The EPA has regulated the evaporative pressure of gasoline since 1989. Gasoline evaporation varies with temperature. The EPA regulations dictate a switch to winter blends beginning September 15th. The details of the rules and the enaction of the annual process delves deep into minutiae. I've attached a link at the end to a relatively recent article from Car and Driver, which lists some details in a language we can all process.

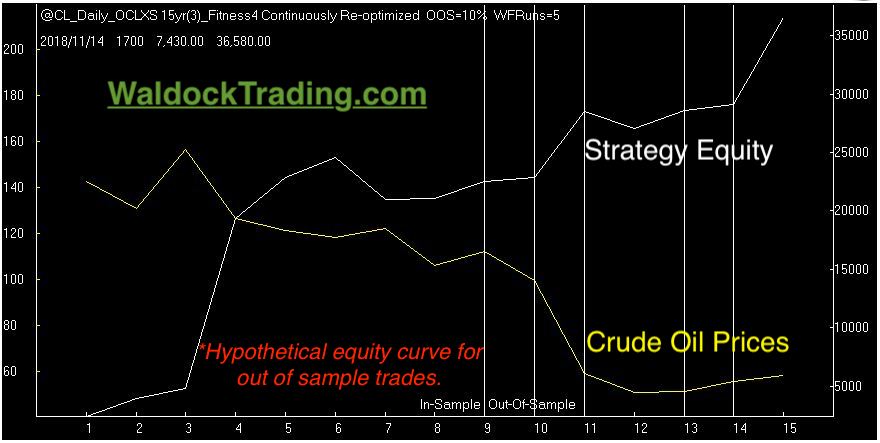

The pertinent information is that we're going to sell short the January crude oil contract within the next week. This is a short term seasonal trade with a holding period of roughly two weeks. This is one of the more stable seasonal trades as the same dates have produced incredibly consistent and profitable results. As always, our seasonal program will use the historical results as an overlay while employing current market volatility measures to assess risk and reward. Let's get to the details.

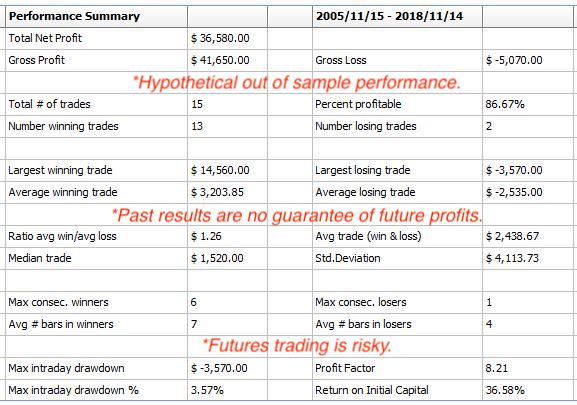

Crude oil margin for the January contract we'll be trading is currently just under $4,800 at the New York Mercantile Exchange. We intend to place our protective buy stop 2% above the entry price for our new short position, $1,100 per contract with January crude at $55 per barrel. While our holding period is only two weeks, Monte Carlo testing generates an expected return of 2.35%, and our out of sample performance for this model over the last 15 years shows a winning percentage above 80%. These are metrics with which I feel comfortable.

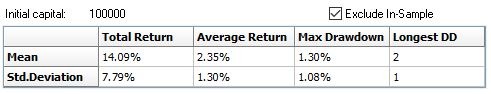

As always, I close with the Monte Carlo analysis because I believe it provides a more realistic look at our expectations of the market. This is because the Monte Carlo testing chops up and re-sequences the trade data to provide a bigger sample size then an annual event will allow.

We base the Monte Carlo testing on a $100k account to allow for easy manipulation, especially in crude oil. An average return of 2.35% on a $100k account equals $2,350. This is the equivalent of a $2.35 move in the January crude oil futures.

Car and Driver - Vapor Rub: Summer vs Winter Gasoline Explained.