The steep decline in gold came as no surprise to our readers as they were positioned to profit handsomely.

We began discussing the growing imbalance between the commercial gold miners selling their anticipated forward production versus speculative buyers betting on inflation in mid-August.

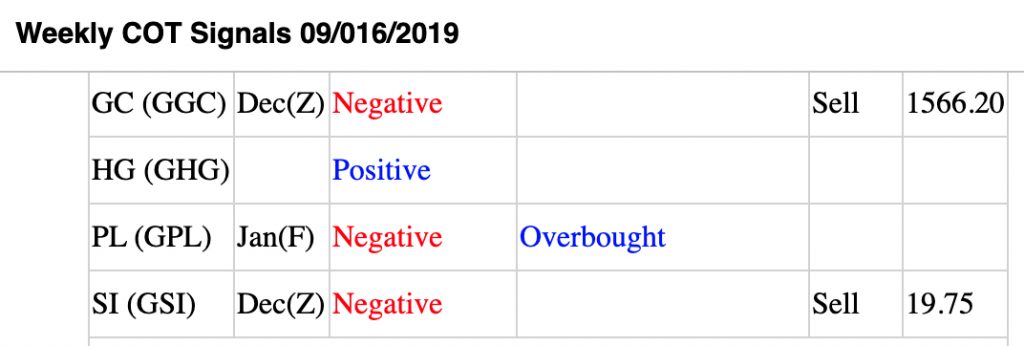

Weekly COT Signals - 08/12/2019

"Gold miners took the opposing action and accelerated the pace of their forward sales. They increased their net short position by another 10%, pushing it to another 52-week high. The gold miners’ current net position of -324,325 is less than 5% from their record. Also, keep in mind that this makes the speculators exceptionally long. Our COT Ratio shows that the speculators are now long six contracts for every short. This is their most lopsided position since November of 2012. The obvious question is, 'Where will more buying come from?'"

We followed this up with an official COT Short Sale Signal on September 16th. Initially targeting $1,1415 in gold and $16.50 in silver.

We updated the trade in our weekly letter on September 30th. We didn't change the protective stop or, targets.

Weekly COT Signals - 09/30/2019

Gold miners set another net short record. The speculators have yet to breach their net long record set in July of 2016. As a point of reference, speculative gold buyers from the 2016 run just began to show a profit in August of 2019. Our trading horizon is much shorter.

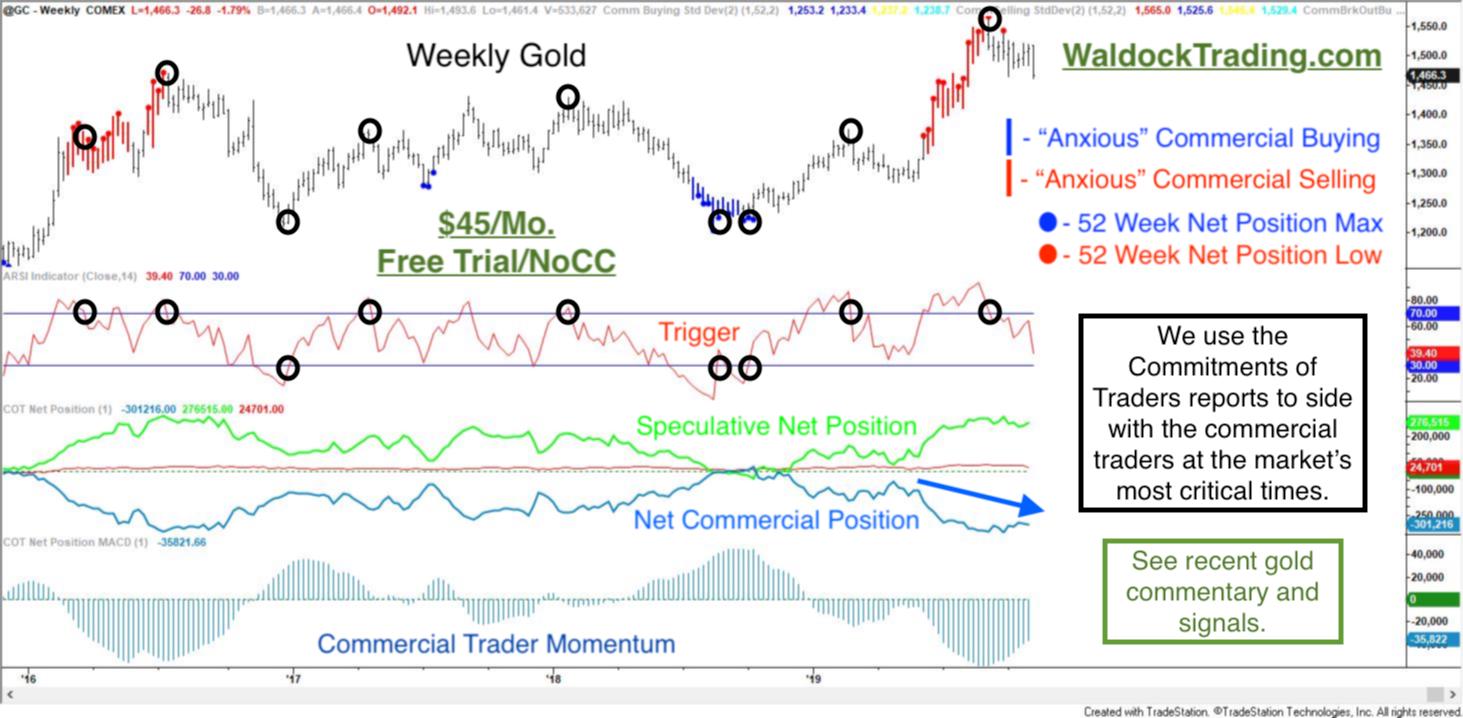

This is the weekly chart with our Commitments of Traders tools for TradeStation overlaid. The black dots represent the signals sent in our emails and referenced, above.

This is a mean reversion methodology. We are looking for major turning within a commodity market based on the actions of the people with a fundamental hand that market's supply or, demand. The people whose livings are made in the gold market were huge sellers over the last month and a half. We defined their selling as, "anxious" because it is more than two standard deviations beyond their anticipated behavior. This meant that gold miners were selling their anticipated forward production at a breakneck pace.

Following the commercial traders' lead put us on the lookout for short selling opportunities. The first of which, coincided perfectly with the high at $1,566.

Please, REGISTER, on our site to view past emails and see what the commercial traders at the year's crucial moments in YOUR favorite market.

No credit card required for free trial.

Sincerely, Andy Waldock.