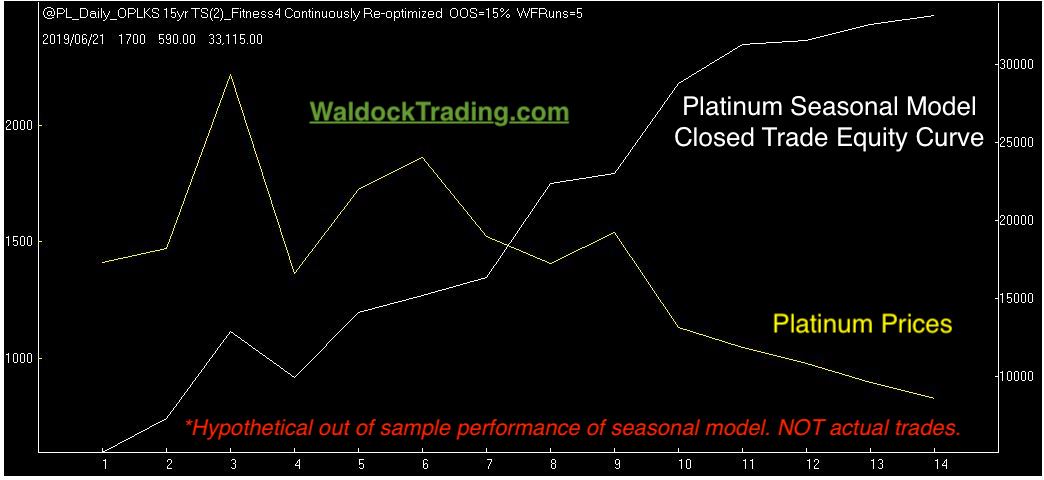

We are preparing to short July platinum sometime next week.

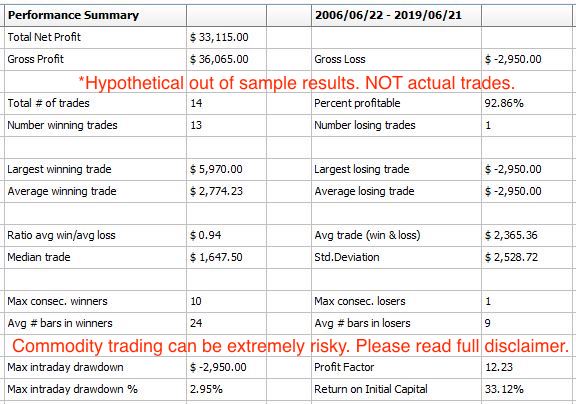

We'll hold the trade through mid-June, and risk 3% from the entry price (currently about $1,200 per contract).

Platinum margin is currently just under $5,000 per contract.

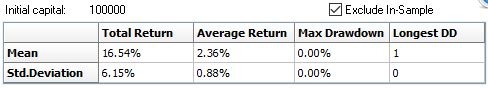

Monte Carlo analysis shows us that the expected win is more than twice the standard deviation of the average trade. This also shows that we can expect, on average, a winning trade between 1.48% and 3.24% on a $100k account. The current market prices suggest a move in the platinum futures between $30 and $65 or, 3.7% to 8%.