The Treasury Bond market tends to fall during the month of September ahead of the Federal Open Market Committee's (FOMC) meeting ending on the 21st. Simply put, companies and individuals begin to increase their cash on hand as we head toward year-end expenses and policy unknowns. This holds true for corporations raising cash for year-end bonuses and tax liabilities just as it does for us as individuals heading into the holiday season.

Seasonal Trading Setup

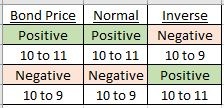

I use this period to my advantage by short selling December Treasury bond futures. While that may sound like a mouthful, if you've already traded stocks or crypto, you're already halfway there. The key is an Exchange Traded Fund or, ETF. They trade just like a stock. When you buy a stock at $10 and sell it at $11, you've made 10%. An ETF is simply priced as an index but, the move is the same. Buy the Treasury Bond ETF at 10 and sell it at 11 and you've made 10%.

The key to making it work for this trade is a product called an "inverse" ETF. An inverse ETF is based on the idea of short-selling, just like I'll do in the December Treasury Bond Futures. Treasury Bond ETF's track Treasury Bond prices. Standard ETF's are like owning a piece of the market while an inverse ETF is like short-selling a piece of the underlying market.

In our pricing example if you buy an inverse Treasury Bond ETF at 10 and the underlying Treasuries decline, the inverse ETF will increase by the same amount the normal ETF would fall.

Finally, ETF's typically offer multiple levels of leverage. It is extremely important to know which one you're trading and calculate your trading plan accordingly. I'll calculate the math using percentages and underlying market prices but only you know what the appropriate amount of risk is for your personal financial objectives and goals.

Treasury Bond Seasonal Trading Strategy:

I expect the Treasury Bond market to fall beginning sometime next week and continue through the FOMC meeting on the 21st. My research has shown that the market has a greater than 80% chance to fall 2.45% over the next three weeks. Most importantly, my research shows that I don't need to risk more than 1% from my entry price once the trade is triggered.

Risk to Reward Profile:

No leverage (TBF) - 1:1 ratio. Expect to risk about 1.2% of the allocation while expecting a return between 1.08% and 3.82% on the invested amount within the 10-12 day window of opportunity.

Double leverage (TBT) - 2:1 ratio. Expect to risk about 2.4% of the allocation while expecting a return between 2.16% and 7.64% on the invested amount within the 10-12 day window of opportunity.

Triple leverage (TMV) - 3:1 ratio. Expect to risk about 3.6% of the allocation while expecting a return between 3.24% and 11.46% on the invested amount within the 10-12 day window of opportunity.

30yr Treasury Bond Futures (USZ23) - 20:1 (roughly) ratio. Exchange traded futures are some of the most highly leveraged financial instruments available and should only be traded with proper knowledge of risk and guidance. I'll risk approximately $1,300 to per contract with the expectations of making somewhere between $1,100 and $3,820.

Look for another email when the market finally triggers our entry.

Best, Andy.