Approximately half of the world's cocoa comes from the Ivory Coast and Ghana with the Ivory Coast supplying more than a third on its own. We've written extensively on the background of Ivory Coast politics, the ouster of Laurent Gbagbo and what Alassane Ouattara means not only to the country but also the global cocoa market. Currently, cocoa prices are the lowest they've been in a decade. We'll explain what is happening structurally within the cocoa market as well as what actions the market's biggest players are taking right now as a follow-up to the Brown Cow Spread in the March issue of Modern Trader magazine.

Cocoa beans and cocoa products account for nearly 40% of the Ivory Coast's exports according to MIT's Observatory of Economic Complexity. The most obvious point here is that the world's cocoa market is firmly bound to a tiny geographical region that is undergoing a tremendous metamorphosis from a dictatorial third-world country to a modern democracy. The transition is being led from the top down. Recently re-elected President, Alassane Ouattara was educated at Drexel University and earned his Ph.D. in economics from the University of Pennsylvania. He's been employed by the International Monetary Fund(IMF) off and on since 1968, reaching the highest position of Managing Director in the late 90's.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) President Ouattara's western education and entrenchment in "the system" places the cocoa market in a unique situation. First, the cocoa market has traditionally consisted of small family farms working plots of 10 acres or less. Cocoa is labor intensive, and the family plot has been their livelihood. President Ouattara is facing the task of modernizing cocoa production while maintaining civil order. Upgrading production means installing a western agribusiness model. The top-down model would include input from industry leaders like one of Nestle's board members, Jean-Pierre Roth. He was also formerly employed at the IMF and was a Swiss National Bank representative for the IMF before that. Swiss chocolate. Nestle's board also includes former Secretary of Agriculture, Ann Veneman and Bradley Alford of ConAgra(CAG) as well as Ajay Banga of Dow Chemicals(DOW) where Juan Luciano of Archer Daniels Midland(ADM) is also a board member. Only a short chain is required to link the process of cocoa industrialization to the Fortune 500 companies and western educated production philosophies that are making it happen.

President Ouattara's western education and entrenchment in "the system" places the cocoa market in a unique situation. First, the cocoa market has traditionally consisted of small family farms working plots of 10 acres or less. Cocoa is labor intensive, and the family plot has been their livelihood. President Ouattara is facing the task of modernizing cocoa production while maintaining civil order. Upgrading production means installing a western agribusiness model. The top-down model would include input from industry leaders like one of Nestle's board members, Jean-Pierre Roth. He was also formerly employed at the IMF and was a Swiss National Bank representative for the IMF before that. Swiss chocolate. Nestle's board also includes former Secretary of Agriculture, Ann Veneman and Bradley Alford of ConAgra(CAG) as well as Ajay Banga of Dow Chemicals(DOW) where Juan Luciano of Archer Daniels Midland(ADM) is also a board member. Only a short chain is required to link the process of cocoa industrialization to the Fortune 500 companies and western educated production philosophies that are making it happen.

Inevitably, increasing productivity means eliminating labor costs. Modern agriculture practices imported from the West are beginning to show up in production numbers. This has caused cocoa prices to fall by more than 20% since August pushing prices to their lowest level in a decade. Ivory Coast family farms are struggling to make ends meet. Each farmer assumed bigger yields personally would lead to better personal income. Collectively, their production has driven prices below their breakeven point. The current harvest glut has created the civil unrest. This will be an ongoing problem and is creating the classic migration pattern we've seen over the years as societies industrialize. Able-bodied individuals who formerly worked on farms will be driven to the cities in search of employment.

This is not just a hypothetical situation. Bloomberg reported last fall that a company from Brussels called Solea which is a division of KKO International SA is starting a modern farm of nearly 5,000 acres. This will be the first large cocoa farm run as an agribusiness. Historical yields are typically about 200 kilos per acre per year. Cocoa flowers and produces year round, and Solea, using hybrid seeds and drip watering irrigation, expects to be producing 2.5 metric TONS per acre within the next decade. That is the equivalent output of 12.5 family farms per acre. If Solea's production plans come to fruition, that will put more than 60k Ivorian families out of work. The flip side is that it will ensure cocoa production and prices well into the future for the cocoa processors.

