The second trade for February is in the March silver futures contract. We'll be buying March silver futures late this week or, early next week. We'll place a protective stop loss order 2% below the entry price. This is $.34 per ounce if silver is trading at $17 per ounce. Thirty-four cents in the futures market equals a $1,700 move per contract in your trading account. Silver futures margin is currently $4,400. Our Monte Carlo analysis suggests an average trade (wins - losses) of $3,600.

*Past performance is no guarantee of future results.

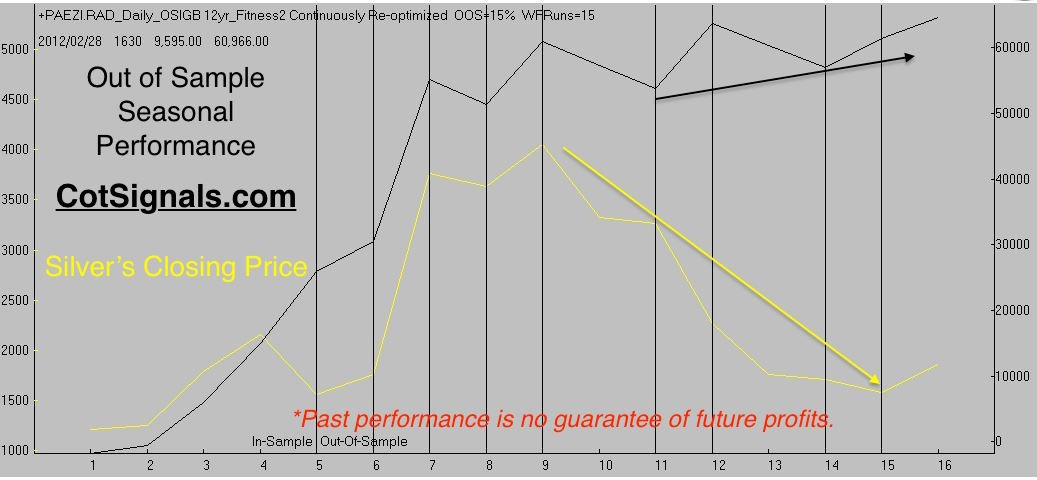

The standard performance reports and graphs are posted below but first, consider the dynamics of the silver futures market over the last several years. The market has fallen by more than two-thirds since the 2011 high. This program did very well during silver's rise. The most impressive thing to me is, how well it has performed through a 6+ year bear market.

This program is designed to capture a repeatedly bullish period during February. The math behind the training and learning forecasts the date, risk and, holding period based on the market's previous performance and the Commitment of Traders data. The program's out of sample performance shows six of nine winning trades and a net profit of more than $9k since silver's peak in 2011.

Now, let's look at the Commitment of Traders report and how we set up these trades. We are looking for commercial purchases heading into the forecasted period of strength. We've outlined the last three years on the weekly silver futures chart, below. You'll see that the commercial silver processors purchase their raw materials ahead of the seasonal weakness. More importantly, you'll see that their purchases are now coming with greater urgency. Their net position shows that they're becoming increasingly long as the market prepares to push above $17.50 per ounce. The final key to the current trigger is the fact that the speculative traders have their smallest long position since June of 2014. The speculators are typically wrong at the market's most important turns. Considering the abnormally bullish position the speculators usually carry, it appears likely that they'll miss the next leg of the rally, only to be sucked in near the top where we hope to exit.

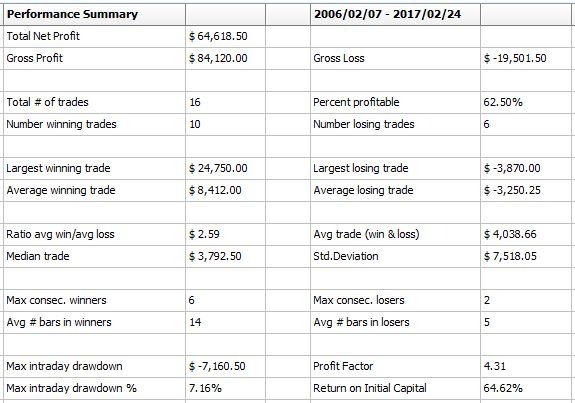

Moving to the standard performance reports, remember that these are the result of out of sample testing protocols. These are not historical returns, and all hypothetical results can differ significantly from what's expected. The following results suggest that if this is a winning trade, the market will rise towards $18 per ounce within the next couple of weeks.

*Past performance is no guarantee of future profitability.

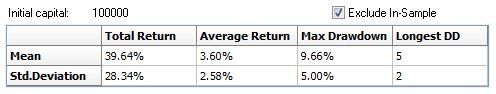

As always, we'll close with our Monte Carlo testing. This is the equivalent of running 1,000 walk forward out of sample routines and summarizing the results. Remember that "Average Return" represents the average for a single trade in an annual strategy. Again, while rigorous, this is still hypothetical testing. As always, only true risk capital should be used.

*Past performance is no guarantee of future results.

Signup for Seasonal Analysis for $35 per month and have the exact entry and exits sent within minutes of their generation.