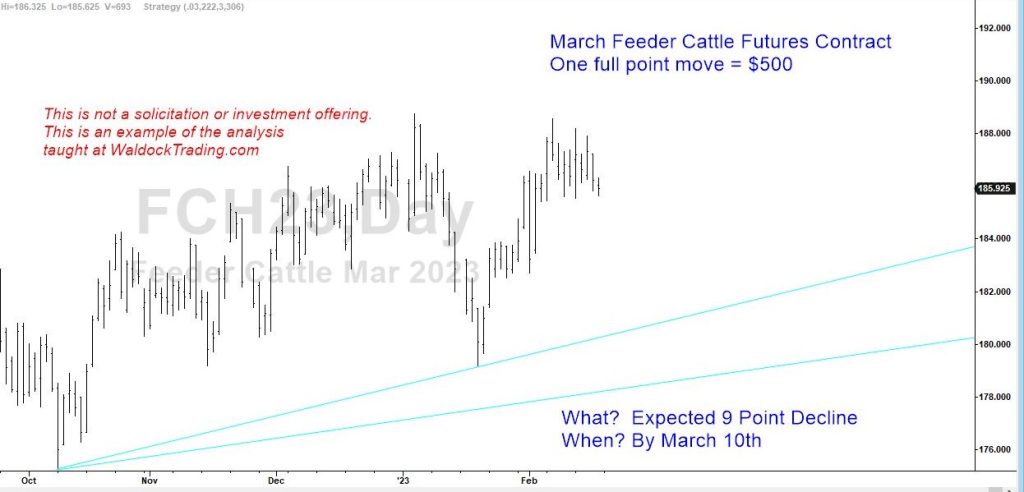

My next trade will be in the feeder cattle market. Our research shows that the March feeder cattle futures contract traded at the CME has fallen by an average of almost 10% between the third week of February and about a week into March. Very rarely do we find a setup that moves roughly 10% in less than three weeks.

Unfortunately, the only market is the Chicago Mercantile Exchange's (CME) futures contract, and while there is an ETF for trading cattle (COW), there isn't an inverse contract that would allow an equities/crypto trader to profit from the expected decline in feeder cattle prices. As always, we'll include any exchange traded funds with a strong enough positive correlation to widen the applicability of these strategies.

What and When:

As we just stated, we expect the March feeder cattle futures contract to fall by almost 10% between the third week of February and the first to second week of March.

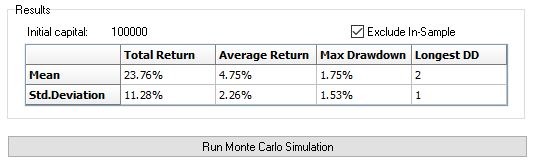

We use Monte Carlo analysis to determine the magnitude of the expected move. Statistically, this helps increase the sample size and assists in the validation of the trading model we'll deploy.

Monte Carlo analysis shows that we expect this strategy to make 4.74% on average with a standard deviation of 2.26%. This means we can reasonably expect feeder cattle to fall somewhere between 2.48% and 7%. Furthermore, it shows that we can achieve these returns with a maximum risk of 1.75%

Strategy Stability:

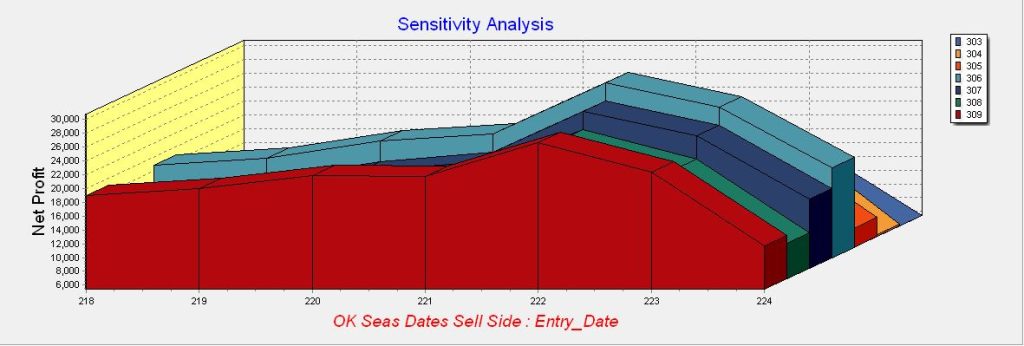

Another test we run is Tradestation's cluster analysis. This allows us to quickly see the results from varying our sample size across the expected window of opportunity. We look for profitable results across the range first, then we start digging deeper.