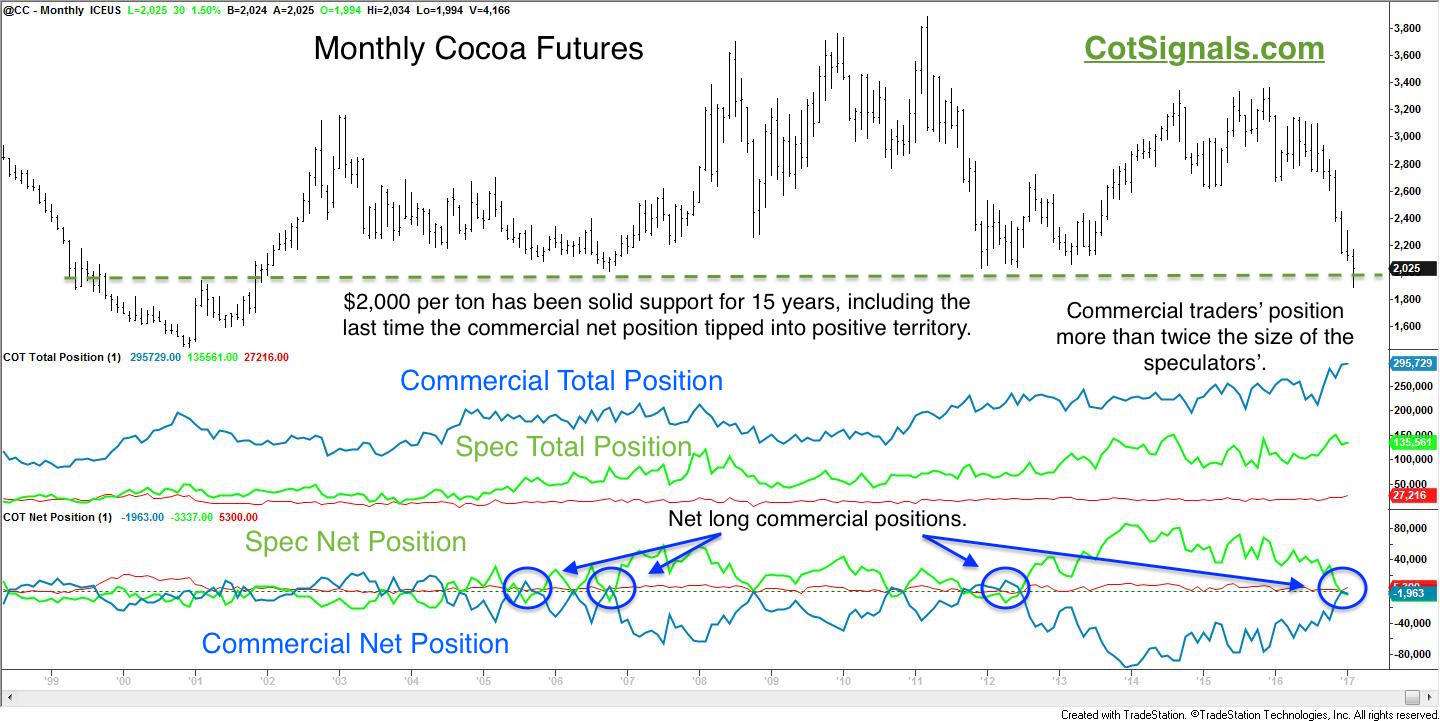

Moving to the actual market and the current trade setting up, we begin with the monthly chart. This will provide some context as well as an illustration of the macro forces that play out in the market over time.

The key points on the monthly chart are the arbitrary $2,000 per ton price level and the commercial traders' actions in response to low prices. There are two sides to the commercial traders' market. Producers line up on the sell side to lock in revenue based on their anticipated crop production. Processors line up on the buy side to ensure the necessary raw materials to meet their sales targets. The chart clearly shows that cocoa processors are willing to purchase and store the necessary forward inputs at $2,000 per ton. The last point to make here is that the size of the collective commercial trader position is more than twice the size of the speculative position.

