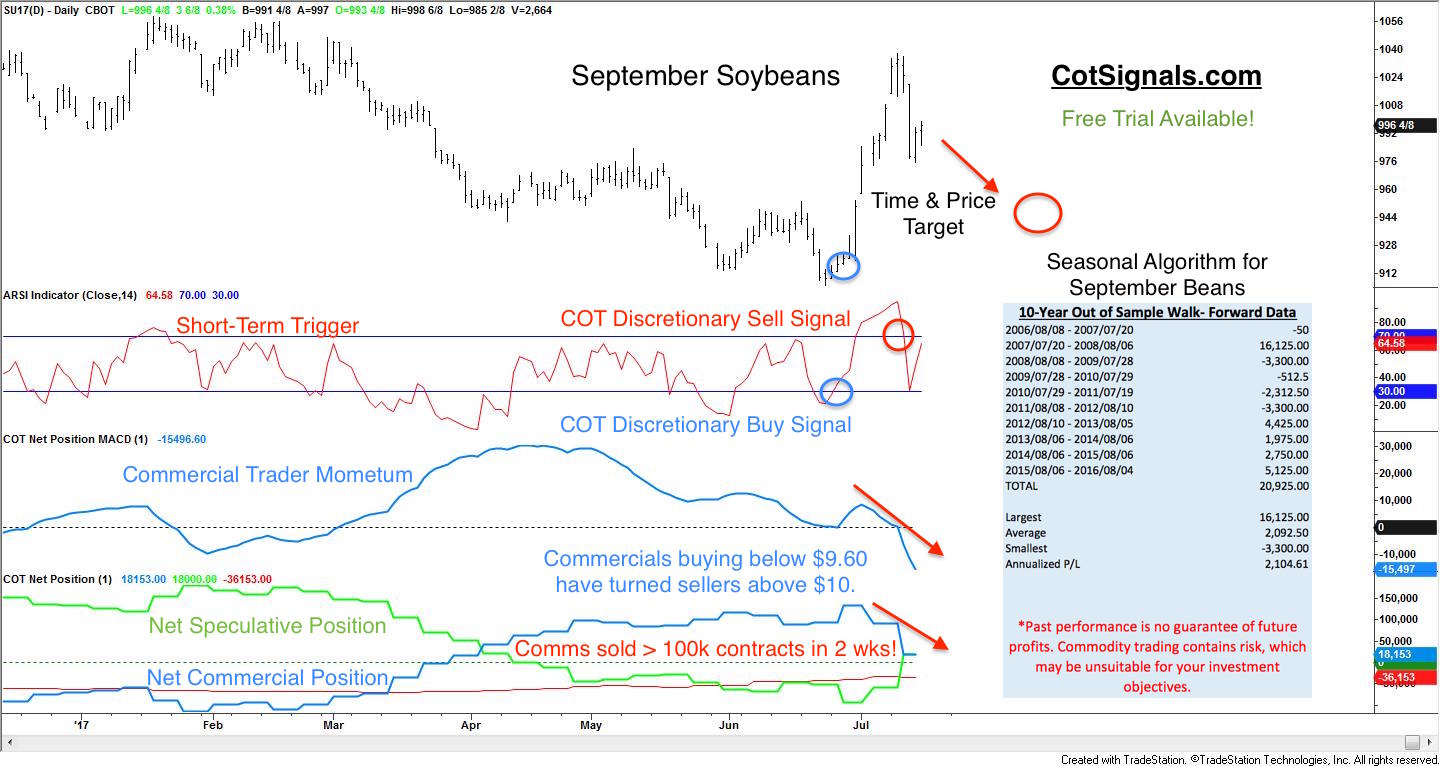

Soybeans have spiked as much as 15% higher over the last three weeks. So far, the commercial traders' actions have accurately forecasted this year's market behavior. In fact, it was commercial processor buying that triggered the discretionary COT buy signal we published for June 28th's trading. Now that the market has rallied, the commercial balance of power between processors and farmers has shifted to the farmers' supply side. The net commercial position has declined by more than 100k contracts in just the last two weeks due to their selling. Farmers feel confident in their ability to deliver, and are anxiously selling their forward crops. which indicates that the weather induced rally is a short selling opportunity.

Before we get into the details, we need to examine the typical crop cycle and market action. Supply or, lack thereof is the number one concern in agricultural markets. Fear premium is why agricultural call options are priced higher than their corresponding put options. Fear in the grain market comes in multiple stages. The first fear concerns getting the crop in the ground. Fear typically manifests on the chart as an increase in the speculative net position as they hope to catch an early lead on a wet spring and planting delays ending in a smaller crop with proportionately higher end of season delivery prices. The second stage is the early growth. These two early season fears turn into losing trades if the weather cooperates. It has, and the overly anxious speculators were washed out of their long positions from March through early May.

Once the crops are in the ground, we reach the third point, the July USDA Oil Crops Outlook. This compares the planted acreage to March's intended acreage forecast. This report also sets the tone for the summer's crop. This year the USDA expects to farmers to establish new records in soybean acreage and production despite the Dakota's poor weather. Meanwhile, increasing export demand continues to be the primary source of soybean support.

From the USDA July 14th Oil Crops Outlook.

"Export competition from Brazil and Argentina has been less brisk than previously anticipated. Now, even with fewer new U.S. export sales to sustain a firm shipments pace throughout the final quarter of the crop year. Thus, old-crop soybean exports are seen 50 million bushels higher this month to a record 2.1 billion."

