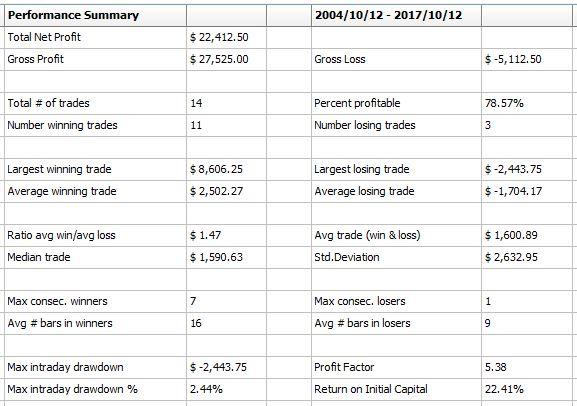

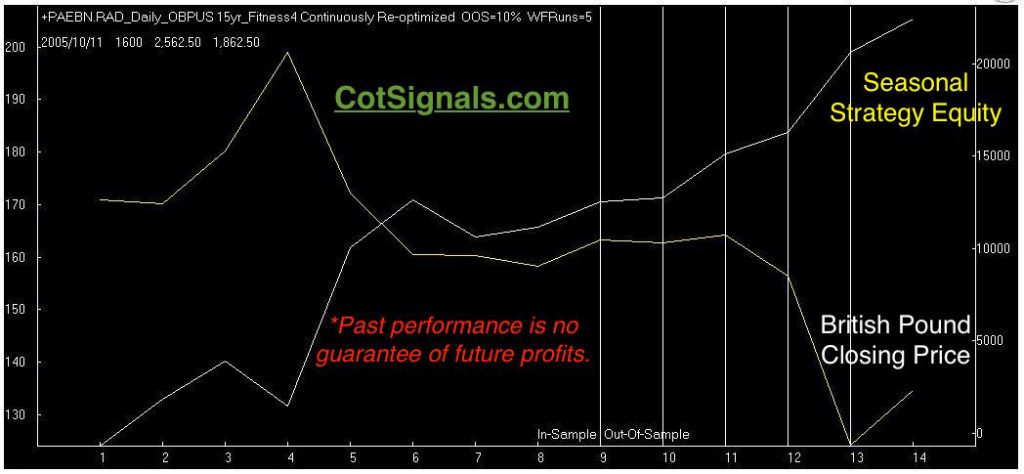

We expect to sell the December British Pound on Wednesday night for Thursday's trade. We'll be risking 2.5% from the Wednesday night's opening price. This equals 330 points or $2,062.50 per contract. Initial margin for the British Pound is currently $1,650. Finally, we plan to hold the trade through the first week of October.

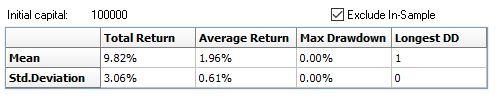

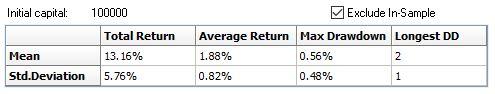

Finally, the Monte Carlo analysis shows us that the risk to reward ratio is firmly on our side because the average trade is more than three times the standard deviation of the returns.

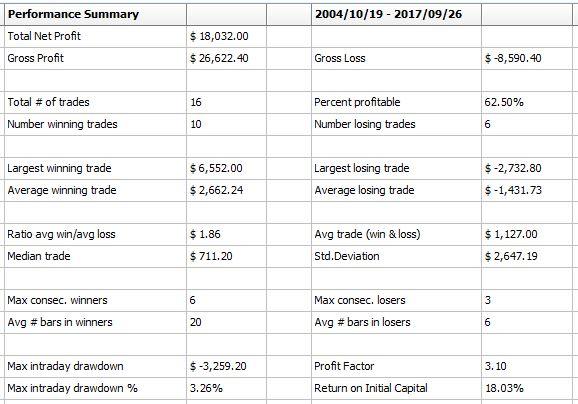

Moving to the March sugar, we expect to enter a new long position Thursday night for Friday's trade or, Sunday for Monday's trade. Either way, we'll be risking 4% from the entry price. This equals 46 points or, $515.20 with March sugar trading at $.1050 per/lb. Obviously, the total risk on the sugar trade is less than the British Pound. This brings up the point of proper contract sizing for a portfolio. We never know what the market will give us on the profit side but, we can control the risks fairly well. A portfolio equalized for risk across both of these trades would clearly trade 3-4 sugar contracts for every British Pound. Finally, we'll be holding the sugar trade through mid-October.

Once again, the Monte Carlo analysis indicates the risk to reward profile fits our requirements. This shows that our risk to reward ratio is better than 2:1 excluding the in sample periods.

We'll update subscribers nightly and send out clear entry, exit and, stop prices as the trades are triggered.