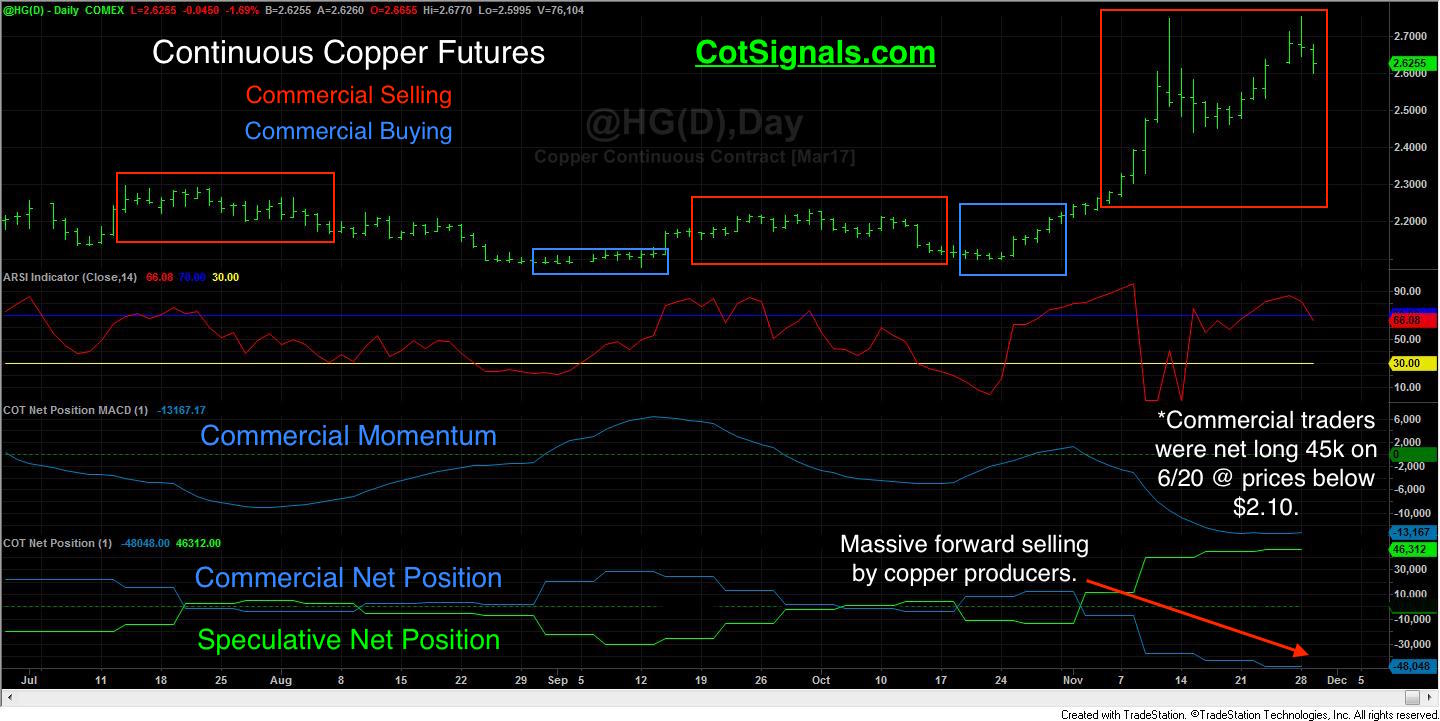

The copper market has rallied over 30% since the October 24th low near $2.10 per pound. The decision has come that this post-election rally has gone far enough as copper miners are stepping in to hedge their forward production at a near record rate. This action provides a great insight into the workings of the futures markets as they were originally intended. We'll see the fundamental law of supply and demand leave the speculators holding the bag at the market's top.

The futures markets were intended to provide consistent pricing mechanisms for those who produce or, consume a given commodity. This places commodity producers on the sell side as they attempt to lock in profits based on their forward production expectations. Conversely, commodity refiners attempt to lock in their raw material needs at advantageously low prices. In this way, commercial sellers provide resistance in the commodity markets while commercial refiners provide support to the same commodity markets.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) The large speculators, meanwhile, help provide liquidity as they attempt to profit; typically through trend trading. This is an important distinction because the commercial traders are mean reversion traders. The commercial traders expect prices to trade within a band of value. The Large Speculator category of the Commitment of Traders report is primarily made up of trend following strategies as that's the only way to move sizable sums of money through the futures markets. Their models are based on money management rules that should account for the 80% of the time markets are not trading sideways. The current situation clearly shows that they began buying in early November. However, they're buying didn't accelerate until the market broke out above the $.20 resistance level. This is classic speculative breakout trading behavior, and this will leave them caught with their largest position at the dead top of the move.

The large speculators, meanwhile, help provide liquidity as they attempt to profit; typically through trend trading. This is an important distinction because the commercial traders are mean reversion traders. The commercial traders expect prices to trade within a band of value. The Large Speculator category of the Commitment of Traders report is primarily made up of trend following strategies as that's the only way to move sizable sums of money through the futures markets. Their models are based on money management rules that should account for the 80% of the time markets are not trading sideways. The current situation clearly shows that they began buying in early November. However, they're buying didn't accelerate until the market broke out above the $.20 resistance level. This is classic speculative breakout trading behavior, and this will leave them caught with their largest position at the dead top of the move.

Commercial traders have taken the opposite approach. They didn't begin selling until the market broke through the $2.20 barrier. However, it's important to note that as recently as June 20th, the commercial traders net long more than 45k contracts. Therefore, much of their initial selling was merely the early offset of long hedges as the market rose above the processors' expectations. New copper producer short selling is what is really newsworthy. Commercial short selling has now reached its most bearish level since 2003. Furthermore, we've seen a turnover in the net position between the commercial speculative trading groups of more than 120k contracts since late October, in a market with open interest of 235k. This is truly noteworthy.

We expect the copper rally may have run its course. Beyond the commercial/speculator argument, there's also a good case for a technically bearish momentum divergence. Additionally, this is the biggest one month rally we've had since 2011 as well as being the highest RSI reading on a weekly chart since 2010 and 2011 on a monthly chart. We see $2.75 per pound as being the market's near-term high. If today's decline holds, it will trigger a COT Sell signal. You can have this signal; it's protective stop and our nightly Commitments of Traders worksheet for 35 US markets delivered to your email box with a 30-Day Free Trial.