The British Pound was trading at more than $1.47 to the Dollar just one year ago. The Brexit vote last June and the British Pound "Flash Crash" in October combined to drive the Pound to its lowest level against the Dollar in more than 30 years. The one thing that both of these events had in common was commercial traders stepping up to hedge the currency risk in their business models by buying the British Pound futures at what they felt would be cheap short-term prices. Now that the Pound has begun to recover some, eight months later, it's time to take stock of the recent activity in the Commitment of Traders report.

Post-Brexit selling pushed the market below $1.30. The market traded sideways for a couple of months rather than instantly rebounding. Commercial buying momentum remained positive throughout this period, right through the Flash Crash in October. Commercial traders are long-term value players, and they were quick to step in and buy Pounds at what they perceived as transient bargain prices as the market reached 15-year lows. In fact, it wasn't until after the Flash Crash when the Pound traded to 30-year lows below $1.21 and began to rebound that we saw the first hint of commercial selling.

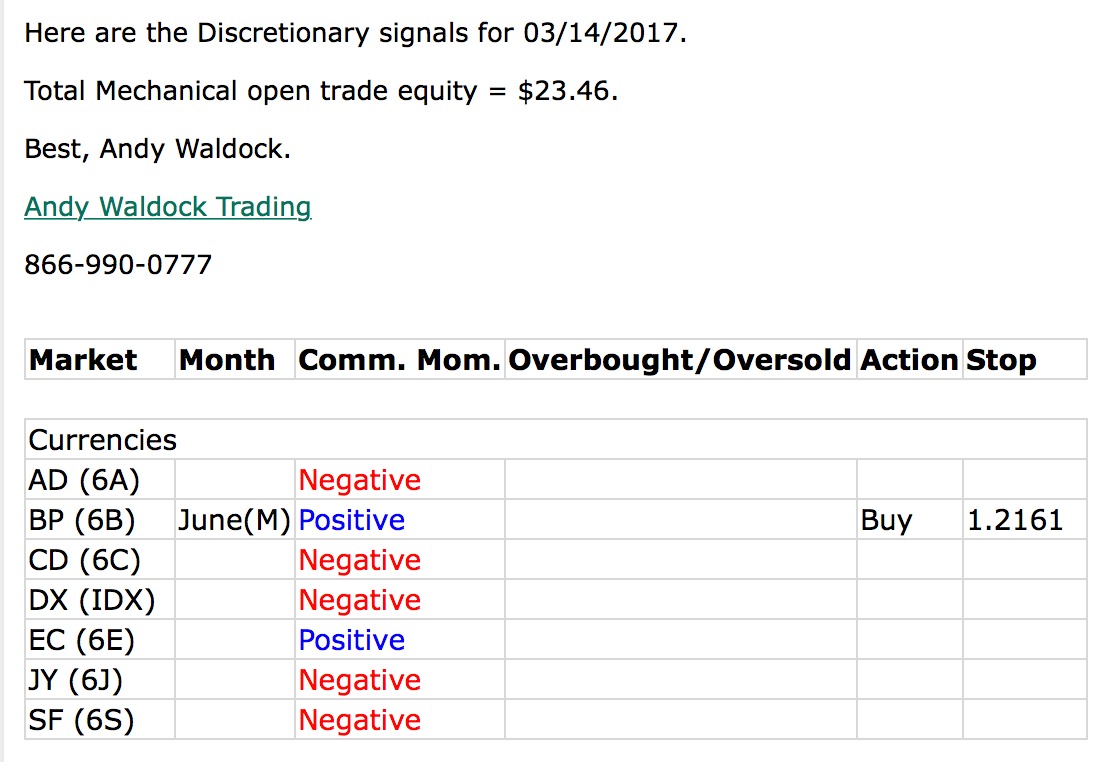

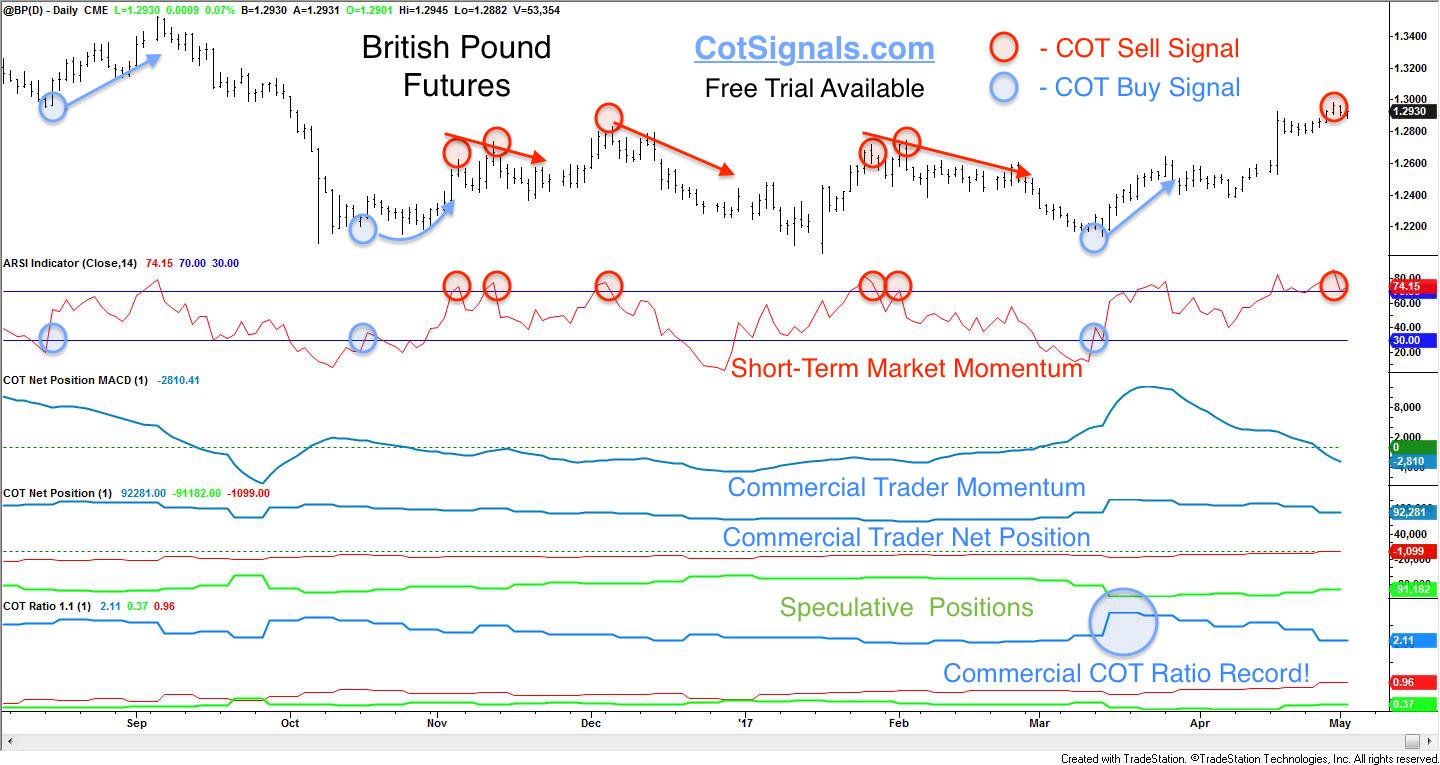

This brings us to the second point; commercial traders are range traders. The market stabilized between October and March. The commercial trader behavior during this period clearly shows them as sellers of rallies. And while they used these rallies to offload some of the long positions they'd accumulated, they still felt bullish enough on March's decline to set a new commercial trader COT Ratio record, making them long nearly three contracts for every short position they held. This influx of cash immediately preceded the Pound's typical April seasonal strength and triggered a Discretionary COT Buy signal on March 14th.

Let's move to the chart below and see how we construct these signals and where we currently stand. Our research has shown that the commercial trader category of the Commitments of Traders report is the most predictive of future price movement in the underlying contract. The commercial traders are typically the ones pulling the commodity out of the ground or, processing it for consumption. However, in the financial markets, they are hedging currency risk. Fortunately, the same rules apply because commercial trader behavior is all about the company's bottom line, not speculation. They base their decisions on the best analysis and connections they have...and boy do they have connections.

