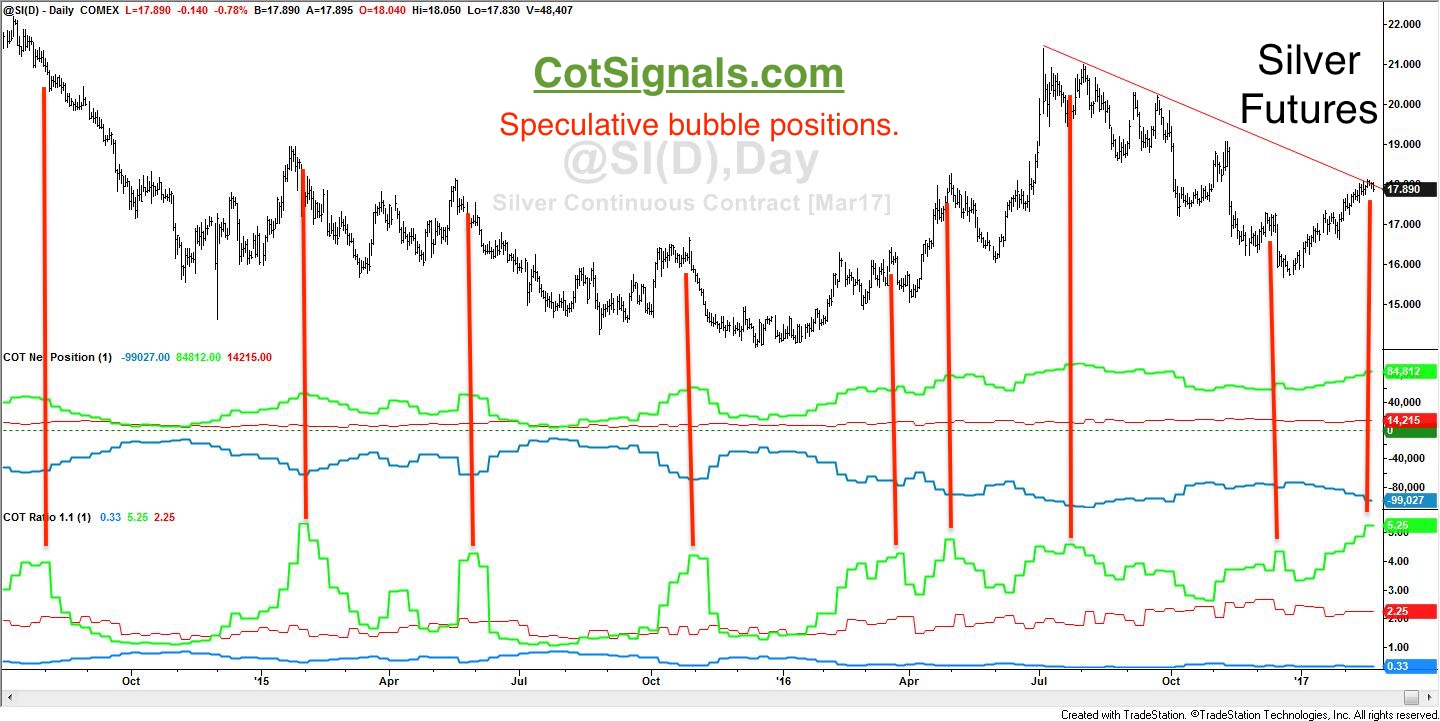

Speculators have gotten ahead of themselves in the silver futures market and now face trouble with their near record long position. We use the Commitments of Traders(COT) reports, published weekly by the Commodity Futures Trading Commission to track the actions of the commodity markets' primary participants. The main benefit of this report is that it tells us the positions of commercial and speculative traders. Today, we'll explain our proprietary COT Ratio indicator and what it is telling us about the silver futures markets right now.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) First, a brief and obvious but necessary explanation of the data. The commercial traders represent the miners and silver processors. Silver miners use the futures markets to sell their expected forward production. Short hedging allows the silver mines to predict forward revenues and eliminate anticipated market risk. The net commercial position declines as silver producers sell more futures contracts. We track their action for both scale and pace. This helps determine how anxious they are to lock in forward sales at current market prices. We also follow the silver processors as their bids represent the buy side of the commercial silver market. The difference between the miners' selling and the producers' buying is the net commercial position illustrated by the blue line in the second subgraph of the included chart.

First, a brief and obvious but necessary explanation of the data. The commercial traders represent the miners and silver processors. Silver miners use the futures markets to sell their expected forward production. Short hedging allows the silver mines to predict forward revenues and eliminate anticipated market risk. The net commercial position declines as silver producers sell more futures contracts. We track their action for both scale and pace. This helps determine how anxious they are to lock in forward sales at current market prices. We also follow the silver processors as their bids represent the buy side of the commercial silver market. The difference between the miners' selling and the producers' buying is the net commercial position illustrated by the blue line in the second subgraph of the included chart.

The green lines on the chart represent the speculative positions in the market. The first subgraph illustrates their net position while the bottom subgraph depicts our COT Ratio indicator. We created the COT Ratio indicator to determine transitory market imbalances on a weekly scale that we can exploit trading daily data. We define market imbalances through the combination of a market that has had a run and is now overextended, either overbought or, oversold depending on the situation and a disproportionately one-sided speculative net position.

The silver futures have gained more than 12% already this year. This places the market in overbought territory. Additionally, speculators are now their most bullish in two years. The overextended market plus the disproportionate size of the speculators' position equals a market that should be watched very carefully for signs of a reversal.

We use this information to create swing trading opportunities that profit as overly anxious speculators are driven out of the market. The smallest decline in the chart above is still more than $1 per ounce or, $5,000 per contract in the silver futures market. Since this is an explanation of our Discretionary COT model, I won't add any other statistics as your results may vary. However, 20+ years of commodity market research has also led to the mechanization of the same premise and the program I trade for myself. Please, feel free to evaluate both of our programs at, CotSignals.com.