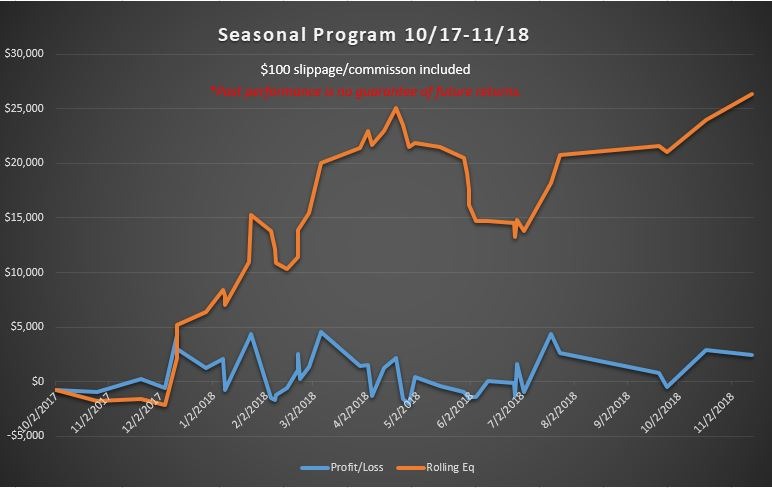

Every month brings many seasonal trading possibilities. Years of work with the Commitment of Traders data has shown me that not all seasonal trades are created equally. Our program is now one year old and the seasonal results have been quite solid. I'm pleased with the trading plan I've put together which has included limited risk, reasonable winning percentage and still allowed me to capture some outsized gains. The current setup in the January frozen concentrated orange juice futures is a good example of the seasonal trades I've taken over the last year.

First, it's important to understand the primary difference between commercial and speculative traders. Commercial traders are tied to a given market through their industrial needs. In this case, orange juice producers have begun buying futures to lock in their future needs at what they currently believe are cheap prices. Commercial traders can take delivery of their purchases or make delivery of the futures contracts they've sold forward. Speculators must be out of the market prior to the contract's delivery date.

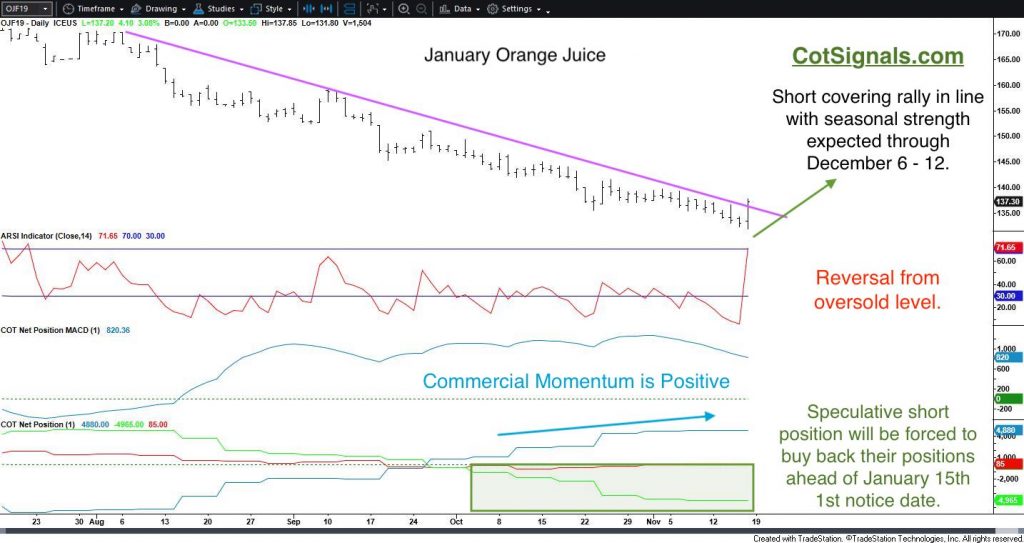

Speculators have had a very good run shorting orange juice futures over the last two months. You can see on the chart below that they've continued to sell as the market has declined. This is classic speculative trend-following behavior. They'll have to offset their positions outright or, roll them over to the next contract within the next three weeks. Their current position is net short 4,965 contracts. This equals 4,965 contracts worth of buying pending in the market. It's a bit like seeing the broker's order deck for those of you who remember pit trading.

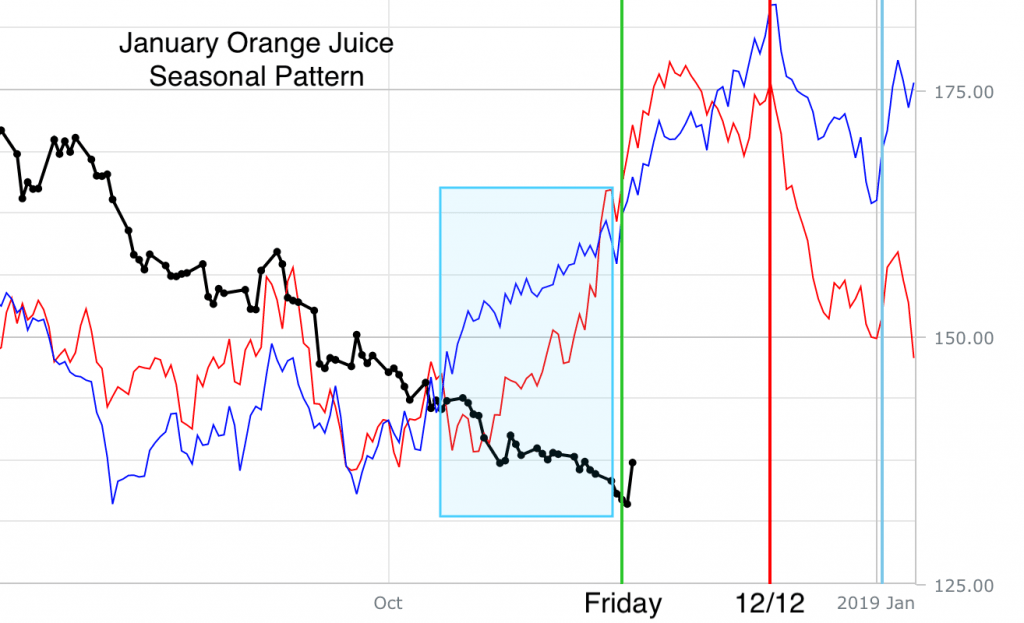

We've been waiting for orange juice to show signs of reversing higher before issuing a seasonal buy signal. Friday's outside day provided the technical trigger to pull the market up from its previously oversold level. The technical reversal, in conjunction with the seasonal pattern shown below, has finally prompted our entry.

The black line traces the future's prices, while the blue and red illustrate the expected seasonal pattern. We'll be buying January OJ Monday morning. If you'd like to follow along and be updated with the protective stop prices and, eventual, exit signal. Subscribe for $35 per month. We just closed nearly $2k in Yen profits last week and we expect to have our last trade for November later next week. See a snapshot of our annual performance below, view our full seasonal trading results and, join us.

*Past performance is no guarantee of future profits. Future trading is risky.

The blue line on the bottom tracks our profit or loss, trade by trade. The orange line is our rolling equity since inception last year.