There are many phrases for capitulation. Very few have happy endings. I specialize in the analysis of the Commodity Futures Trading Commission's weekly Commitments of Traders report. This report separates the traders into three primary categories; commercial, large speculator, and small speculators. Big silver bugs, pools and, funds fall into the large speculator category. Throughout the history of this report, the large speculators have maintained a net long position. This April, they shifted to net short for the first time in history, and they're threatening new records as you read. Let's see what this means.

The battle between the large speculators and the commercial traders typically climaxes in significant turning points. Furthermore, these battles are usually won by the commercial traders' understanding of the fundamental activity of the market in which they make their living. There are two primary reasons for this. First, commercial traders are hedging their anticipated business needs. Their actions are relative to their anticipated business plan and the commodity's price. Silver miners' hedging of forward production has caused their net position to remain negative throughout the history of this report. This dynamic has reversed due to the declining price of silver and record commercial purchases due to the business prospects of processors and end users. The second reason the market climaxes through these conflicts is due to the herd mentality of the speculative traders. Their trend following positions grows in size as the market moves in their anticipated direction. Pyramiding positions always invert spectacularly.

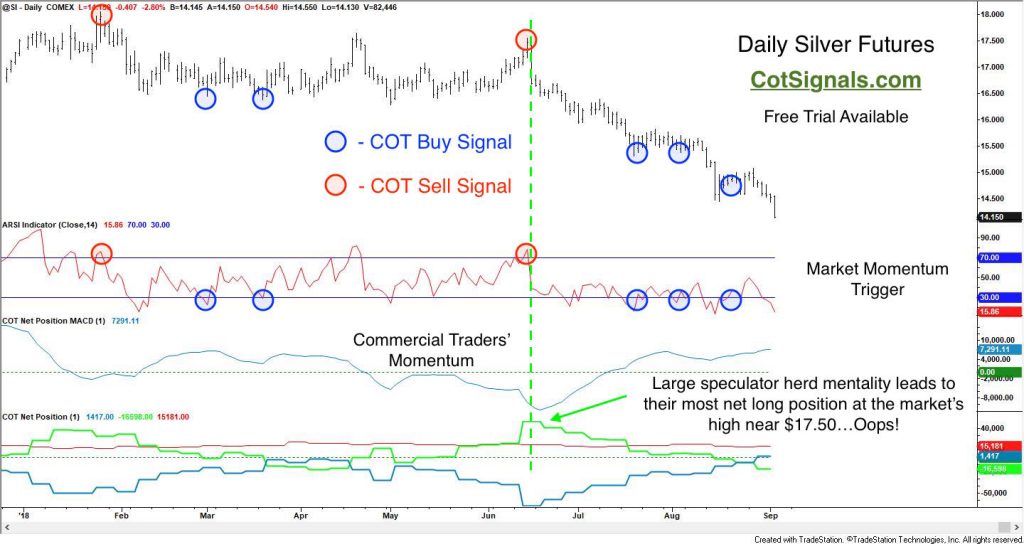

Let's look at a weekly chart and illustrate periods of commercial buying and selling. Commercial traders are negative feedback traders. The farther a market moves from their value area, the more they will buy or, sell according to their business plan. These are raw material hedges. Historically, the silver market has been controlled by miner selling on rallies as they attempt to lock in favorable delivery prices in the future. Currently, commercial users of silver believe that they will not be able to purchase silver at the delivery time as cheaply as they can, now. They are stating this collectively, in record fashion.

This does not suggest that prudent speculators should run out and buy silver. These processes take time to develop. You can see that the recent record positions were set in April of this year. We are currently threatening those same levels. Furthermore, speculative short selling is compressing the market's prices as more people are piling into the short side of the trade. Finally, there's really never any telling of how far a market can or, can't go. Therefore, we must wait for a reversal of some type to show us that the market is thinking about turning around. We use the setup below, in our nightly Discretionary COT Signals email to signal when the turn may be coming as well as, how much we should risk.

There are two primary points to make on the daily silver futures chart. First, note that the dashed green line represents the most net long the speculators have been, recently, and that it came at the last major high. The large speculators were anticipating a trend higher and began piling in just as the market collapsed. This is very typical speculative behavior and a big reason why so many have such trouble trading commodities. The second point is that each of the circles represents a signal sent by our nightly COT Signals email. These are meant to catch reversals (remember capitulation?) with tight stops. Each of these trades was sent with a protective stop placed at the recent swing high, or, low. No method is perfect, and we've lost on our last couple of silver trades. However, once the market reverses, we'll have a long entry for the next day's trading and, we'll only be risking it to the recent low.

The Commitment of Traders report can be fashioned into a useful trading tool given patience and discipline. I've used this report in my trading for more than 15 years, and I continue to build the same worksheet every night. Our programs, methods and computational power have improved but, for me, this is still a fantastic indicator of a market ready to turn due to growing battles between the commercial (fundamental) and speculative traders at a market's major high or, low.