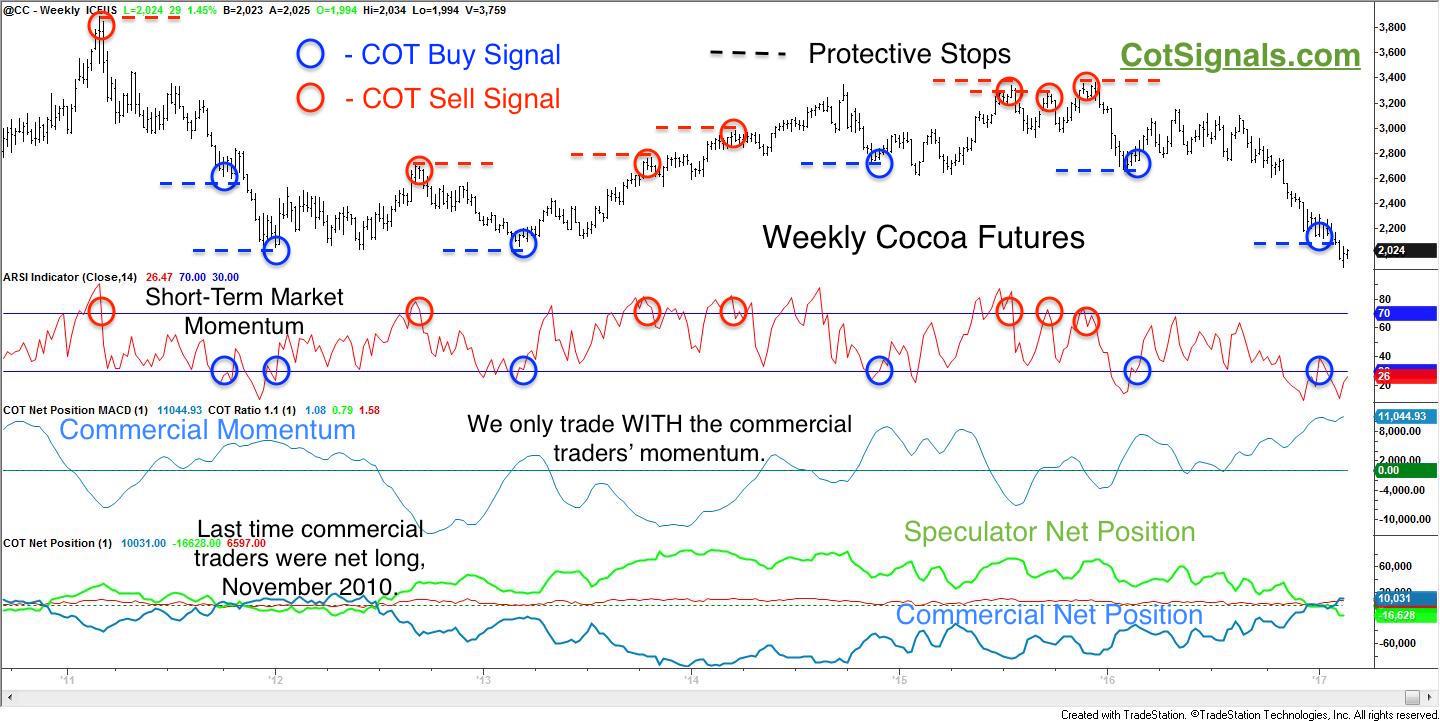

Moving to the weekly chart below, you'll see how we build our trading decisions using the CFTC's weekly Commitments of Traders report. This report tabulates the actions of the market's biggest players. This is where the actions of Nestle and Hershey hit the market.

The chart looks busy but what it's saying is pretty simple. The red and blue circles indicate trade signals. The dashed lines represent the protective stop placements that are applied with this method.

We only take trades in the direction of the commercial traders' momentum. We want to put the buying power of the processors on our side as they lock in future bargains just like we want to put the selling pressure of the farmers in our favor when the market is overpriced. However, we aren't hedging. Therefore we don't HAVE to be in the market. We are free to wait for market conflict to build up. Market conflict consists of an overextended underlying market move in the face of a growing and opposing commercial trader position. The farther the speculators push and the bigger the opportunity the Fortune 500 companies see as detailed by their actions in the COT report, the more we expect the market to reverse and wash out the speculators. This process occurs because the commercial trader category is operating from a hedge perspective based on their business model while the speculators are always pushing for more - higher highs and lower lows. You'll also note that the speculative position consistently reaches its largest size at the market's most important turning points.

