I specialize in analyzing the Commodity Futures Trading Commission's (CFTC) Commitments of Traders (COT) report. This weekly report breaks down a given market's open interest into three primary categories and tallies their positions. According to the CFTC's COT report, speculators have never been more bullish than they are now in the Dow Jones futures. This spells trouble, and I'll explain.

The COT report is broken down into commercial, speculative and index trader categories. We focus on the relationship between the commercial and speculative traders. The commercial traders are the ones who grow the crop, drill the well, and mine the ore. The commercial trader category in the Dow futures is made up of professional investors using the efficiencies of the highly leveraged futures market to enhance, balance, and minimize the risk in their cash portfolio. The mini Dow Jones futures contract has a cash value of $110,000 with the index trading at 22,000. This is done on margin of less than $4,000. The 27.5 leverage multiple helps equity investors sell stock index futures to lock in gains and help provide downside protection without having to cash in their underlying positions or create undue tax liabilities for their investors.

Speculators, on the other hand, use this multiple to juice their market returns. Let's face it, how many of us thought the 2009 bottom would still be riding the bounce to all-time highs? It's human nature to chase. Low margins and high leverage entice individual investors and overly aggressive fund managers into market timing moves, hunches, and gut shots. They all work, as long as the market continues higher.

We'll set the stage and work the trade from macro to micro, below.

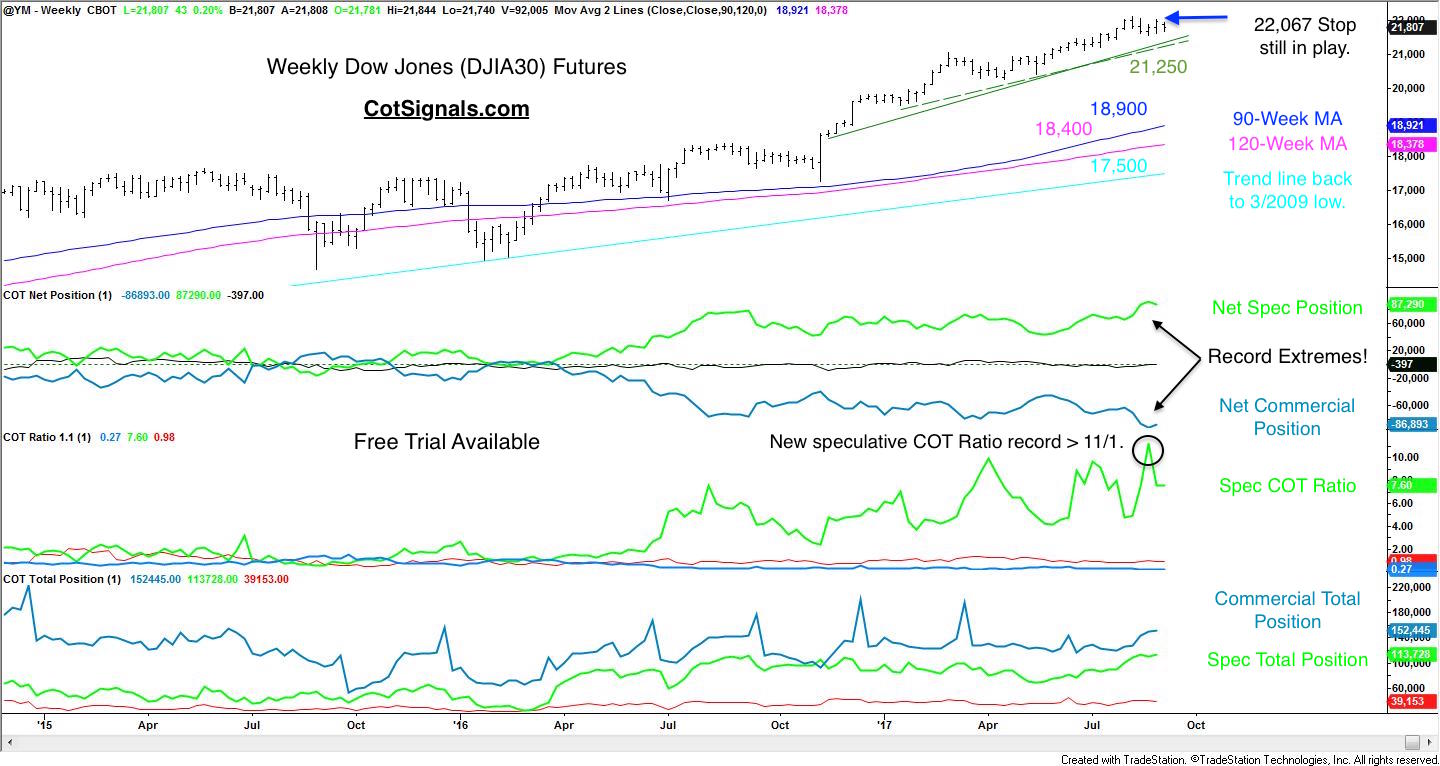

The first sub-graph contains the net position for the commercial and speculative traders. Note the speculative buying last July July as the market finally pushed out to new highs ahead of the Presidential election. The second sub-graph plots a COT Ratio of our calculation. It calculates the betting flow of COT categories. Speculators set a new record last week at $11 to $1. We think this is an intuitive way to visualize the data. Finally, the third sub-graph plots the total size of the categories' positions. The commercial traders typically overwhelm the speculators. However, herd mentality in the markets is a real thing. The speculative position has been gaining ground on the commercial traders. The last time the spec position took the outright lead was election time. The bigger the speculative position, the bigger the washout. The more skewed the COT Ratio is, the more imminent a reversal becomes.