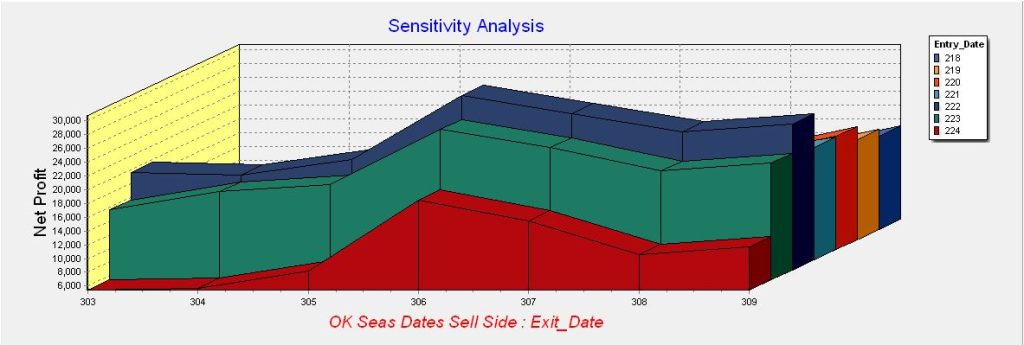

Digging deeper, we turn to input sensitivity analysis. We want to know we're catching a repeatable trend or viewing a statistical anomaly within the data. Sensitivity testing allows us to hold one variable steady while testing the others across their entire range.

While the entry dates re all profitable, there are two important notes to be made, here. First, profitability declines if we wait too late. Second, the most robust dates fall between February 21st and the 23rd.

Now, let's look at the exit dates.

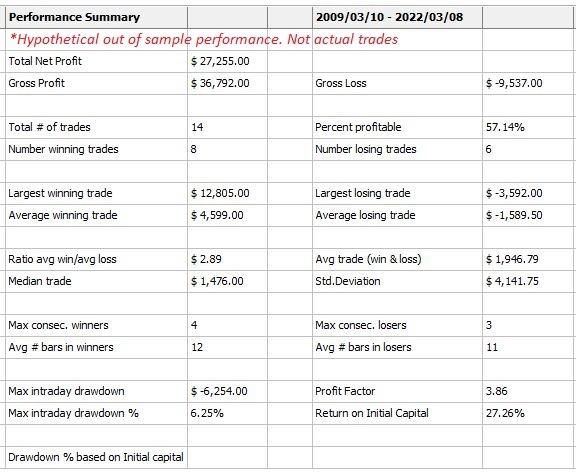

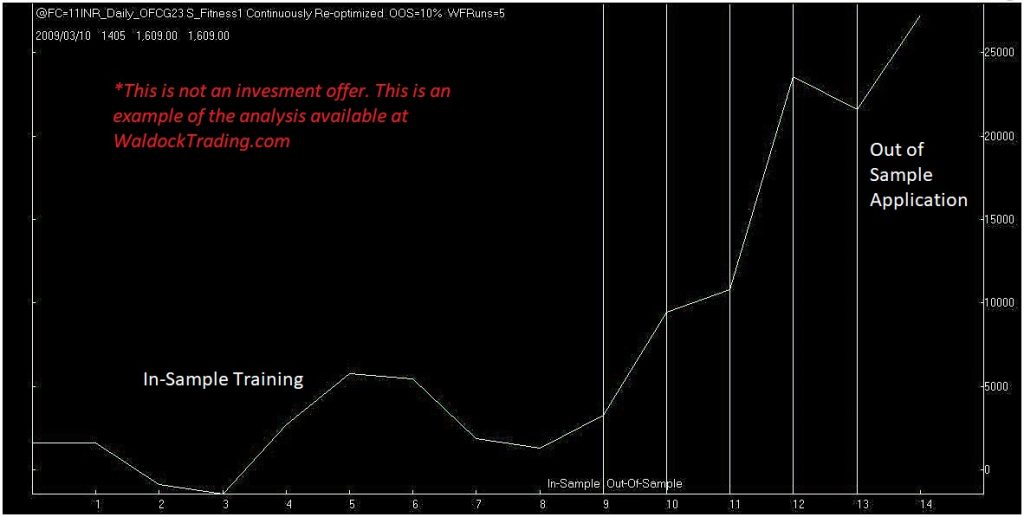

Finally, we look at the classic buy and sell performance report. While these are the out of sample results of the model we'll use, keep in mind that it's still a single string of data. For example, this data is based on the last 15 years. Therefore, there were only a total of 15 trading opportunities. When I build my day trading algorithms, I'll run through several hundred thousand iterations. So, while the performance results and accompanying equity graphs are instantly familiar to the eye, they don't contain the depth of data presented in the previous charts.

Conclusion

We expect March feeder cattle to fall by almost 5% or, a little over $4,500 per futures contract during the next month.

Subscribers will be notified of the entry date, exit date, and protective stop loss(risk) levels.

Best, Andy.

Updates:

2/24 - Initiated new short position in March feeder cattle at $189.

This creates a mean-based target around $182 with a standard deviation envelope between roughly $176 and $186. This equals a profit range between $1,500 - $6,500 with a risk of approximately $1,650 in the March feeder cattle futures traded at the Chicago Mercantile Exchange.

Finally, we expect to hold this position for roughly two weeks.

3/6 - We were stopped out of this trade with a loss of just over $700.