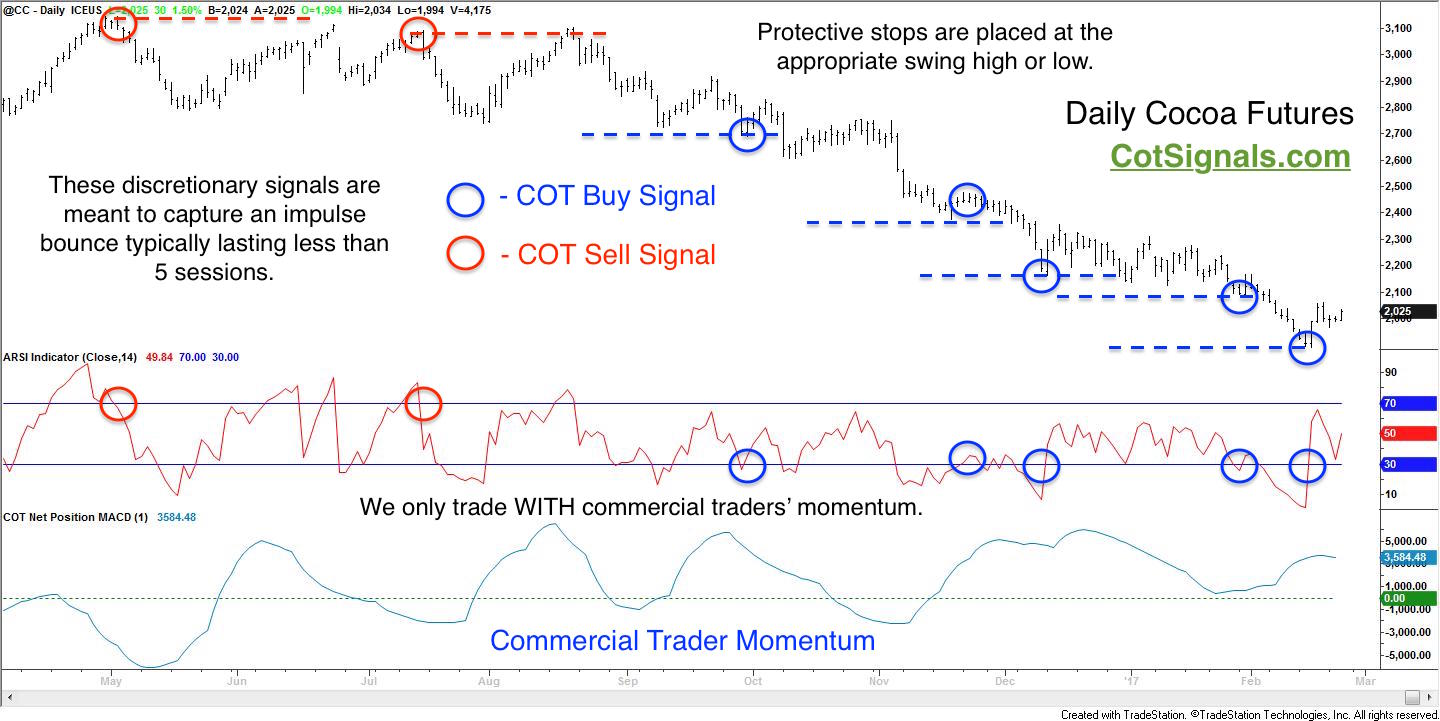

Moving to the daily chart and our Discretionary COT nightly email methodology, we see the current pattern shaping up. This is the same method as shown on the weekly chart now, on a daily scale. Trading on daily bars helps control the risks by placing protective stops at the recent swing high or low and capturing profits based on the market's expected return to its value area as the speculative position is washed out and the market resets itself.

The evolution of the cocoa agribusiness model is still in its early stages. However, there is no stopping progress. Over time, yields will rise, and the production chain will solidify. Dependable supplies will eliminate much of cocoa's environmental volatility. A bigger issue may be the handling of the demographic shift of the Ivorian people from an agrarian economy to one based in the city on some type of government subsidy. However, it is important to remember that the structural shift in Ivory Coast politics has been made. The Ivory Coast will be run and modernized along western principles of capitalism. Increasingly, political turmoil may be the friction point for cocoa spikes of the future. Meanwhile, we'll continue trading based on the actions of the experts with the best connections and the most at stake - the commercial traders and the commercial traders are big buyers of cocoa under $2,000 per ton.