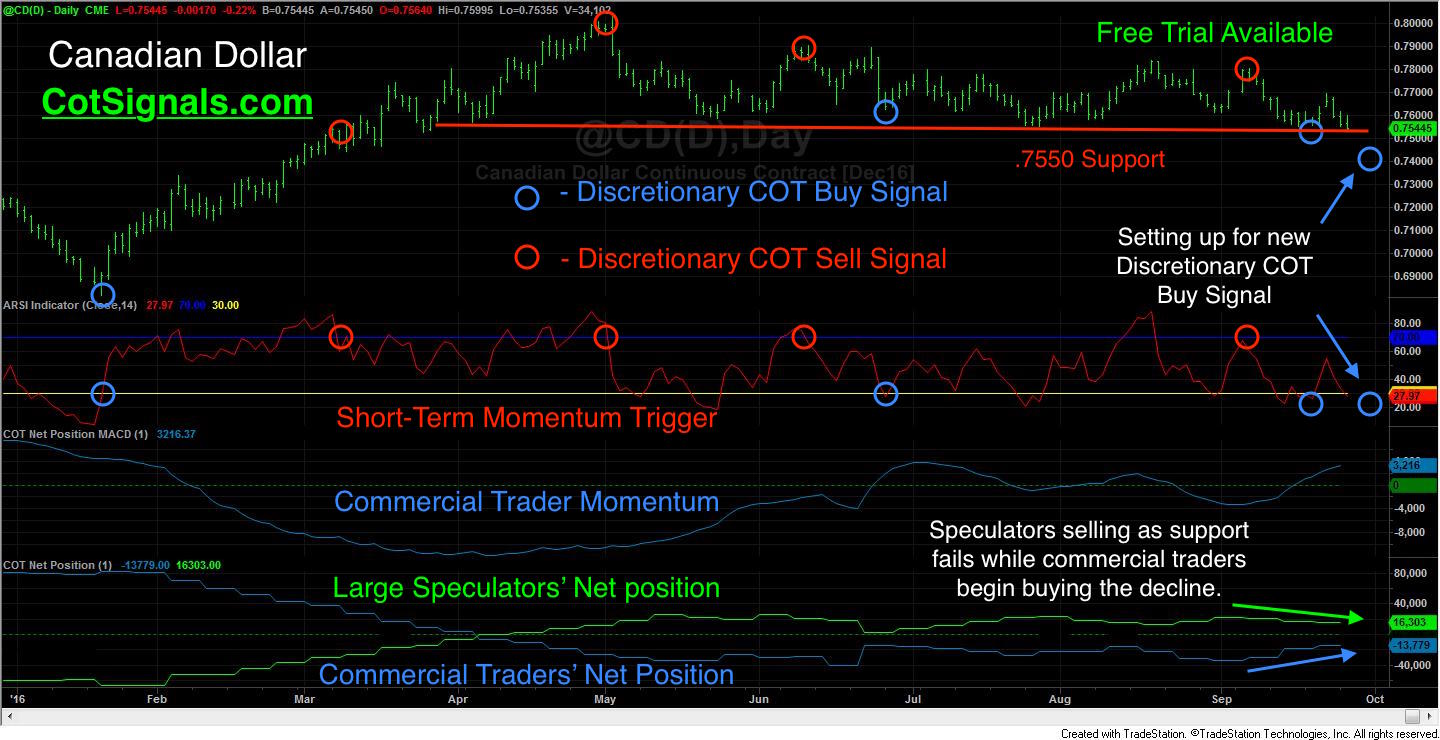

The Canadian Dollar made one last try higher at the beginning of the month but has ground its way lower ever since. Moreover, the recent weakness has now breached important support around $.7550 to the U.S. Dollar. Classic momentum trading techniques would suggest that breaching this level could be the catalyst to a washout towards lower prices. However, we don't think this will be the case as commercial traders have come in on the buy side and supported the Canadian Dollar's recent weakness.

This year began with commercial traders selling the Canadian Dollar above $.71. In fact, commercial traders were on the sell side for 15 straight weeks. They built their largest short position in more than three years as the Canadian peaked at just over $.80 to the Dollar. Since then, the market has been stuck in a sideways range between $.7550 and $.80.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) As expected, the large speculators made one more push to restart the upward trend in early June and failed miserably. You can see on the chart below that the large speculators shed roughly 25k contracts in three straight weeks of selling after June's failed attempt to rally back above $.80. Currently, even the patient large speculators are being forced into action as the long-term trend they've intended to ride, is falling through summer's support. Once again, the large speculators are being compelled to sell. This time, fighting among themselves to get their sales off as the long-term positions are laid off and new short positions are added on the market's weakness.

As expected, the large speculators made one more push to restart the upward trend in early June and failed miserably. You can see on the chart below that the large speculators shed roughly 25k contracts in three straight weeks of selling after June's failed attempt to rally back above $.80. Currently, even the patient large speculators are being forced into action as the long-term trend they've intended to ride, is falling through summer's support. Once again, the large speculators are being compelled to sell. This time, fighting among themselves to get their sales off as the long-term positions are laid off and new short positions are added on the market's weakness.

This brings us to the setup. The battle between commercial traders and large speculators typically resolves itself in favor of the commercial traders' collective momentum, which you see plotted in the third pane of the included chart. This is our first screen. Next, we look for a short-term market move against the commercial traders' momentum. This combination creates tension within the market as the speculators try to push the market while the commercial traders take the opposite side because recent price movement reflects added value to their business interests. As long as a speculative fever doesn't overwhelm the collective capacity of the commercial traders' business operations, the commercial entities' analysis of future currency movement remains intact.

Commercial traders are using the Canadian Dollar's recent weakness to flatten out their net position. This buying is apt to offset the commercial traders offsets of long positions and rebuff and speculative attacks on Canadian Dollar devaluation. Therefore, this is most likely a false breakout to the downside in the face of growing commercial bullishness. We'll watch the decline for a reversal higher in our short-term momentum indicator and use this as our signal to join the big money on the long side at a discounted price. Finally, as always, we'll place a protective sell stop at whatever the swing low price turns out to be.

We're offering a 30-Day Free Trial to our Discretionary Cot Signals. This will most likely include publishing the Canadian Dollar buy signal and protective stop.