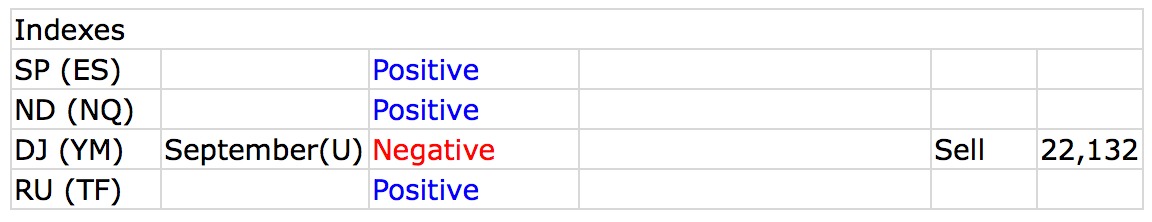

We noted the following in our August 9th Discretionary COT Signals regarding the September Dow Jones futures:COT Signals

Here are the Discretionary signals for 08/09/2017.

Total Mechanical program open trade equity = $23,322.

One new signal - selling the Dow futures.

This may be a good hedge for those of you with long equities exposure.

Best, Andy Waldock.

Andy Waldock Trading

The Discretionary COT signals are very simple to implement in your own trading. The email was sent Tuesday evening for Wednesday's business. The September Dow Jones futures have a "Sell" signal. First, sell short the September Dow Jones futures upon receipt of this email or, at a price you determine on your own. Second, place a protective buy stop as noted in the "Stop" column at 21,132.

The Discretionary COT signals are very simple to implement in your own trading. The email was sent Tuesday evening for Wednesday's business. The September Dow Jones futures have a "Sell" signal. First, sell short the September Dow Jones futures upon receipt of this email or, at a price you determine on your own. Second, place a protective buy stop as noted in the "Stop" column at 21,132.

The third and final step is up to you. When should you take profits? This is why we offer a 30-day free trial. It's important for you the see how the market's behave at their turning points as forecasted by the commercial traders.