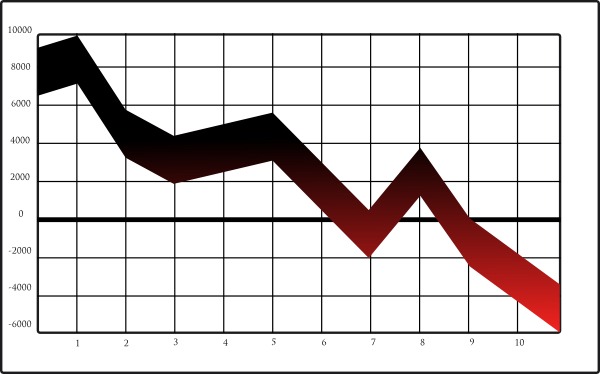

Commercial Traders Aggressively Selling S&P 500 Futures

There’s been a lot of talk about trade wars triggering an overdue stock market correction.

There’s been a lot of talk about trade wars triggering an overdue stock market correction.