We have a seasonal sugar trade ready to go. Now, we're just looking for the entry setup. Friday's outside bar reversal higher was indicative of the market's reversion towards seasonal strength we're predicting for this time of year.

The market is currently higher for the third consecutive day. We'd like a pause to position our purchase.

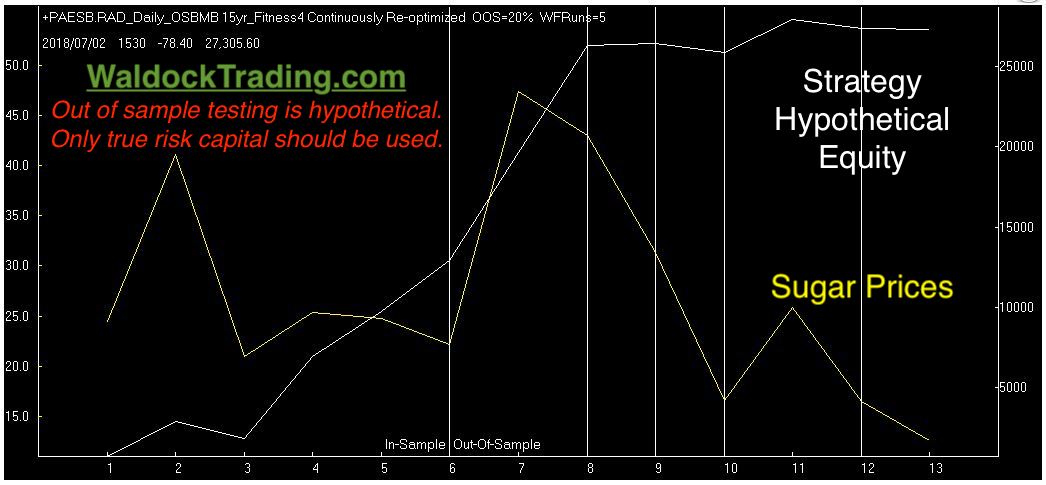

Depending on our entry, we expect to hold the trade for approximately three weeks.

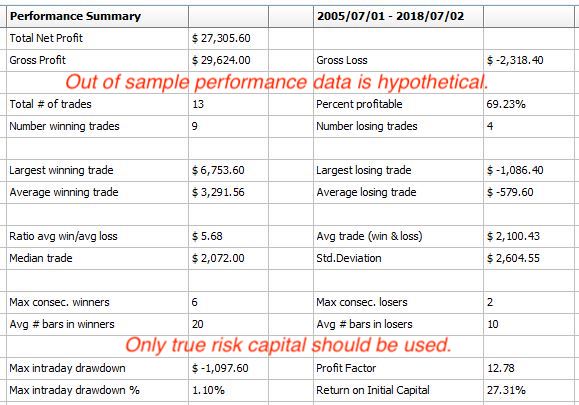

We'll likely risk somewhere between $950 and $1,000 per contract.

Sugar margin is currently $1,047 initial margin and $952 maintenance margin.

We'll send the buy signal via our Seasonal COT Signals email and follow-up daily with the protective stop and exit day once our time is up.

I'll be delivering a bullpen session on seasonality at the TradersExpo in Chicago on July 23rd, at 1:45 CST. Free Online Registration

Best, Andy Waldock.