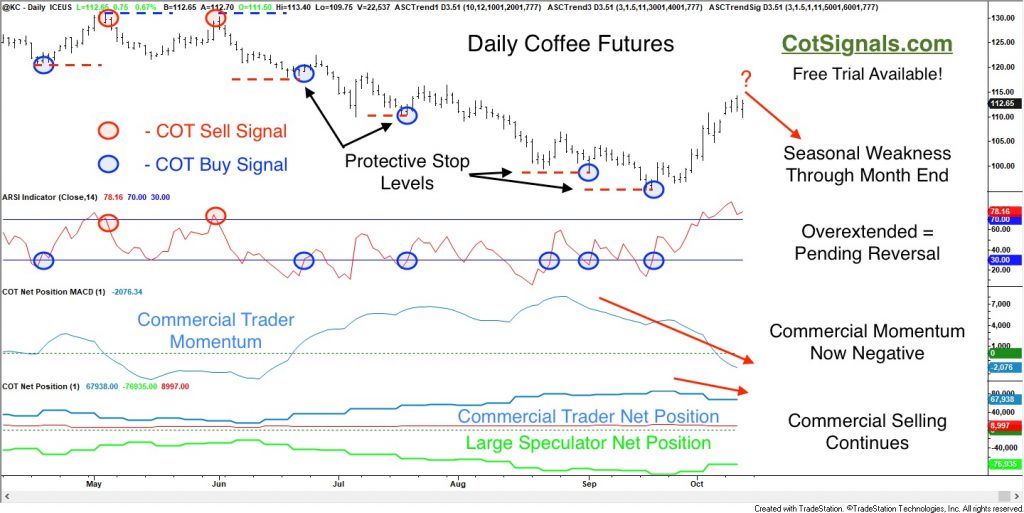

The commercial coffee producers have taken the upper hand in the December coffee futures contract ahead of seasonal weakness through month's end.

The weekly Commitment of Traders disaggregated futures report divides the markets into three basic groups; small speculators, large speculators and, commercial traders. Our thesis is that the commercial traders, whose interest in the futures markets relates solely to their business plan, ultimately prove to be correct in forecasting profitable turning points in many markets because they have better information than do we. Therefore, when the commercial traders are selling coffee futures ahead of seasonal weakness, we take note.

The first chart displays the mechanics behind our nightly COT Signals worksheet. We identify the commercial traders' momentum. We wait for the large speculators to overextend their position against the commercial traders' momentum. Once the market reverses back inline with the commercial traders' directional indication, we enter the market. Finally, and always, we place a protective stop loss order at the recently created swing high or, low. The true discretionary nature of this setup lies in the profit taking.

It's no coincidence that the commercial traders have turned to the sell side ahead of the projected seasonal weakness through month-end. As you'll see below, the seasonal component we provide separately is strong enough to stand on its own. Feel free to view the seasonal results for verification. Our seasonal research is nearly ready to produce a short signal in the coffee futures. The Commitment of Traders analysis provides a sensitive tool for scalping in and out of the more broadly defined seasonal weakness.

Let's see what we expect from the coffee market over the next couple of weeks.

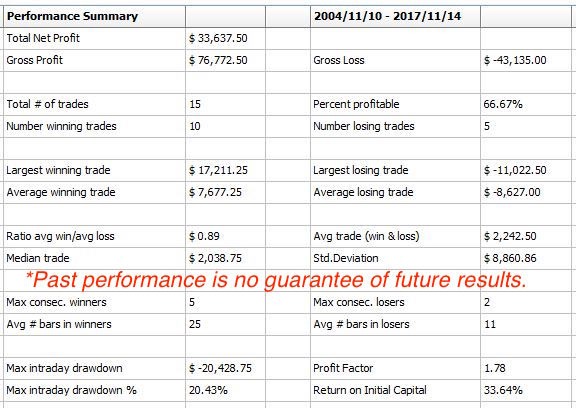

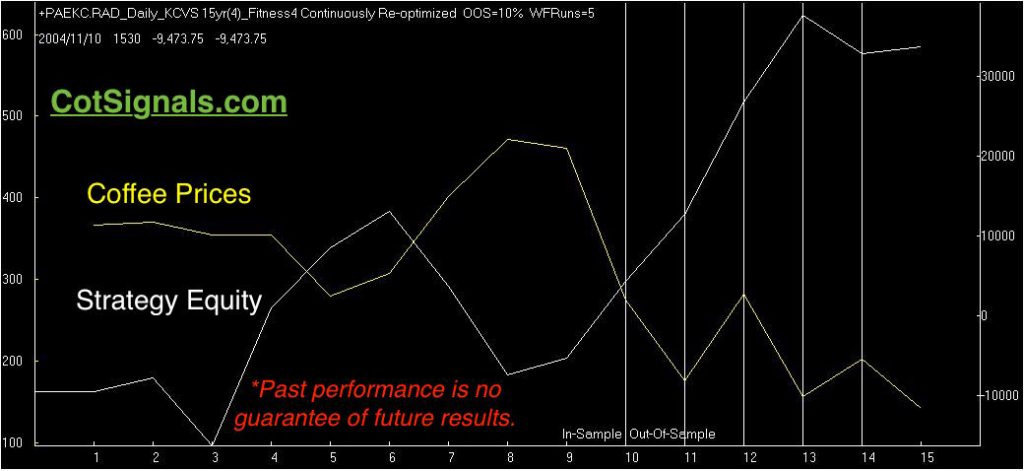

Our standard delivery format for the seasonal trading program includes out of sample charts and Monte Carlo results adjusted to current market prices. The out of sample equity curve for the model is plotted in white, while coffee futures prices are plotted in yellow.

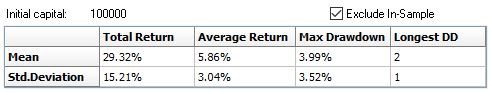

More important to than the equity curve are the Monte Carlo results. One of the biggest problems with seasonal trading is having such a small sample size with which to work. Monte Carlo testing helps provide a better big picture of returns than the small number of trades that populate a given model's history.

The results, below tell us that the model's average gain for this period is 5.86% with a standard deviation of 3.04%. This means that we expect two-thirds of our trades to fall somewhere between 2.82% and 8.9%. These returns are based on trading one contract of coffee futures with a point value of $375 on a $100,000 account to make the math simple. This equals a decline in the value of coffee and a profit to us of somewhere between 7.5 and 23 points per contract. Meanwhile, we'll only be risking 2% from the entry price or about 2.25 points.

When it comes down to it, successful trading requires three things. First, a strategy with a mathematically positive outcome; an edge. Second, the money management skills to not only implement the strategy but, also maximize its effectiveness through proper trade sizing. Finally, the biggest variable is number three; execution. We must stick to the strategy as closely as possible to generate similar performance. Try the Discretionary COT Signals or our, seasonal analysis for the first two, and we'll wait till you suggest we trade it for you on the third.