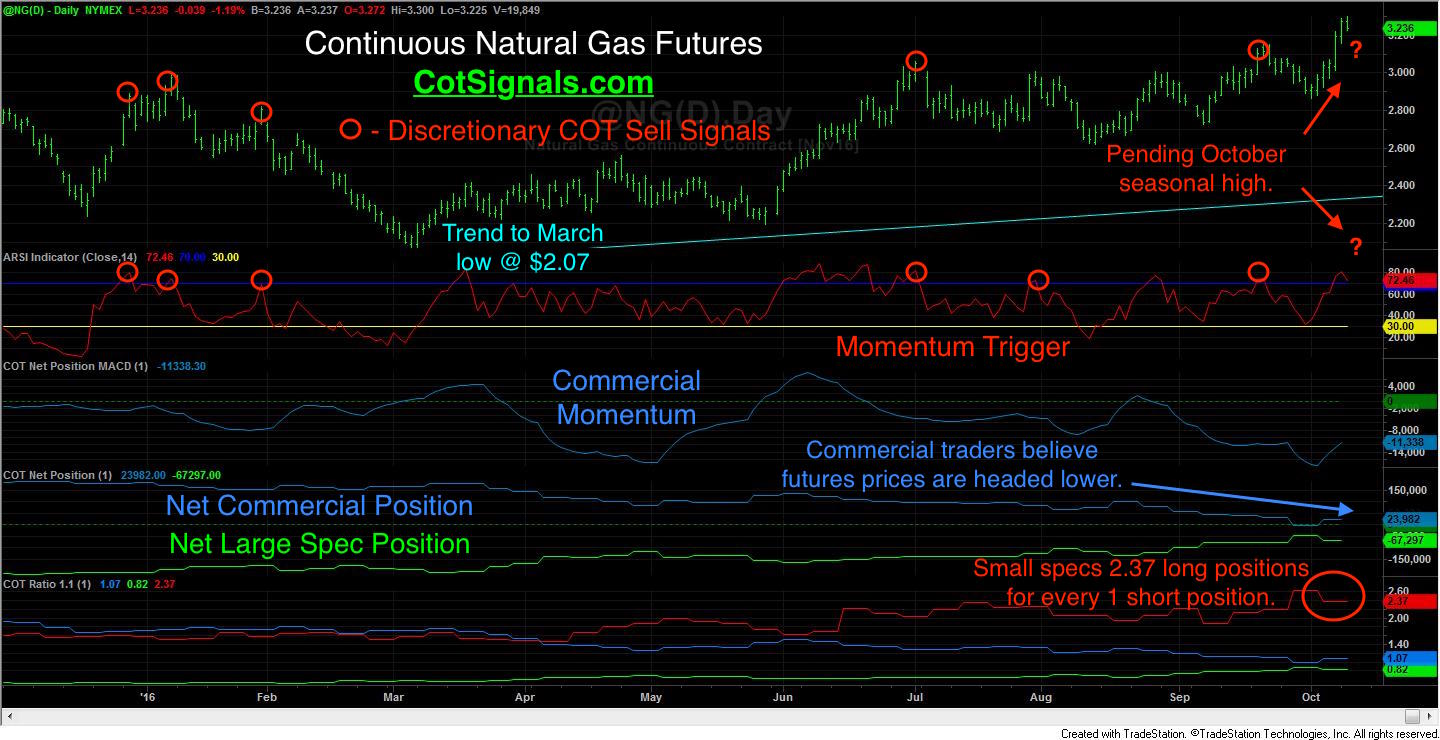

Natural gas, like the other energy markets, has ground its way higher since bottoming this spring as noted by the trend on the included chart. Much of the grind higher has been based on production cuts as prices fell below breakeven during the multi-year decline. The recent trend higher got a boost from Hurricane Matthew and its anticipated impact on the natural gas industry of the Gulf Coast. However, this speculatively led charge was just what the well operators have been waiting for to hedge forward production as Matthew's impact on the natural gas industry was minimal. This leaves natural gas futures ripe for short selling as we approach the typical, late October seasonal peak.

Due to the natural gas price declines over the recent years, the market has become driven by waves of speculative rallies rebuffed by the forward hedging of the natural gas well operators. You'll see in the chart below that we base our focus on the weekly Commitments of Traders report. We track the actions of the commercial traders and the large and small speculators to determine bias in the commodity markets. Note the divergence of opinions between the large speculators and the commercial traders beginning in August.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) Commercial traders have been net sellers in 14 out of the last 19 weeks. Furthermore, their selling increases proportionately as the market moves higher. Higher prices bring more producers to the market, and their collective selling pressure adds overhead resistance to fundamentally overvalued prices. This is the primary difference between speculators and commercial traders. The commercial traders are married to a given market's movements and remain committed whether prices rise or fall because their actions are based on the hedging model of their underlying business concern.

Commercial traders have been net sellers in 14 out of the last 19 weeks. Furthermore, their selling increases proportionately as the market moves higher. Higher prices bring more producers to the market, and their collective selling pressure adds overhead resistance to fundamentally overvalued prices. This is the primary difference between speculators and commercial traders. The commercial traders are married to a given market's movements and remain committed whether prices rise or fall because their actions are based on the hedging model of their underlying business concern.

Speculators, meanwhile are just looking for the next hot market and trying to, "catch a bid." This is easiest to see in the small speculators' position and our proprietary COT Ratio calculation. Heading into Matthew, the small speculators' position swelled to 2.63 long contracts for every short. Currently, it remains solidly in overbought territory at 2.37 to 1. The small speculators are historically the least successful trading group. This makes their reading noteworthy at extreme levels like we're currently experiencing.

Finally, the natural gas market tends to have two main seasonal peaks. One in the spring and the other near mid to late October. The current supply and demand situation along with minimal damage done to the Gulf Coast natural gas industrial complex leads us to believe that that Matthew has pushed us into and beyond the typical seasonal peak. Therefore, we will be selling natural gas futures once our short-term momentum trigger fires its signal. The sell signal will be distributed in our nightly, Discretionary COT Signals for which, there is a 30-day free trial. Finally, we expect the reversal lower could be significant as there is little in the way of fundamental information to support natural gas prices at these levels.