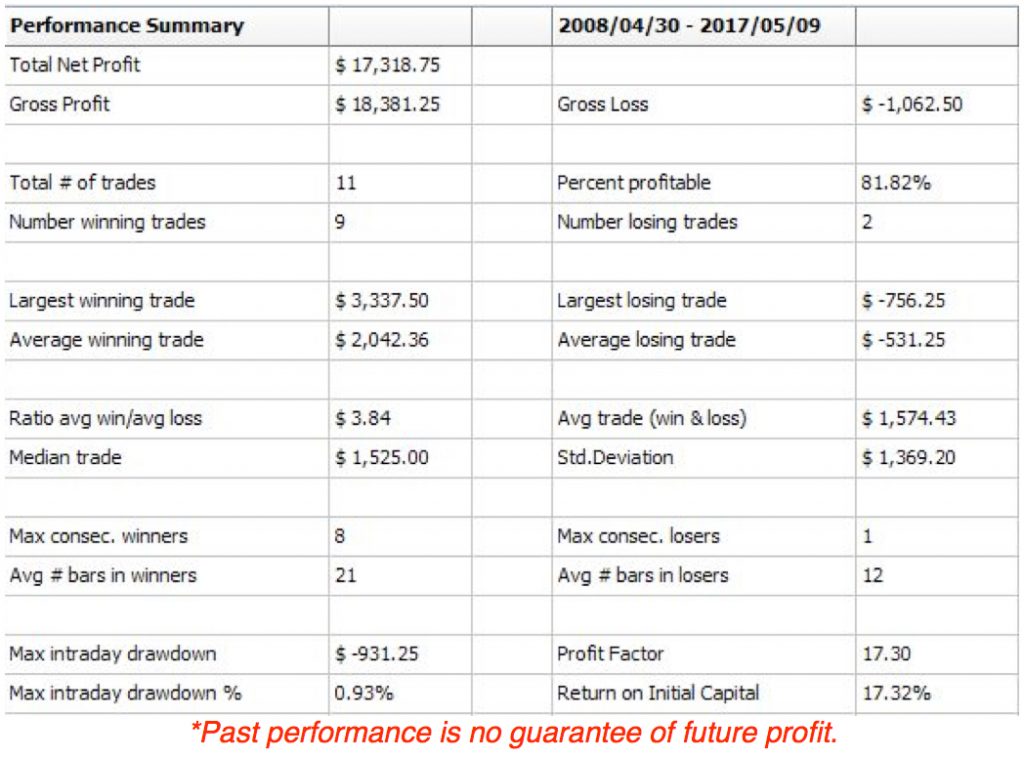

See the Tradestation report below for full out of sample performance.

Now, the British Pound closing prices plotted against the strategy's closed trade equity curve. I have to admit; I continue to be amazed at the pockets of profitability that can be found in spite of a market's overall trend. This is a long-only strategy, and the British pound has declined precipitously since mid-2014. As an aside, it appears that the Pound wants to re-test the $1.50 level, last seen the day of the Brexit vote.

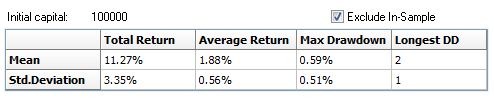

Finally, we'll close with theMonte Carlo statistics. The results below are the composite results of 1,000 walk-forward runs based on a $100k account size. This provides a more representative sample of trade expectations. Once again, the drawdown/return metrics coupled with the expected winning percentage meets the edge necessary to put my dollars at risk. Remember, I developed this to trade my account, as well.

One final note on the British Pound setup. The weekly trend is supported at 1.3990 going back to November and 1.3700 going back to last March. as mentioned above, the Pound is behaving like it wants to test the Brexit breakout near $1.50. The market is currently forming an inverted head and shoulders pattern. The near-term weekly trend at 1.3990 represents the failsafe line. This pattern will be triggered by a close above the neckline at 1.4260 and has a measured upside objective of 1.4620.

As always, we'll send out the entry signal once it's generated and follow up nightly with the dynamic stop's calculation.