Yesterday, the World Agriculture board released its Supply and Demand report (WASD). This is a key report for the US grain markets ahead of the 2016 harvest. Rather than re-hashing the reported data or pulling preferred pieces to make an argument for market movement, we'll look at the markets' reactions to the report and see if we can't find some relative strength within the grain markets.

Obviously, we're all aware by now that this should be a record production year in both corn and soybeans. The slow realization of this fact has been our primary trade of the summer as the short hedgers, the farmers who produce corn and soybeans set records in their placements of forward hedges. Collectively, they signaled the June highs and put us on the short side for the duration of the summer's decline. Following the typical cyclicality of the grain markets

Following the typical cyclicality of the grain markets, we'll now begin looking for value. We begin our calculation of value through the weekly Commitments of Traders reports. This report breaks down the actions of the primary market participants. In so doing, it allows us a glimpse into the outlook of the given commodity's sentiment through the eyes of those who produce or, consume the commodity in question. Recently, commercial long hedgers, those who use the physical commodity have come to view the wheat market's recent prices as somewhat of a value and begun stocking up.

See the new look of COTSignals!

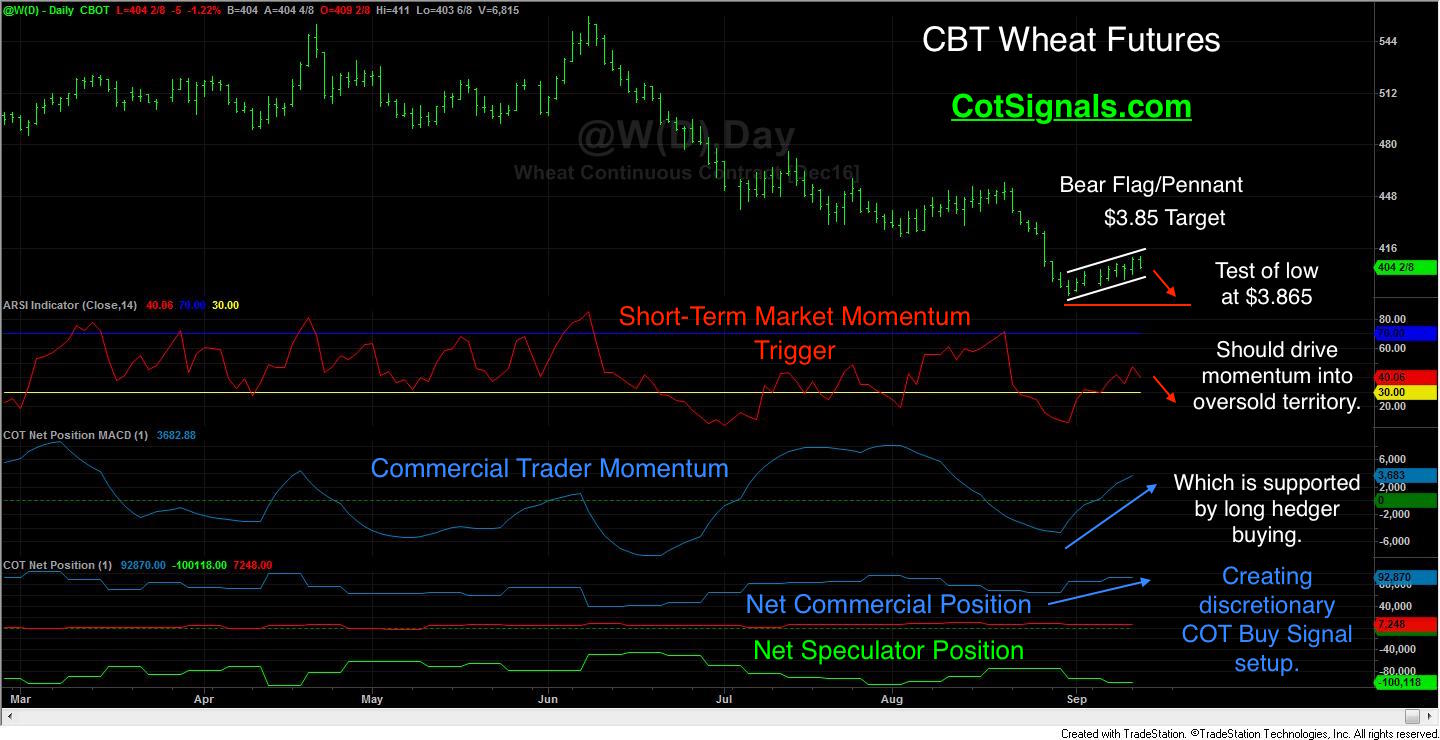

This sets the stage for the current situation. Corn and soybeans sold off hard on yesterday's report. Based on the numbers, they probably both have further to decline, including making a new low for the recent decline. This will create sympathetic selling in the wheat market, which held up pretty well compared to corn and beans. The relative strength of the wheat market is coming from the long hedgers' value based buying. We expect their buying to continue on further weakness and sets us up for the play described on the chart.

This situation describes the classic interaction between the speculators and commercial traders in the commodity markets. We expect the wheat market to fall through the bear flag currently supporting the market. This would provide a test of the low at $3.8675 and usher in trend following short selling by the speculators. However, based on the commercial traders' support we aren't expecting much in the way of lower prices. Commercial support just below technical trigger levels like new lows is a classic reversal play. Furthermore, marginally lower prices would place our short-term momentum trigger into oversold territory in the face of bullish commercial momentum. This is a classic Commitments of Traders commercial buy signal setup and speculative short selling trap. Beware and trade accordingly.