We are not running businesses with commodity or currency risk to hedge. We are speculators. However, we are not trend traders. We are swing traders. We base our trades on the conflict between commercial and speculative traders. Speculators exist for trends and bubbles. They rarely occur. We take the opposite side and expect trends and bubbles to be the exception rather than the rule. Therefore, when commercial traders are selling, and speculators are trying to push a market higher, we wait for the speculative drive to fail and enter on the short side. We use the failed high point as our protective stop, and we expect to cover our short position at a profit while the speculators take their losses as another attempted trend fails to gain traction.

We are not running businesses with commodity or currency risk to hedge. We are speculators. However, we are not trend traders. We are swing traders. We base our trades on the conflict between commercial and speculative traders. Speculators exist for trends and bubbles. They rarely occur. We take the opposite side and expect trends and bubbles to be the exception rather than the rule. Therefore, when commercial traders are selling, and speculators are trying to push a market higher, we wait for the speculative drive to fail and enter on the short side. We use the failed high point as our protective stop, and we expect to cover our short position at a profit while the speculators take their losses as another attempted trend fails to gain traction.

Obviously, the opposite is true for long trades. We let the speculators press the market down towards commercial buying support. When the market becomes oversold on our short-term market momentum indicator, and the commercial support holds, we'll go long as the market reverses higher. Additionally, we'll use the recent low as our protective sell stop point.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) Finally, the commercial traders appear stuck offering at $1.30 to the GBP. This makes sense as it was the bottom of the post-Brexit but, pre-Flash Crash range. This turns commercial traders who were once buyers at the 15-year low into sellers now that it has taken nearly eight months to return to breakeven. We expect their selling to continue to provide resistance in the short-term and advise taking profits on any long positions initiated on the March buy signal. Furthermore, we expect a short-term reversal lower here for those nimble enough to trade both sides.

Finally, the commercial traders appear stuck offering at $1.30 to the GBP. This makes sense as it was the bottom of the post-Brexit but, pre-Flash Crash range. This turns commercial traders who were once buyers at the 15-year low into sellers now that it has taken nearly eight months to return to breakeven. We expect their selling to continue to provide resistance in the short-term and advise taking profits on any long positions initiated on the March buy signal. Furthermore, we expect a short-term reversal lower here for those nimble enough to trade both sides.

We use the Commitment of Traders report to generate nightly Discretionary and Mechanical commodity trading signals. Please visit CotSignals.com for more information and a free trial of the Discretionary email referenced above.