The Pitfalls of Relying on the Commitment of Traders Report

All trading involves risk, and all trading programs have some pitfalls. However, Andy Waldock strives to provide thorough, fair, and even-handed analysis and recommendations for our brokerage, account management, day trading, and COT Signals clients. We provide this analysis of the pitfalls of using the Commitment of Traders Report in the interest of disclosure and education.

Due to the end use or delivery of the commodity at hand, the commercial traders do not have to get out of a position. This means that they do not sustain a realized loss; they simply have hedges that could have been better placed.

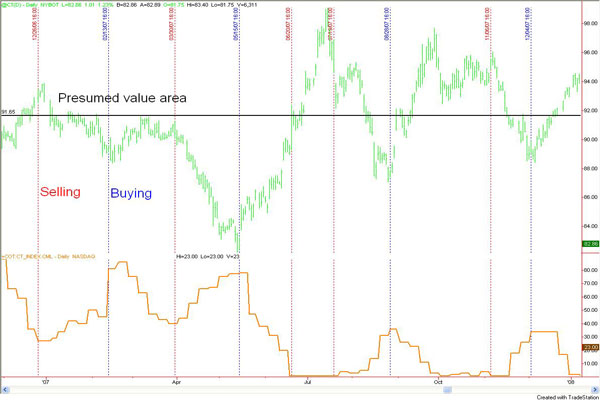

Commercial traders perform well as negative feedback commodity market participants. This means that they sell more as prices continue to go up and buy more as prices continue to fall. Their trading is based on their consumption or delivery needs and their sense of fundamental futures market value.

This brings us to the issue of trending markets and commercial blowouts. Once the commercial entity is fully hedged, they have an asset that needs to be financed or a liability that needs to be fulfilled. Occasionally, a market moves so violently or is so out of whack with its fundamentals, that the commercials are unable to meet their obligations and must offset their positions in the futures markets.

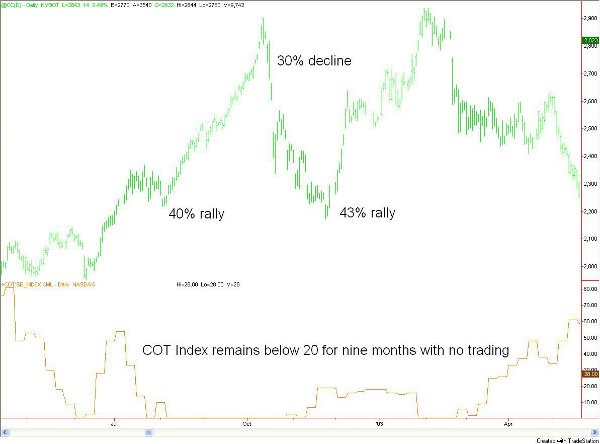

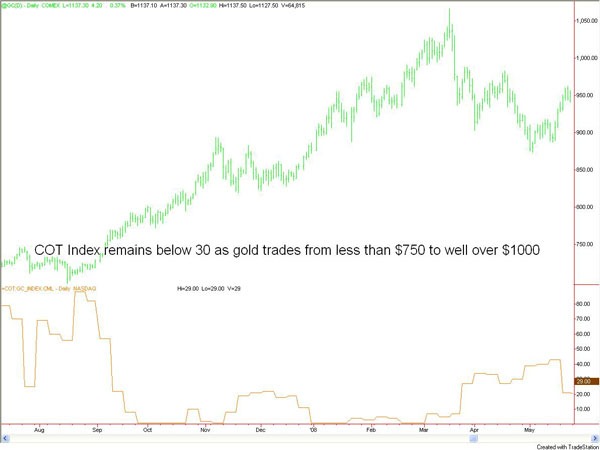

The final pitfall in trading with the commercials in trending markets is the Commitment of Traders Index. This is a popular indicator available in many data packages. It is basically a stochastic of commercial trader movement. It is scaled from 0 - 100. It is usually traded as either an overbought/oversold indicator, or a momentum indicator depending on the individual. Its weakness is that it can read 0 or 100 for months on end in a trending market, while providing neither the opportunity to get into a new position, or exit a losing position.

Andy Waldock's COT Signals program is different than other COT-based systems because it uses the Commitment of Traders Report in conjunction with unique and proprietary algorithms to provide guidance for the setup, the entry signal, and the protective stop price.

Sign up for a FREE TRIAL of COT Signals to receive access to archived worksheets, and evaluate the system for yourself!