Now, let's look at the interest rate market for confirmation before getting down to the daily trade setup. We noted in our remarks for the October '17 COT column of Modern Trader that,

"We believe a pullback in the stock market, specifically the December Dow Jones futures, is inevitable. Speculators are long the Dow Jones futures at an eight to one ratio. Speculators being washed out of their Dow positions are likely to funnel money into interest rate futures. The commercial traders are typically one step ahead of the speculators. Therefore, I expect the commercial traders to initiate short interest rate positions on a speculative flight to quality."

Those comments have been proving correct as the 30-yr Treasury Bond futures chart shows, below.

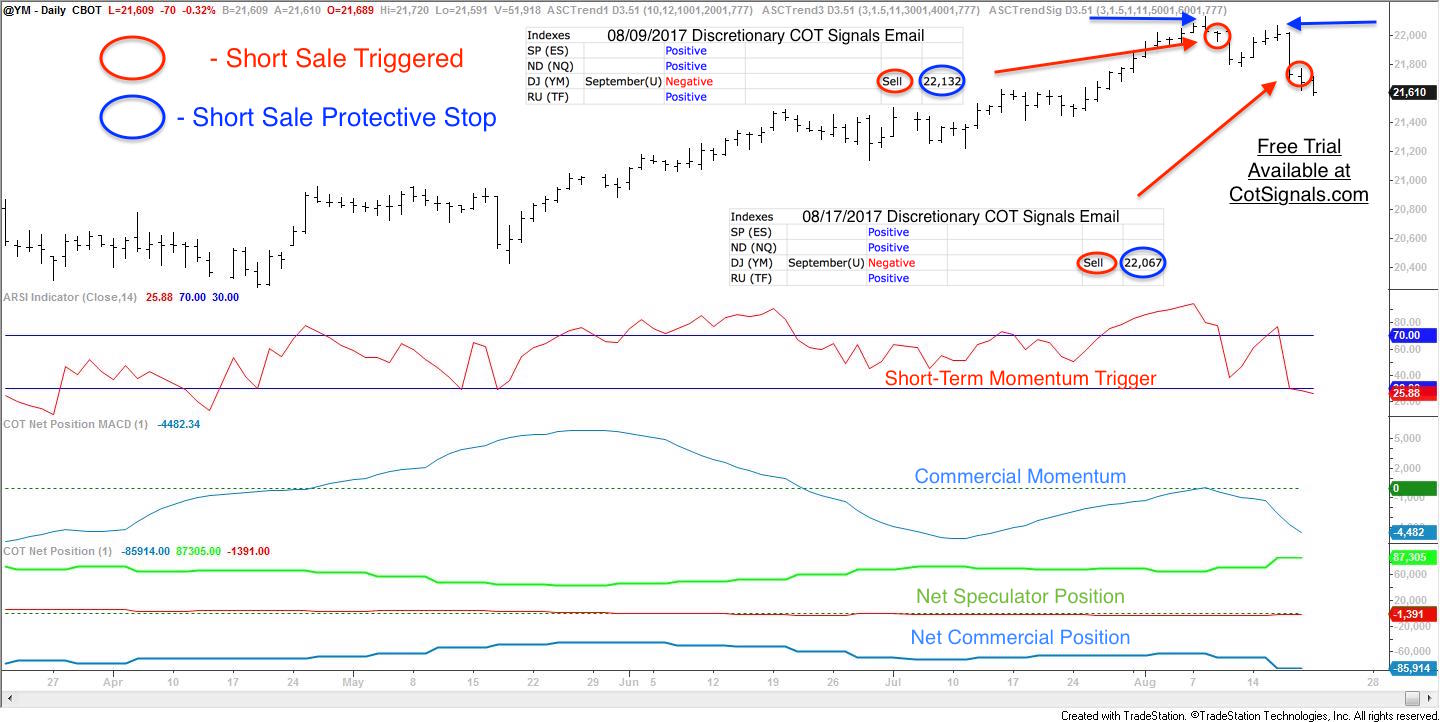

Now, let's get to the practical examples. The next chart shows our Discretionary COT Signal approach in the Dow Jones futures. The discretionary signals have been part of my nightly chart work and trading for nearly fifteen years, now. It is a method and not a quantified strategy. We have different programs for that. The Discretionary COT signals is a counter-trend trading method that employs the power of the commercial traders to provide support or resistance to our trades, as needed. First, we only take trades in line with the commercial traders' momentum. Second, we wait for a market to become overbought or, oversold against the commercial traders' momentum. This creates the battle field for a potential market turn. Once the market reverses, according to our short-term momentum indicator, to move back in line with the commercial traders' predicted direction we take our position with the commercial traders. Finally, we place a protective stop order at whatever the swing high or, low turns out to be.

Our last short sales in the Dow Jones futures are still in play as you'll see on the position initiation chart from last week.

The record setting speculative position in the Dow Jones futures could spell serious trouble. We've included near-term trend line and deeper moving average support, as well as long-term trend lines dating back to the March 2009 low below 6,500. Remember, even a 5% pullback from these levels is more than 1,000 points or, $5,000 per futures contract. These are important considerations to make so that you can put the professional's edge on your side at market extremes without upsetting your core holdings.

For more information on our methodology and several different market examples, please see, "Swing Trading Commodities with the Commitment of Traders Report."

For a free trial to our Discretionary COT Signals, please register here.