There are a number of important changes taking place in the S&P 500 stock index futures. Normally, we focus on short-term swing trading opportunities. However, when something structural appears to be changing, it's important to take note. The small speculators who bought the August decline expecting a strong closing quarter are very near to fighting a losing battle. Furthermore when the rapidly declining open interest and currently low volatility are factored in it doesn't look like the small specs are going to get the strength they'd hoped for.

The weekly S&P 500 chart below also contains Volatility Index (VIX) data in the second pane. The third pane shows the net small speculator and net commercial trader positions while the final pane shows total open interest in the S&P 500 futures. Beginning with the weekly data, note that the August decline was the first penetration of the weekly trend line going back to the October, 2011 low at 952. This trend line is now beginning to act as resistance. It's also important to note technically that the 200 day moving average now comes in around 2045 in the S&P 500 futures, further adding to year-end resistance.

Moving to the VIX index it's important to note the obvious relationship between these two markets. The VIX rallies when the S&P 500 falls because investor panic drives up volatility. The fear in the stock market occurs when it falls. That's why increasing volatility and volatility peaks have always been seen as buying opportunities in the equity markets. The strategy behind trading the VIX is to sell the short-lived rallies in the VIX Index itself. Typically, a VIX reading under 20 indicates a complacent market while a VIX reading over 40 may indicate exhaustion. This must be taken with a grain of salt however, as the VIX peaked near 90 during the 2008 meltdown. The most important feature of the August decline in the stock market and, corresponding rally in the VIX is that small speculators were the only buyers. Commercial traders actually sold more than 245,000 contracts into the decline.

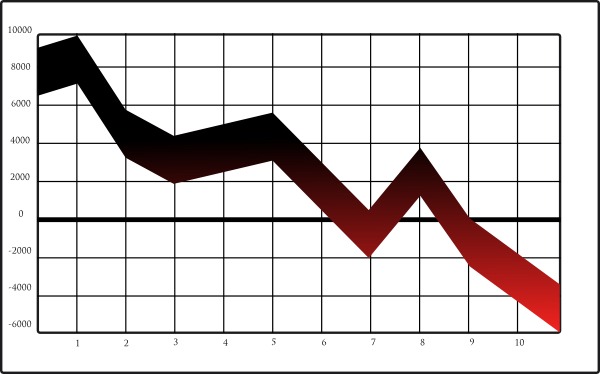

Moving into deeper analysis of the relationships between these markets and players, notice that beginning in September of 2013, the small speculators began leveraging market declines with abandon. September of '13, February of '14, March of this year and finally the August decline all saw increasing small speculator purchases. Individual traders are creatures of habit. It worked last time. It'll probably work this time. As their success compounds, they become increasingly aggressive. The small speculator long position is currently at record levels, even beyond their October '08 buildup which was a solid six months prior to the equity market lows being made. We view the currently speculator driven rally to be a failure in the making.

Finally, open interest has continued to decline as the S&P 500 struggles with the resistance building up around 2,100. Commercial sellers have clearly been booking profits for the year as futures are sold to hedge equity portfolios without the tax consequences of selling the underlying stocks themselves. Open interest peaked coming up off the August lows just shy of 2.9 million contracts. Even accounting for the December contract's expiration, current open interest of 2.56 million is still weak. In fact, we have to go all the way back to April of 2010 to find a lower reading. Not coincidentally, the S&P 500 peaked the week of April 23rd and didn't make a new high until the first week of November. In the meantime, the small specs were washed out or gave up on their long positions. Also not coincidentally, the commercial trader net position surpassed the small specs the last week of October, 2010 just as the market took off and rallied through year's end.

Finally, open interest has continued to decline as the S&P 500 struggles with the resistance building up around 2,100. Commercial sellers have clearly been booking profits for the year as futures are sold to hedge equity portfolios without the tax consequences of selling the underlying stocks themselves. Open interest peaked coming up off the August lows just shy of 2.9 million contracts. Even accounting for the December contract's expiration, current open interest of 2.56 million is still weak. In fact, we have to go all the way back to April of 2010 to find a lower reading. Not coincidentally, the S&P 500 peaked the week of April 23rd and didn't make a new high until the first week of November. In the meantime, the small specs were washed out or gave up on their long positions. Also not coincidentally, the commercial trader net position surpassed the small specs the last week of October, 2010 just as the market took off and rallied through year's end.

The point is, the speculators are typically wrong at the market's most critical moments. Considering we're shouting distance from all-time highs, we think their aggressive buying is actually a major negative. When this is thrown into the context of short selling by the commercial traders while in a low volatility environment and below the market's 200 day moving average, we think the Santa rally may already be over.