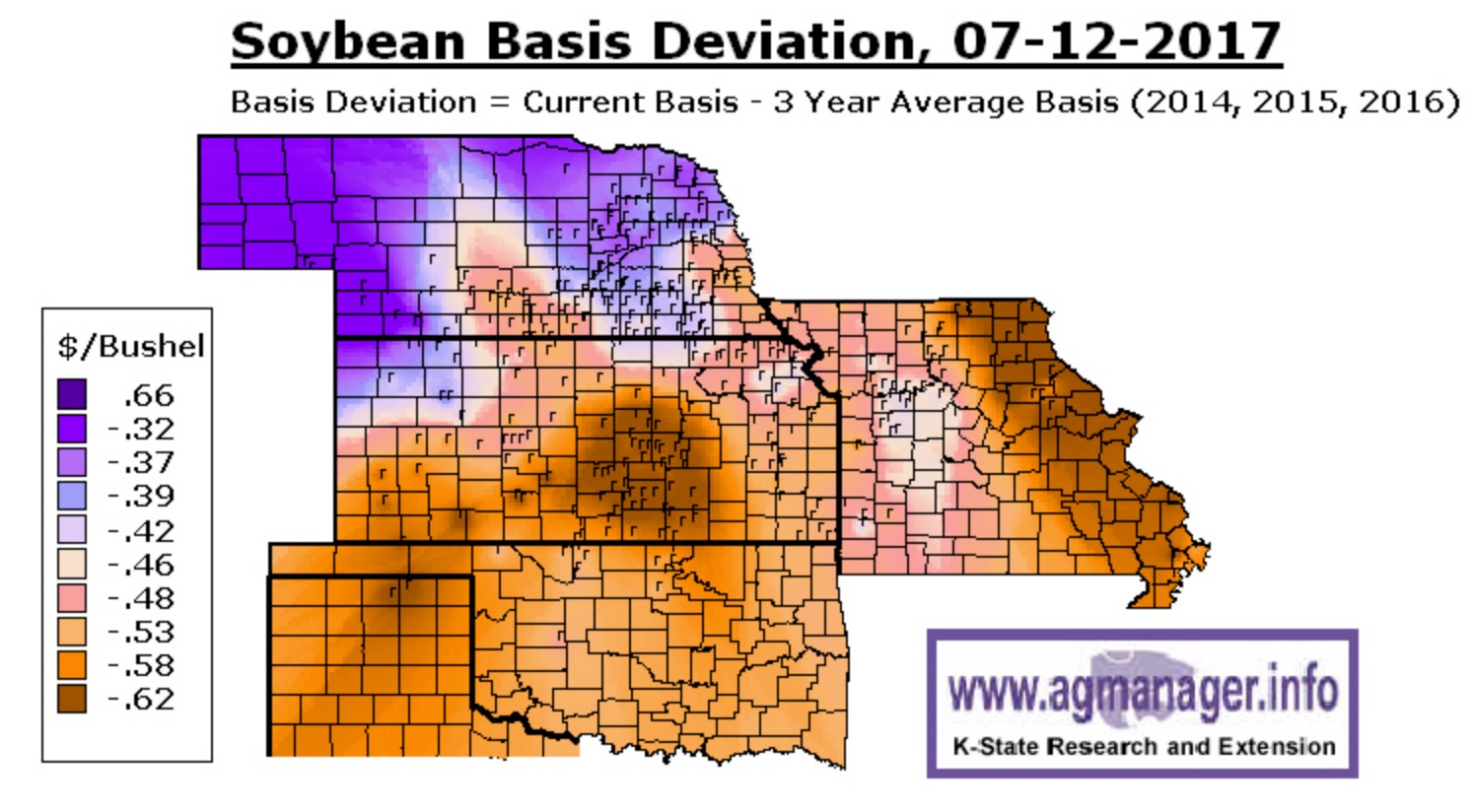

Now that this report is out of the way, and the news suggests roughly an average cycle, the soybean market should begin its grind lower. You can see the commercial traders' balance of power shifting in the two weeks ahead of this report. Their dramatic shift from processor buying to producer selling indicated that the 15% rally off the June low was overblown. Chris Lehner of Archer Financial Services examined the currently bearish basis spread last Thursday, the day before the report. His research indicated that grain elevators throughout the Dakota's were still consistently under the panicked futures market bid. "When a basis is almost $1.00 below the futures, it sure doesn’t make for an argument that buyers are worried dry, hot weather is concerning them about getting crops. Actually, it says if a farmer is willing to sell, they take what they get or leave." The basis map I've included from Kansas State confirms Chris' findings.

The bearish basis provides cash market verification of commercial producer selling in the futures market. Combining the commercial traders' actions and important government report dates led to the creation of the algorithm in the table on the included chart, below.

Commercial farmers feel comfortable in their ability to make good on their delivery commitments. This sets the soybean complex up for the slow grind lower, barring any further weather developments until harvest, the final stage of market fear.

Combining multiple forms of analysis allows us to cross-reference each piece of market information. Fundamental analysis included the USDA reports, the commercial traders' actions, and the current cash market basis. Seasonal analysis focused around the Oil Crops Outlook report confirms a bearish post-report environment. Finally, time, price and volatility analysis help provide us with systematic risk and reward profiles.

See more, and sign up for a free trial at CotSignals.com.